New reforms allow Kenyans to contribute up to Sh30,000 monthly to pension schemes

The reform includes a substantial increase in the monthly deductible pension contribution limit, which has been raised from Sh20,000 to Sh30,000.

In a move aimed at encouraging Kenyans to save more for retirement, the government has introduced tax cuts on pensions, which will benefit workers planning for early retirement or seeking to boost their pension savings.

The new changes, effective December 27, 2024, were announced by the Retirement Benefits Authority (RBA) through the Tax Laws Amendments Act, 2024.

More To Read

- State agencies owe Sh6 billion in unpaid statutory deductions, Treasury warns

- New Bill could allow civil servants to access entire pension upon exit

- Kenya’s pension assets soar to record high, surpassing Sh2 trillion

- Teachers who resigned or were dismissed after April 2018 eligible for pension, says TSC

- Pension savings soar as NSSF collections jump to Sh59 billion

- Governors blame past regimes as pension arrears spiral beyond Sh100 billion, ask treasury to intervene

The reform includes a substantial increase in the monthly deductible pension contribution limit, which has been raised from Sh20,000 to Sh30,000.

This means individuals can now contribute up to Sh30,000 per month to their pension schemes and enjoy tax relief on that amount.

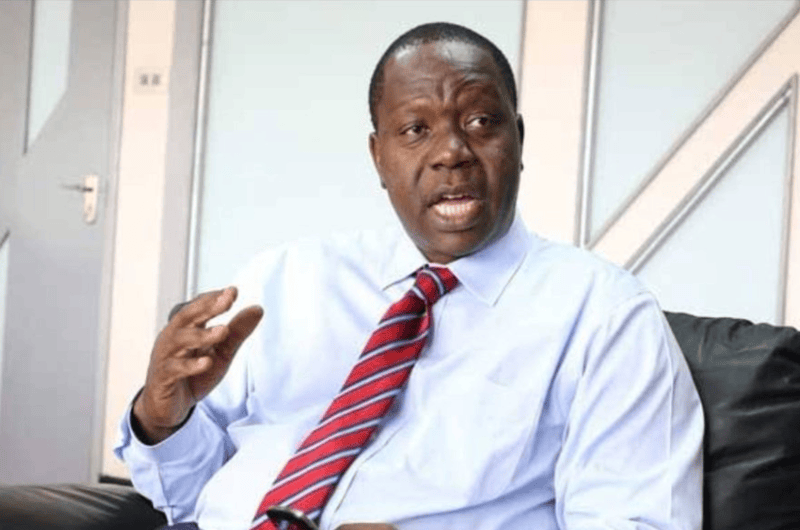

"These reforms align tax legislation with the current economic realities, addressing long-standing challenges to promote retirement savings, ease healthcare burdens, and empower retirees," said RBA CEO Charles Machira.

The changes also raise the annual deductible contribution from Sh240,000 to Sh360,000, benefiting both employees and employers.

This change is expected to encourage more workers to increase their pension contributions, which could lead to larger savings and better tax benefits.

A major highlight of the new laws is the tax exemption for pension payouts.

Individuals aged 38 and above can now access their pension funds tax-free, provided they have been members of their pension scheme for at least 20 years.

This is a significant expansion from the previous rule, which allowed only individuals aged 65 and older to qualify for tax-free withdrawals.

Additionally, the exemption applies to pension withdrawals made before retirement age in cases of ill health.

"The exemption from tax also applies to withdrawals from the funds before attaining retirement age due to ill health or after attaining 20 years from the date of registration as a member of the fund," read the authority's statement.

Previously, retirees under 65 were subject to a sliding tax scale on lump-sum pension payouts.

For instance, the first Sh600,000 was tax-free, but the next portions were taxed at rates of 10 per cent, 15 per cent, and 20 per cent.

Any amounts above Sh1.2 million were taxed at a rate of 25 per cent. This meant that retirees could lose a significant portion of their savings to taxes.

To further support retirees, the RBA has also introduced a tax-deductible limit for post-retirement medical expenses.

Retirees can now claim up to Sh15,000 per month in tax relief for medical savings after they retire.

These reforms are designed to address long-standing issues that have hindered retirement savings and healthcare accessibility for retirees, ultimately aiming to improve the financial security of Kenyans after retirement.

Top Stories Today