Policy shifts, rising demand drive Kenya’s growing mitumba market

Fresh data compiled by MIT reveals that Kenya imported mitumba worth $298 million (Sh38.5 billion) in 2023, surpassing Nigeria despite its much larger population.

Kenya has now become the largest importer of second-hand clothes in Africa, a development that highlights the country’s heavy reliance on used apparel while its textile industry struggles to regain its footing.

Fresh data compiled by the Massachusetts Institute of Technology (MIT) reveals that Kenya imported mitumba—locally used to refer to second-hand clothes—worth $298 million (Sh38.5 billion) in 2023, surpassing Nigeria despite its much larger population.

More To Read

- Cars registered before 2019 must reach Kenyan ports by December 2025 - KEBS

- Tough times for Nairobi hawkers as city county enforces new street trade restrictions

- From bargains to burden, inside Gikomba’s growing pile of textile waste

- Mitumba supports two million jobs, gives Sh12bn taxes, not a threat to manufacturing - report

- Mitumba trade no threat to local textile industry, supports 2 million jobs, report says

- Why using fabric softener might be ruining your clothes

The latest statistics mark a sharp rise in Kenya’s importation of second-hand clothing, reflecting a 12.45 percent jump from the $265 million (Sh34.28 billion) recorded in 2022.

The increase in imports is driven by a rising demand for affordable clothing, with traders bringing in a wide range of second-hand items, including underwear, trousers, dresses, jackets, shoes, and household textiles such as curtains, bedding, and towels.

The steady flow of mitumba into Kenya contrasts with the approach taken by neighboring countries such as Uganda, Rwanda, and Ethiopia, which have imposed restrictions on the trade to promote local textile manufacturing.

Analysis from MIT’s Observatory of Economic Complexity shows that in 2022, Kenya’s mitumba imports were nearly equal to Nigeria’s, both valued at $265 million(Sh34.5 billion).

South Africa followed closely, bringing in second-hand clothes worth Sh33.76 billion ($261 million) during the same period.

However, Kenya’s imports have since surged past those of other African nations, a trend that has been further fueled by policy changes at the national level.

The removal of two key taxes—the Import Declaration Fees (IDF) and the Railway Development Levy (RDL)—through the Tax Laws (Amendment) Act, 2024, has made mitumba imports even cheaper.

This decision, passed by lawmakers, has drawn criticism from manufacturers and some officials in the Ministry of Trade, who claim the amendments were inserted into the law at the committee stage without broad consultation. Local textile producers fear the move will further undermine efforts to revitalize the industry, making it even harder for Kenyan-made fabrics to compete with cheap second-hand clothes.

Restrictions

As some East African Community (EAC) countries tighten restrictions on mitumba, Kenya remains an exception, allowing large volumes of used clothing to flood the market.

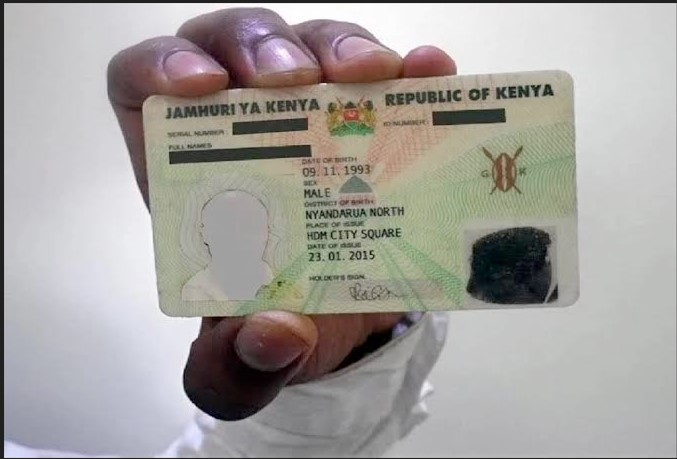

Kenya imported mitumba—locally used to refer to second-hand clothes—worth $298 million (Sh38.5 billion) in 2023, surpassing Nigeria despite its much larger population. (Photo: Mitumba Association)

Kenya imported mitumba—locally used to refer to second-hand clothes—worth $298 million (Sh38.5 billion) in 2023, surpassing Nigeria despite its much larger population. (Photo: Mitumba Association)

Some EAC member states have opted to impose higher import duties or introduce incentives to boost local textile production.

Currently, used clothing brought in from outside the EAC is subject to a duty rate of 35 percent or $0.20 per kilogram, whichever is higher.

Rwanda, for instance, has taken a firm stance by increasing tariffs on second-hand clothes, even in the face of pressure from the United States, which remains one of the biggest suppliers of mitumba globally.

Some officials within Kenya’s Trade Ministry suspect that not all mitumba imports are meant for the Kenyan market, as a significant portion is allegedly being smuggled into neighboring countries. They argue that Kenya has become a key transit point for second-hand clothes destined for other nations, further complicating efforts to regulate the trade.

Kenya’s membership in the African Growth and Opportunity Act (AGOA) also plays a crucial role in the mitumba debate. The agreement allows duty-free access for African countries exporting textiles and other products to the U.S., but Kenya’s continued participation depends on keeping its borders open to second-hand clothes. Countries such as Ethiopia and Uganda were removed from AGOA after banning mitumba imports, a scenario that Kenya may be keen to avoid.

The long-running debate over Kenya’s second-hand clothing trade has deeply divided policymakers, with some viewing mitumba as a lifeline for low-income earners who cannot afford new clothes, while others argue that the thriving market has crippled the local textile sector.

The textile industry, which has the potential to support millions of jobs, has struggled for decades despite various government interventions aimed at its revival.

During the last general election, the issue of mitumba imports became a contentious campaign topic. Former Prime Minister Raila Odinga faced backlash after suggesting a shift toward local textile production, a statement that was quickly used against him by his political opponents.

Traders in the mitumba business perceived his remarks as a threat to their livelihoods, leading him to clarify that he had no intention of banning the trade. President William Ruto and other leaders capitalized on the controversy, using it to gain support from mitumba traders.

Successive administrations have attempted to revamp the textile industry with limited success. The previous Jubilee government sought to achieve this through its Big Four Agenda, while the Kenya Kwanza administration is now implementing a “value chain” approach under the Bottom-Up Economic Transformation Agenda.

However, these efforts have barely made a dent in the dominance of the second-hand clothing market.

One of the major projects aimed at reviving local textile production is the modernization of Rivatex East Africa, a factory based in Eldoret.

The government has pumped significant funds into upgrading the facility, which is now seeking strategic investors to expand its operations. The factory has been working to improve its production capacity to meet growing demand, but competition from cheap mitumba remains a major challenge.

The government has also drafted the National Cotton, Textile, and Apparel (CTA) Policy 2024, which aims to support cotton farmers and strengthen the local textile value chain.

The policy outlines measures to enhance the sustainability and competitiveness of Kenya’s textile industry, including plans to establish textile value-addition centers in Nyando and Kieni. Additionally, the government intends to build seven new ginneries while upgrading existing ones to boost production.

As part of its broader economic strategy, the government is equipping county industrial development centers with tailoring facilities to support small businesses. It also plans to launch international campaigns promoting Kenyan-made textiles and apparel while identifying and addressing unfair trade practices affecting the sector.

Top Stories Today