New KCC on the brink of collapse as Auditor General reveals billions in financial losses

The company's liabilities exceed its assets by Sh1.2 billion, indicating severe cash flow challenges exacerbated by reliance on bank loans and overdrafts to sustain operations.

State-owned milk processor New Kenya Cooperative Creameries (New KCC) is on the brink of collapse, according to a damning audit report by Auditor General Nancy Gathungu.

The report, covering the fiscal year ending June 2024, revealed staggering financial losses and mounting debts, casting a shadow over its pivotal role in Kenya's dairy sector.

More To Read

- Government sets deadline to resolve Sh204 million former KCC workers’ dues

- Debts choking New KCC as state agencies yet to pay up Sh500 million

- Senators seek payments for former KCC workers awaiting dues for decades

- CS Oparanya gives New KCC 90-Day deadline to present restructuring report

- Ruto promises Sh1 billion to New KCC after state's huge debts were revealed

- Milk crisis looms at State House as unpaid Sh14m debt to KCC sparks concern

Gathungu's audit disclosed a significant pre-tax loss of Sh1.5 billion, revealing New KCC's precarious financial position.

The company's liabilities exceed its assets by Sh1.2 billion, indicating severe cash flow challenges exacerbated by reliance on bank loans and overdrafts to sustain operations.

"This is an indication of negative working capital," remarked Gathungu, highlighting the unsustainable financial practices that have burdened New KCC with hefty interest expenses totalling Sh192 million on loans and overdrafts.

Delays in settling debts risk triggering penalties and supplier withdrawals, further complicating the company's recovery efforts.

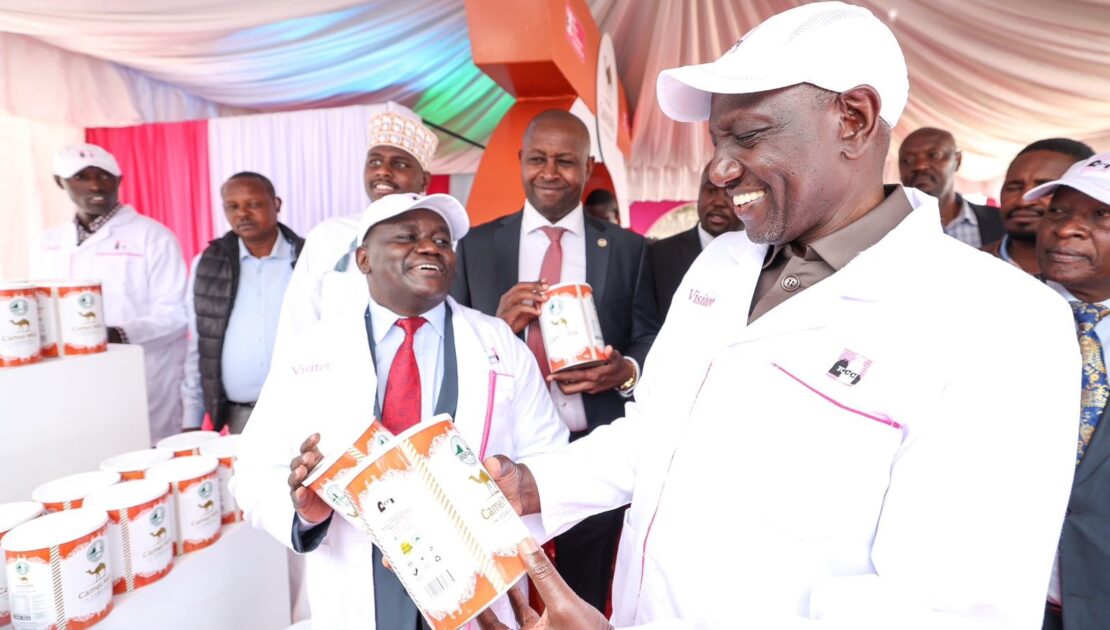

President William Ruto, during a recent tour, reiterated the government's commitment to rejuvenating the dairy sector through the New KCC.

Financial turmoil

However, Gathungu's audit has raised doubts about the company's future, citing uncertainties amidst the financial turmoil.

"These events cast doubt on the company's ability to continue as a going concern," warned Gathungu, citing a looming Sh3.2 billion debt, primarily owed to farmers, some overdue by more than 120 days. Non-payment risks disrupting supply chains and exacerbating financial distress.

Despite government assurances of support, challenges persist within New KCC's management and operational practices.

The company currently employs 171 staff beyond its approved establishment, a discrepancy noted by auditors as potentially detrimental to its financial recovery efforts.

The Auditor General's report also highlighted discrepancies in asset management and accountability, further complicating efforts to stabilise operations.

A lack of clarity in the valuation of assets has added to the uncertainty surrounding New KCC's financial health.

In response to these findings, parliamentary oversight committees have expressed concern over New KCC's management practices and financial viability. Efforts to address these issues include proposals for mergers and operational restructuring within the state-owned sector to mitigate financial risks.

New KCC, originally established in 1925 and revived in 2003, has played a crucial role in supporting Kenya's dairy farmers, providing a stable market for milk and contributing significantly to the agricultural economy.

However, its current financial crisis reveals the challenges facing state-owned enterprises in maintaining sustainable operations amid economic pressures.

Top Stories Today