Ruto unveils Sovereign Wealth Fund to boost savings, infrastructure and stability

Kenya’s new Sovereign Wealth Fund aims to turn royalties and privatisation proceeds into lasting national wealth.

President William Ruto has announced the establishment of a sovereign wealth fund, saying it will uphold the Constitution's principle of intergenerational equity and ensure that future generations benefit from the country’s natural resources and public investments.

Speaking during the 2025 State of the Nation Address to a joint sitting of the National Assembly and Senate, the President referenced Article 201(c) of the Constitution, which mandates that the burdens and benefits of resource use and public borrowing be shared fairly between present and future generations.

More To Read

- Government to build 50 mega dams to transform Kenya’s agriculture - Ruto

- Ruto says public demand for affordable housing has replaced doubts with excitement

- Ruto terms Hustler Fund largest financial inclusion programme since independence

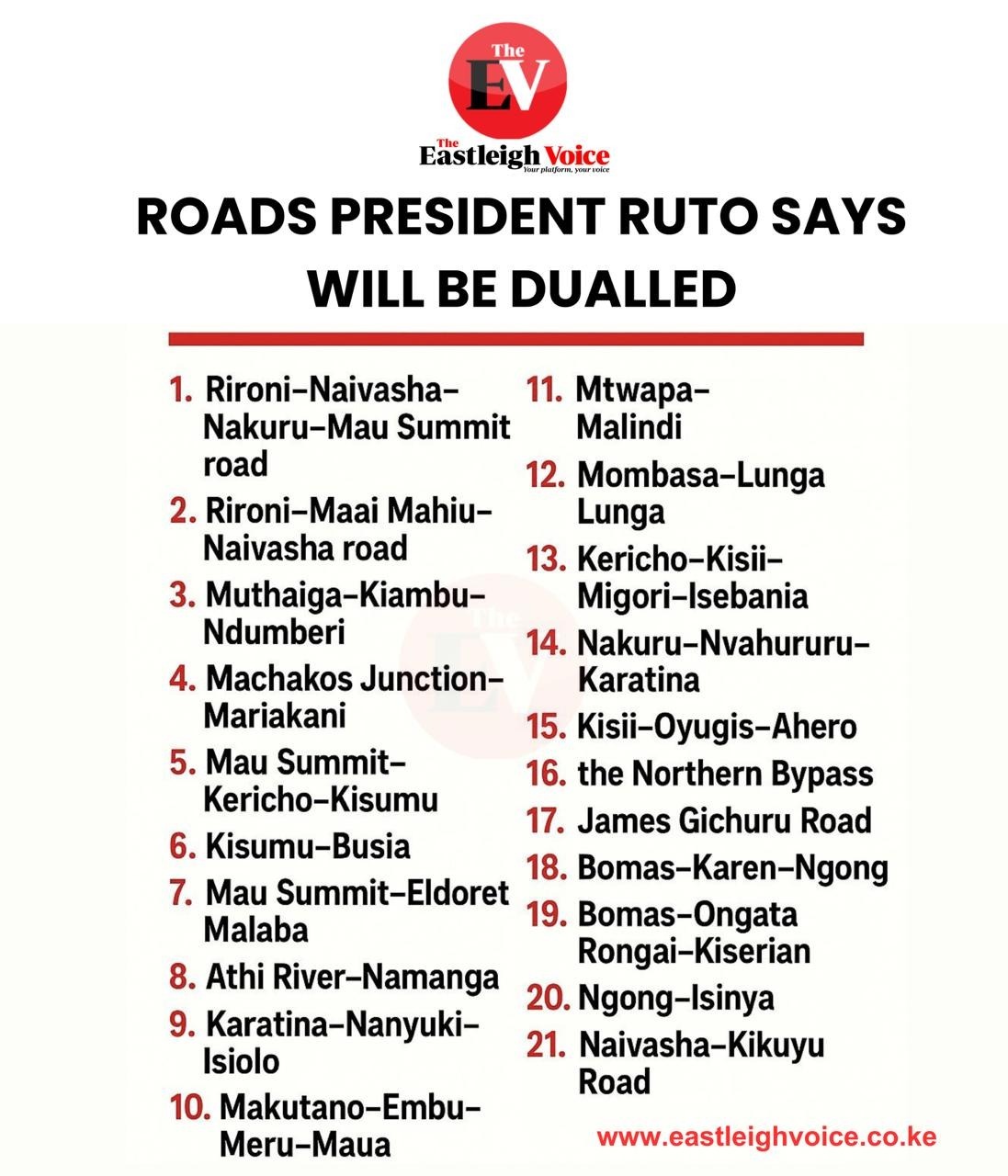

- Ruto announces plans to dual key highways nationwide

- Ruto says fibre-optic growth powering faster eCitizen services and digital access

- Watch: President William Ruto's State of the Nation address

He warned that Kenya must avoid repeating past mistakes of resource exploitation that left communities with nothing. Ruto cited the depletion of titanium deposits along the Coast as an example, noting that the absence of a sovereign wealth framework meant that once the minerals were exhausted, future generations had no lasting benefits.

"We cannot repeat this mistake," he said.

Financing sources

The proposed sovereign wealth fund will be financed from two main sources: a portion of royalties from natural resources and a share of proceeds from the privatisation of state assets. The President said the Fund will rest on three pillars—savings, stabilisation, and infrastructure development.

Under the savings pillar, part of the revenues will be invested to create long-term national wealth, following models used by countries such as Norway, Kuwait, and Saudi Arabia.

The stabilisation pillar will act as a financial buffer against global shocks, including commodity price swings, pandemics, and geopolitical disruptions.

The infrastructure pillar will allocate a regulated share of the Fund toward commercially viable national projects, aiming to attract private investment while expanding public wealth.

Ruto noted that the Fund is part of a broader blueprint for sustainably financing Kenya’s long-term development. He highlighted that the vision was refined through consultations with leaders across political divides, including former Prime Minister Raila Odinga and former President Uhuru Kenyatta, both of whom emphasised the importance of infrastructure in driving economic transformation.

The President also thanked the 13th Parliament for its "outstanding contribution" to advancing this national agenda.

Top Stories Today