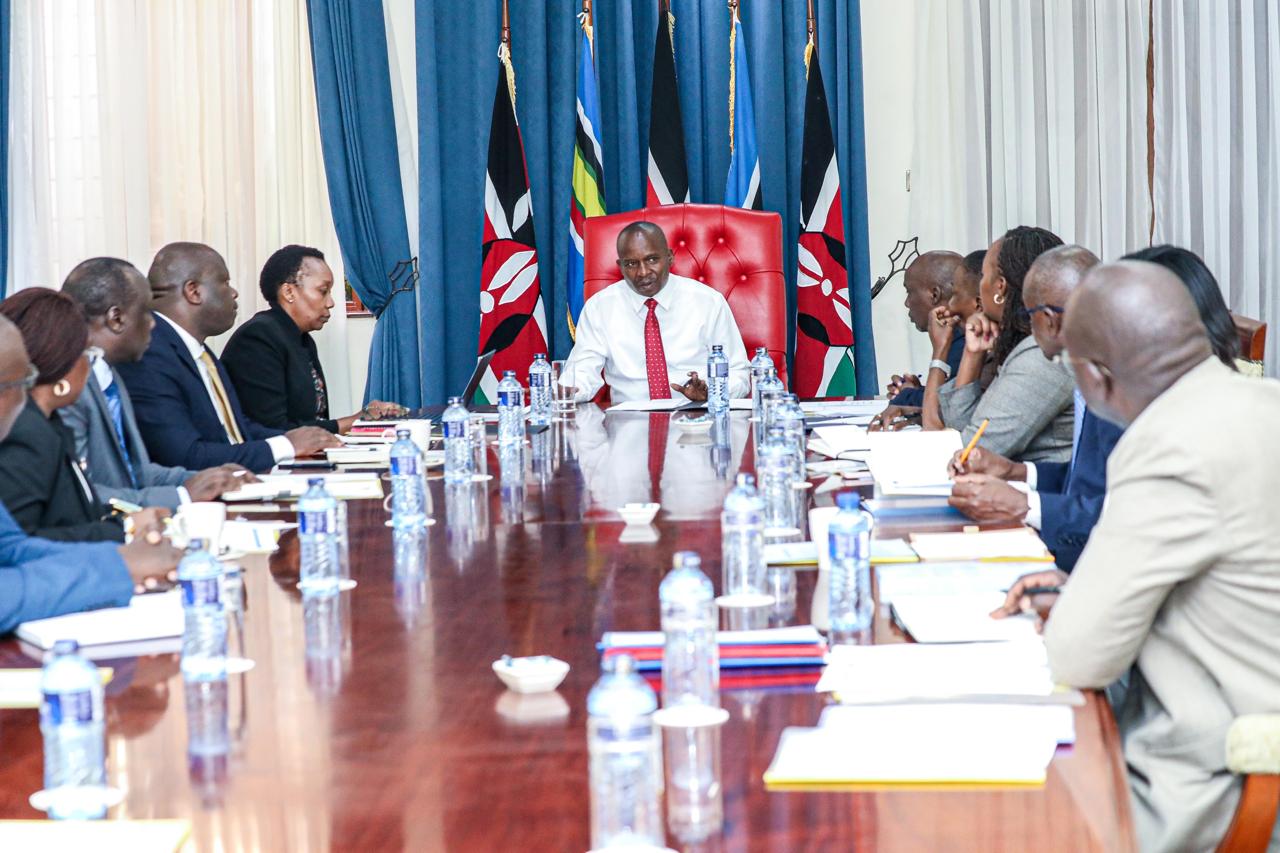

Kindiki leads talks to expand markets for Kenyan tea exports

The discussions in Karen aimed to ensure that these positive trends are sustained while addressing challenges in the industry to further enhance the competitiveness of Kenyan tea in global markets.

Deputy President Kithure Kindiki has met with key players in the tea industry to strategise on expanding market access and increasing the export value of Kenyan tea.

During a high-level briefing held on Wednesday at his official residence in Karen, the Deputy President convened government officials, leaders of tea agencies, and other stakeholders to evaluate ongoing reforms and explore avenues for growth in the sector.

More To Read

- Tea board to probe workers paid without farms in crackdown on fraudulent earnings

- Supreme Court to receive title deed by December 25, says DP Kithure Kindiki

- Farmers accuse KTDA of favouring Eastern regions in bonuses

- National Assembly probes tea bonus disparities after farmer complaints

- National Assembly to probe tea sector over low bonuses and uneven pricing

- Relief for tea farmers as subsidised fertiliser arrives at Mombasa Port after months of delay

Kindiki highlighted the government’s efforts to support tea production through initiatives such as subsidised fertilizer, the creation of common user facilities for value addition, and the pursuit of new international markets.

“These measures, together with favourable weather conditions and a stronger Kenyan shilling, have led to remarkable growth in the sector,” Kindiki said.

Tea production has surged significantly, rising from 445 million kilograms in 2022 to 558 million kilograms in 2023, and reaching an all-time high of 600 million kilograms in 2024.

Similarly, export earnings have grown steadily, increasing from Sh138 billion in 2022 to Sh181 billion in 2023, and hitting Sh211 billion in 2024.

The discussions in Karen aimed to ensure that these positive trends are sustained while addressing challenges in the industry to further enhance the competitiveness of Kenyan tea in global markets.

The Tea Board of Kenya (TBK) recently announced that farmers and factories producing high-quality tea will benefit from improved prices. L

According to TBK Chief Executive Officer Willy Mutai, tea categorised as “good” to “medium” quality has attracted more competitive bids at the auction, fetching considerably higher prices.

Mutai revealed that in October 2024, smallholder tea factories managed by KTDA recorded an average price of $2.83 (Sh366) per kilogram for their main grades, up from $2.78 (Sh360) during the same period in 2023. However, lower-quality teas and secondary grades either sold at discounted prices or remained unsold.

“Depending on the quality band, the leaf grades generally attracted relatively higher prices than the dust and secondary grades,” Mutai said.

The auction sales volume for Kenyan tea in October 2024 stood at 32.58 million kilograms, lower than the 38.63 million kilograms recorded in October 2023.

Mutai attributed the decline to an oversupply of tea and external challenges, including the global economic shocks stemming from the Russia-Ukraine conflict and internal conflict in Sudan, which disrupted market access and shipments through the Red Sea.

Despite these challenges, Mutai noted that demand for tea under the main catalogue was fairly good, with a 69 per cent absorption rate. He added that Pakistan remained an active but selective buyer, while Egyptian and South Sudan packers also showed strong interest.

In October 2024, Kenya produced 710,560 kilograms of speciality teas, accounting for two per cent of total production. Orthodox teas dominated speciality production at 92 per cent (651,527.90 kilograms), primarily manufactured by estates and independent factories. The remaining speciality teas included green and purple tea, largely produced by cottage industries.

The developments, Mutai said, underscore the ongoing efforts to sustain the sector’s growth while addressing challenges to enhance the competitiveness of Kenyan tea in global markets.

Top Stories Today