National Treasury, CRA differ over equitable share revenue allocations to counties

The debate in Parliament will determine whether counties receive the Sh17.6 billion increase proposed by the Treasury or the Sh30 billion increase recommended by CRA.

The National Treasury and the Commission on Revenue Allocation (CRA) are at odds over the allocation of funds to counties, setting up a potential showdown in Parliament.

The two bodies have proposed different amounts for the Financial Year 2025-2026, continuing a pattern seen in previous years.

More To Read

- CS Mbadi summoned over eCitizen revenue control, pension delays

- Teachers, lecturers, police among public servants to benefit from Sh88bn budget boost

- Security, education, healthcare gain as Treasury expands budget by Sh86 billion

- Treasury mulls using existing tax rates for 2025-2026 budget after deadly protests in 2024

The Treasury has proposed increasing the equitable share allocation to counties from Sh387.5 billion to Sh405.1 billion. However, the CRA has recommended a higher allocation of Sh417.4 billion.

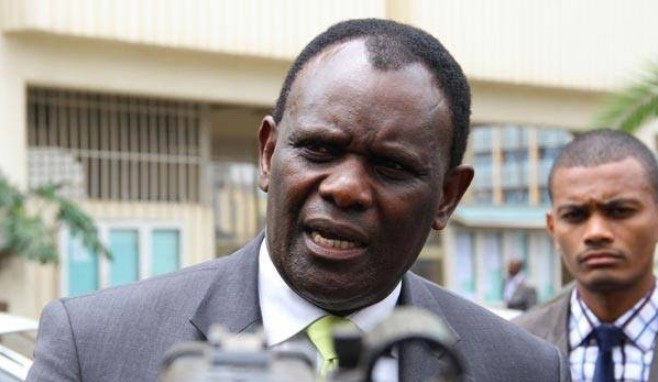

"The commission has recommended an equitable share allocation to county governments of Sh417.4 billion for 2025-26," CRA stated.

In its submission to Parliament, CRA explained that the proposed increase is meant to prevent any county from losing revenue following the introduction of a new revenue-sharing formula.

The fourth basis for revenue sharing, set to be implemented from 2025-2026 to 2029-2030, includes a stabilisation factor to ensure no county receives less than its allocation for the Financial Year 2024-2025

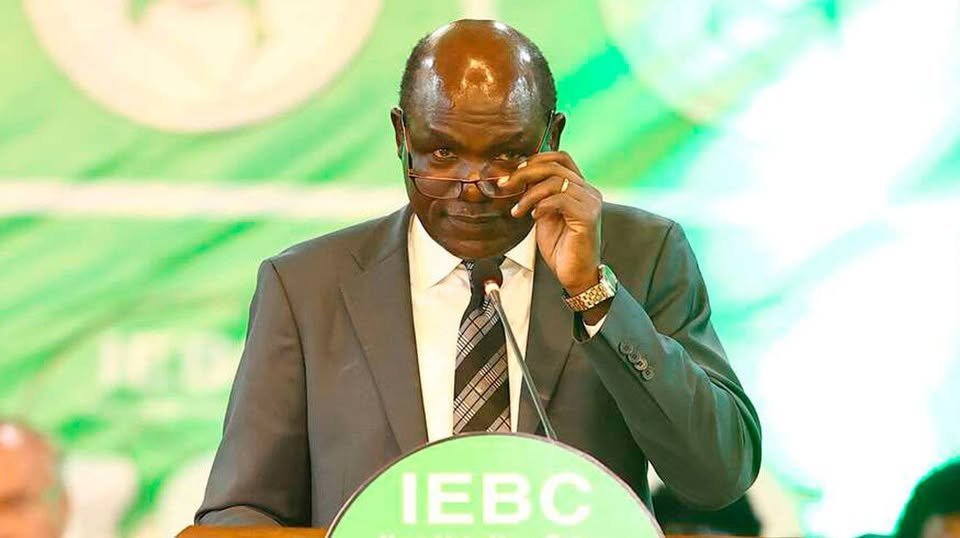

Treasury Cabinet Secretary John Mbadi has proposed an extra Sh12 billion for counties, including Sh10.5 billion earmarked for the Equalisation Fund. This fund is designed to support development programs aimed at reducing regional disparities.

Other proposed allocations include Sh11.5 million for court fines, Sh1.7 billion for doctors' salary arrears, and funds for a 20 per cent share of mineral royalties.

County governments rely on the equitable share of revenue to plan, budget, and implement development projects in line with their priorities.

The debate in Parliament will determine whether counties receive the Sh17.6 billion increase proposed by the Treasury or the Sh30 billion increase recommended by CRA.

Top Stories Today