Kenya to exit G2G oil deal over shilling's sustained depreciation

Kenya admitted that the agreement was creating distortions in the foreign exchange market.

Kenya will exit the government-to-government (G2G) oil deal with select Saudi Arabia companies in December 2024, according to the latest report by the International Monetary Fund (IMF).

In the deal, three State-owned firms - Saudi Aramco, Abu Dhabi Oil Company (ADNOC) and the Emirates National Oil Company (ENOC) - were given leeway to handpick local oil marketing companies which would distribute fuel on their behalf.

More To Read

- Government launches youth registration for 113,000 climate jobs

- Ruto proposes law to allow housing levy contributors access Sh5 million loans

- Over 800,000 youths to benefit from Sh20 billion Nyota project- Ruto

- Ruto nominated me but as IEBC chair I won't favour him, or anybody else- Ethekon

- Watch: IEBC chair nominee Erastus Ethekon faces vetting panel

- Presidents Abdirahman, Ruto meet at State House for trade, security and youth empowerment talks

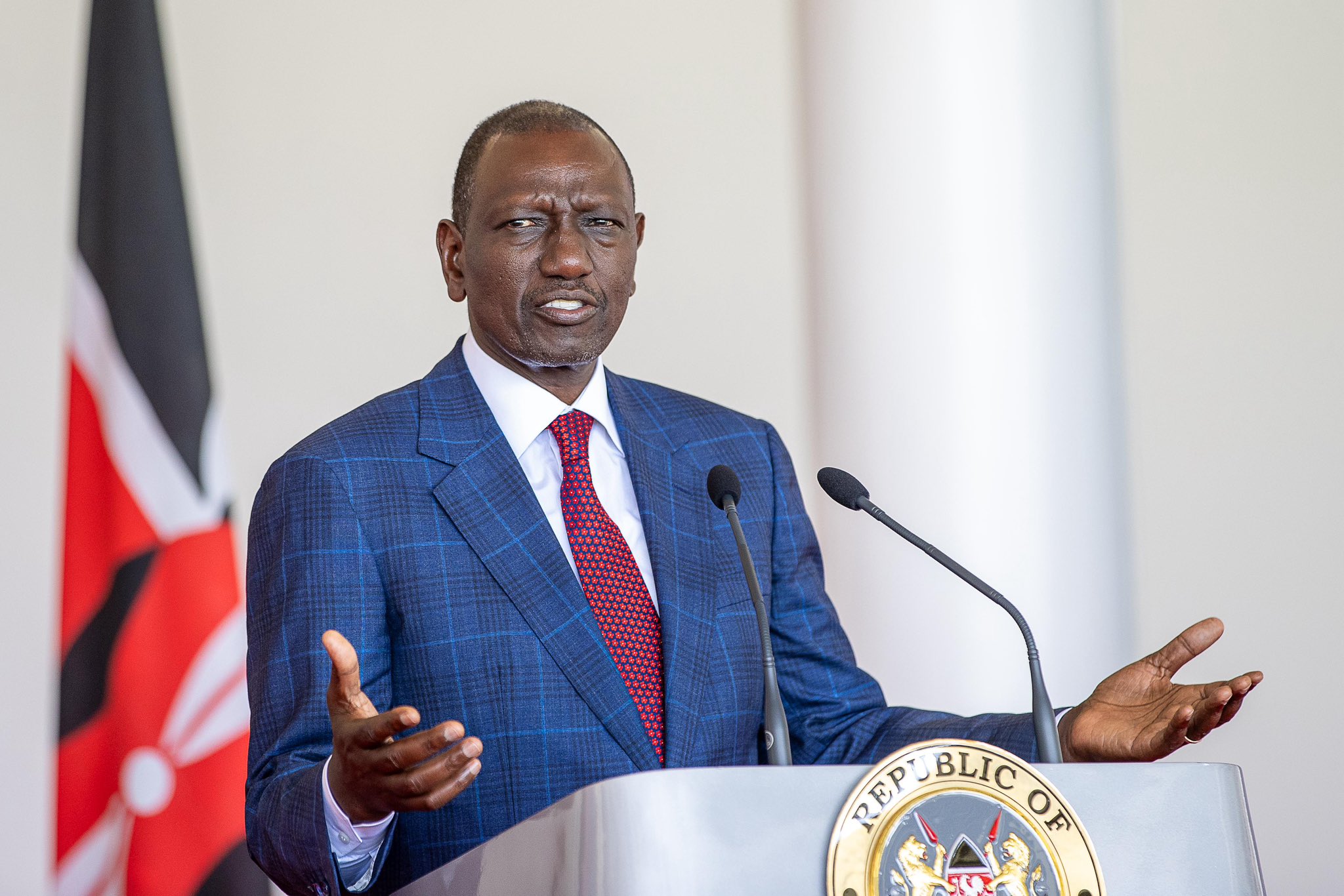

Thus far, however, President William Ruto's administration has admitted that the agreement is creating distortions in the foreign exchange (FX) market.

“The government intends to exit the oil import arrangement as we are cognizant of the distortions it has created in the foreign exchange market, the accompanying increase in the rollover risk of the private sector financing facilities supporting it, and remains committed to private market solutions in the energy market,” the report says.

The oil import arrangement was introduced in April 2023. It replaced an open tendering system, where oil import dues were payable upon five days of delivery. With the deal, Treasury admits it created unnecessary pressure on the FX market.

The Saudi oil deal, which was based on a master framework agreed between Kenya and three national oil exporters from the Gulf nation, provided a six-month credit for oil imports but the average monthly import volumes failed to attain the minimums agreed under the arrangement.

“In the first six months, the actual average monthly import volumes fell short of the monthly minimums agreed under the arrangement. This was due to lower demand from our domestic market as well as from the regional reexports markets,” the report reads.

Kenya's Treasury ministry noted that the initial agreement was then extended for another 12 months, to December 2024, with more favourable costing terms.

“The extension of the arrangement reduces the risk of materialisation of contingent liabilities due to shortfall in the actual imports,” the report states.

President William Ruto touted the G2G deal last year, saying the Kenyan currency would stabilise as fuel marketers would purchase products in Kenya shillings, easing pressure on the dollar. However, nine months late - as of January 15, 2024 - the Kenyan shilling hit a historic low against the dollar, sinking below the Sh160 mark.

The depreciation came despite the Central Bank of Kenya's (CBK) recent efforts to stabilise the currency, raising the alarm about a prolonged period of record weakening. Just weeks ago, the CBK swung a hefty hammer, hiking interest rates by 200 basis points in a surprise attack against the persistent shilling slump.

This aggressive move aimed to stem the tide of inflationary pressures already rippling through the economy due to the currency's devaluation. However, the tactic seems to have fallen short, leaving the shilling on a downward spiral.

Top Stories Today