Insurance firms providing cover for police officers face scrutiny over failure to settle claims

The unpaid claims, which include group life benefits, group personal accident, and work injury benefits act claims, relate to police officers and their dependents.

Insurance firms contracted by the government to provide cover for police officers under a Sh5.1 billion deal are facing scrutiny after failing to settle claims for officers injured in the line of duty.

The Senate Committee on Security, Defence, and Foreign Relations has given the insurers until Tuesday to present a report on their progress in addressing the outstanding claims, amid concerns over delayed payments.

More To Read

- SHA begins review of cancer benefit package after patients’ protest

- SHA directs Kenyans to verify hospital records amid fraud concerns

- Senate probes Kang’ata Care over use of Sh172 million health funds

- Solicitor General calls for tougher rules on emergency care, body detention

- Cancer patients stage protest outside SHA headquarters, demand better medical coverage

- Turkana County, Amref launch final phase of HIV, TB and reproductive care project

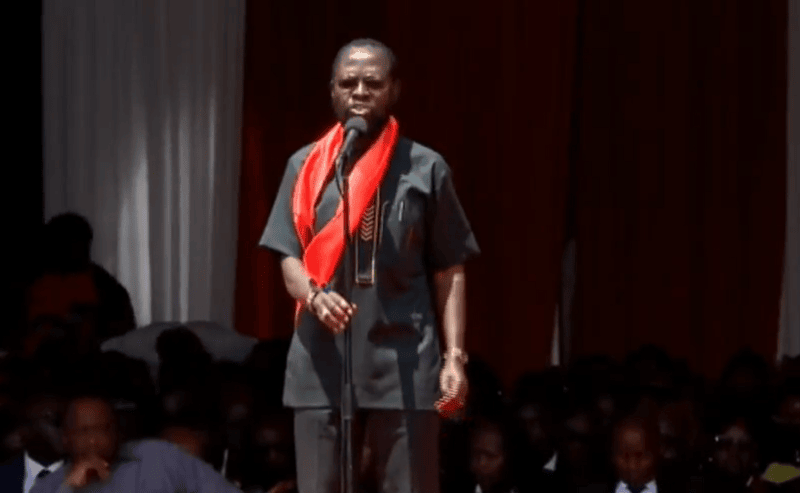

Baringo Senator William Cheptumo, who chairs the committee, had previously vowed to push for the settlement of all claims, regardless of the insurers’ resistance.

The controversy stems from the ongoing issues following the transition from the National Health Insurance Fund (NHIF) to the Social Health Authority (SHA) and the National Police Service’s (NPS) collaboration with these insurers.

Many claims unpaid

Despite government resources being allocated for the police cover, reports have emerged that many claims remain unpaid.

According to Section 26(4) of the Work Injury Benefits Act, employers or insurers must settle claims within 90 days.

However, Cheptumo raised concerns over the failure to settle legitimate claims.

“One of the things the insurance companies do is to reject the genuine claims lodged, and SHA is not firm as it allows the insurance companies to refuse to pay the claims despite clearance by relevant government agencies,” he said.

Contract with NHIF

The NPS entered into a contract with NHIF to provide comprehensive medical insurance for its 141,961 officers and their families for the period between January 1 and December 31, 2023, in a deal worth Sh5.1 billion. NHIF subsequently partnered with a consortium of insurance companies to offer the coverage.

However, an audit report by Auditor-General Nancy Gathungu flagged the unpaid claims, despite officers having submitted their applications and completed the necessary paperwork.

The unpaid claims, which include group life benefits, group personal accident (GPA), and work injury benefits act claims, relate to police officers and their dependents.

A National Police Service Commission (NPSC) document presented to the Senate committee indicates that of the 2,162 claims lodged with NHIF (now SHA), 937 claims worth Sh709.1 million have been paid.

However, 240 GPA-related claims worth Sh289.44 million have been rejected, and 158 other claims valued at Sh264.7 million are being disputed by the insurance firms.

The shortfall affects police officers deployed in high-risk areas, both locally and abroad, including Haiti.

Top Stories Today