State to acquire Telposta Pension Scheme properties in Sh10 billion deal

The government’s acquisition is expected to provide the scheme with the much-needed financial flexibility to continue supporting its pensioners.

In a move aimed at stabilising the Telposta Pension Scheme and ensuring compliance with investment regulations, the government is set to acquire properties worth Sh10 billion from the fund.

The transaction, which includes the purchase of Telposta Towers in Nairobi and other strategic assets, comes amid concerns over the scheme’s liquidity and its ability to meet pension obligations.

The pension scheme, which has been struggling to maintain a balance between asset holdings and cash flow, is required by law to reduce its property investments to 30 per cent of total assets. Currently, its real estate holdings account for over 80 per cent of its portfolio.

The properties up for sale include Telposta Towers, residential estates in Mombasa and Nakuru, and several plots in Kisii.

A valuation process is ongoing to determine the market value of the assets, with the government prioritising their acquisition for strategic use by ministries, departments, and agencies (MDAs).

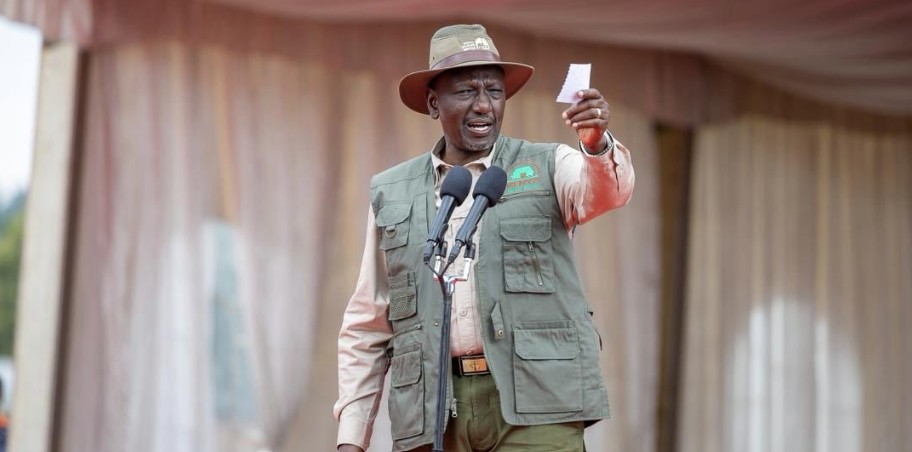

Head of Public Service Felix Koskei, in a letter dated February 5, informed Attorney-General Dorcas Oduor and all Cabinet Secretaries about the planned sale, offering MDAs the first opportunity to acquire the properties.

“Priority has been given to MDAs for the acquisition of the underlisted properties, on account of the strategic advantages they hold: Telposta Towers (Nairobi), Bombolulu Estate and Makande Estate (Mombasa), Gilgil GTD Flats (Nakuru), and nine plots in Nyachwa (Kisii),” Koskei wrote in the letter copied to Principal Secretaries and the President’s Office.

Government first

The National Treasury had in December 2024 approved Telposta Pension Scheme’s request to sell the properties on condition that properties in key locations be offered to the government first.

Telposta Towers, the most valuable property in the deal, is located along Kenyatta Avenue in Nairobi’s central business district. Managed by Tysons Limited, the 29-floor building has a total space of 403,826 square feet, with 10 government agencies occupying 92 per cent of it. The agencies pay an estimated Sh60 million in rent every month.

Documents show that the government has spent Sh3.7 billion in rent over the past five years for space it occupies in the building. As of June last year, Telposta Towers was valued at Sh6.5 billion.

Beyond Nairobi, the scheme’s residential properties include 100 houses in Makande, 88 in Bombolulu, and 40 in Aga Khan, all located in Mombasa. In Nakuru, it owns Gilgil GTD Flats, while in Nairobi the scheme has 129 residential units along Jogoo Road.

Telposta Pension Scheme Chief Executive Officer Peter Rotich said the sale is necessary to align with regulatory requirements and improve the scheme’s liquidity, which has been steadily declining due to ongoing pension payments and administrative costs.

“Over the years, the liquid assets have been going down because of liquidation (paying members’ benefits) and administrative costs, and we have been remaining with properties. When you hold a lot of your assets in brick and mortar, you do not pay members pension through brick and mortar,” Rotich told the Nation.

By the end of 2024, the scheme held Sh2.7 billion in cash out of total assets worth Sh14.7 billion, while properties accounted for Sh12.08 billion.

Rotich further indicated that, upon completion of the sale, the scheme may consider reviewing pension payments by either increasing payouts or issuing one-off bonuses to members.

The scheme’s financial records show that in 2024, it paid out Sh1.07 billion in pension benefits, up from Sh860.7 million in 2023.

The government’s acquisition of the properties is expected to provide Telposta Pension Scheme with the much-needed financial flexibility to continue supporting its pensioners while aligning with investment regulations.

Top Stories Today