Retirement headache: Why some older workers are unable to retire

These stories resonate with many retirees in Nairobi, as highlighted by a 2022 survey conducted by the Retirement Benefits Authority.

In traditional patriarchal societies, there was a widespread expectation for older individuals to retire and perhaps retreat to rural areas to enjoy their sunset years.

However, this expectation is gradually shifting as more elderly people find themselves reluctant to leave urban environments. This change is largely because, even as they reach their 50s, they still carry significant responsibilities and lack the financial security to comfortably retire to the countryside.

More To Read

- Retirement Benefits Authority under fire over delayed pension payments to retired staff

- How blocked drainage systems, open sewers threaten lives, businesses in Eastleigh

- Private sector activities rise for the first time in five months in September

- Nyota programme: Sh5 billion Youth Fund now operational to boost enterprise

- How forged academic papers are helping fraudsters secure top government jobs — EACC

- Africa lags in green jobs boom, holds just 2 per cent of the global sum

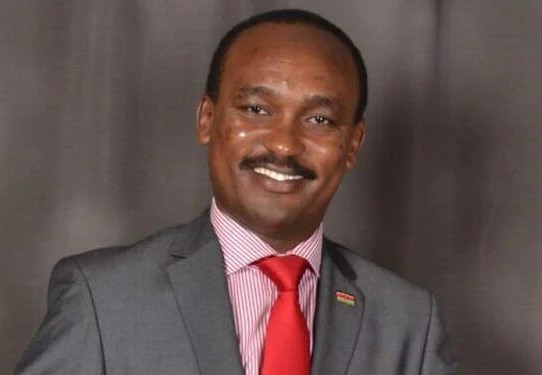

Franklin Ombeta, a 52-year-old security officer in Eastleigh, reflects on his journey: "I've spent the last 18 years in Nairobi, seeking opportunities for a better future. My life has been a blend of urban hustle and rural ties, dictated by the demands of providing for my family."

Franklin, a father of four, tragically lost one of his children. He currently has children at different stages of education, including one in university and another in Form four, while his youngest has just started secondary education.

Franklin's return to Nairobi eight months ago was driven by his determination to ensure his children receive a good education: "I came back to Nairobi to ensure my children get a good education because that's my priority above all else."

Despite his dedication, Franklin faces the harsh reality of living paycheck to paycheck, with little set aside for retirement. "I barely have anything set aside for retirement apart from the Sh70,000 in my NSSF account."

Franklin Ombeta, a security officer at California Square in Eastleigh on March 21, 2024. (Photo: Justine Ondieki).

Franklin Ombeta, a security officer at California Square in Eastleigh on March 21, 2024. (Photo: Justine Ondieki).

The COVID-19 pandemic dealt him a blow, costing him his job and forcing him to rely on the hope of one day acquiring his NSSF savings for sustenance in retirement.

Despite these challenges, Franklin remains resolute, planning to start a small business like a kiosk or poultry farming when he eventually returns to the rural area. "When I finally go back home, I plan to start a small business like a kiosk or rear chickens, which might yield long-term benefits."

Joseph Njogu Ngwachi, a 75-year-old resident of the Majengo slums in Pumwani, epitomizes the struggle of many retirees in Nairobi. Having lived in the city since 1958, Joseph has strong ties to both urban and rural life.

He juggles his visits to his rural home with the demands of managing his real estate business in the city. Joseph's vision for retirement includes returning to the rural area and focusing on agricultural projects, supported by his wife, who manages their household affairs.

"I visit my family in the rural area frequently, sometimes every week, and whatever I make goes towards sustaining my family," he says.

However, he acknowledges the financial challenges ahead, knowing it will take time to accumulate enough funds to sustain himself in retirement. "I plan to move back to the rural area once my agricultural project stabilizes, but it will take some time to gather enough money for survival."

RBA survey

These stories resonate with many retirees in Nairobi, as highlighted by a 2022 survey conducted by the Retirement Benefits Authority.

The survey revealed that 88 per cent of retirees have dependents relying on them for support, with the highest number of dependents (377) falling in the age category of 25 years and above.

Moreover, nearly two in five pensioners use their pensions to pay for their children's education, emphasizing the financial strain faced by retirees. Despite these challenges, retirees remain resilient, with 73 per cent supplementing their retirement benefits with additional sources of income, such as business ventures or real estate.

According to the survey, dubbed The Eighth Pensioners and Retirees Survey 2022, released on October 5, 2022, retirees increasingly found themselves responsible for caring for grandchildren, including covering expenses such as school fees, healthcare, household expenses, among others.

Many supplemented their retirement income through farming, business ventures, and real estate, with 73 per cent feeling their savings were inadequate. Among respondents, 65 per cent sought additional income sources and engaged in business and real estate, which yielded higher average earnings compared to farming.

The survey indicates that in their retirement years, many retirees find themselves shouldering significant responsibilities rather than enjoying the anticipated rest.

424 retirees from the year 2016 to 2020 were interviewed out of a sample of 602. They were from 42 counties with the majority from Nairobi and Kiambu.

Top Stories Today