Edible oil manufacturers warn tax hikes in Finance Bill could trigger food crisis

The price of cooking oil could jump from Sh202 per litre to Sh337, and cooking fat from Sh107 to Sh162, heavily straining low- and middle-income households.

Kenyan households could struggle to meet basic food needs due to the proposed tax increases in the Finance Bill 2024/2025, Edible oil manufacturers have warned.

The bill suggests a 25 per cent excise duty on edible oils and margarine, projected to significantly raise these commodities' prices.

More To Read

- Fury as plainclothes police camp outside Rongai artist Matiri's home without warrant ahead of protests

- MPs reject proposed PAYE changes, urge Treasury to expedite broader tax review

- Finance Bill 2025 proposes 16% VAT on internet radio and TV

- MP Kuria Kimani indicates additional tax measures likely in Finance Bill 2025

- Top state offices allocated Sh5 billion more for salaries, entertainment amid budget cuts

- Treasury mulls using existing tax rates for 2025-2026 budget after deadly protests in 2024

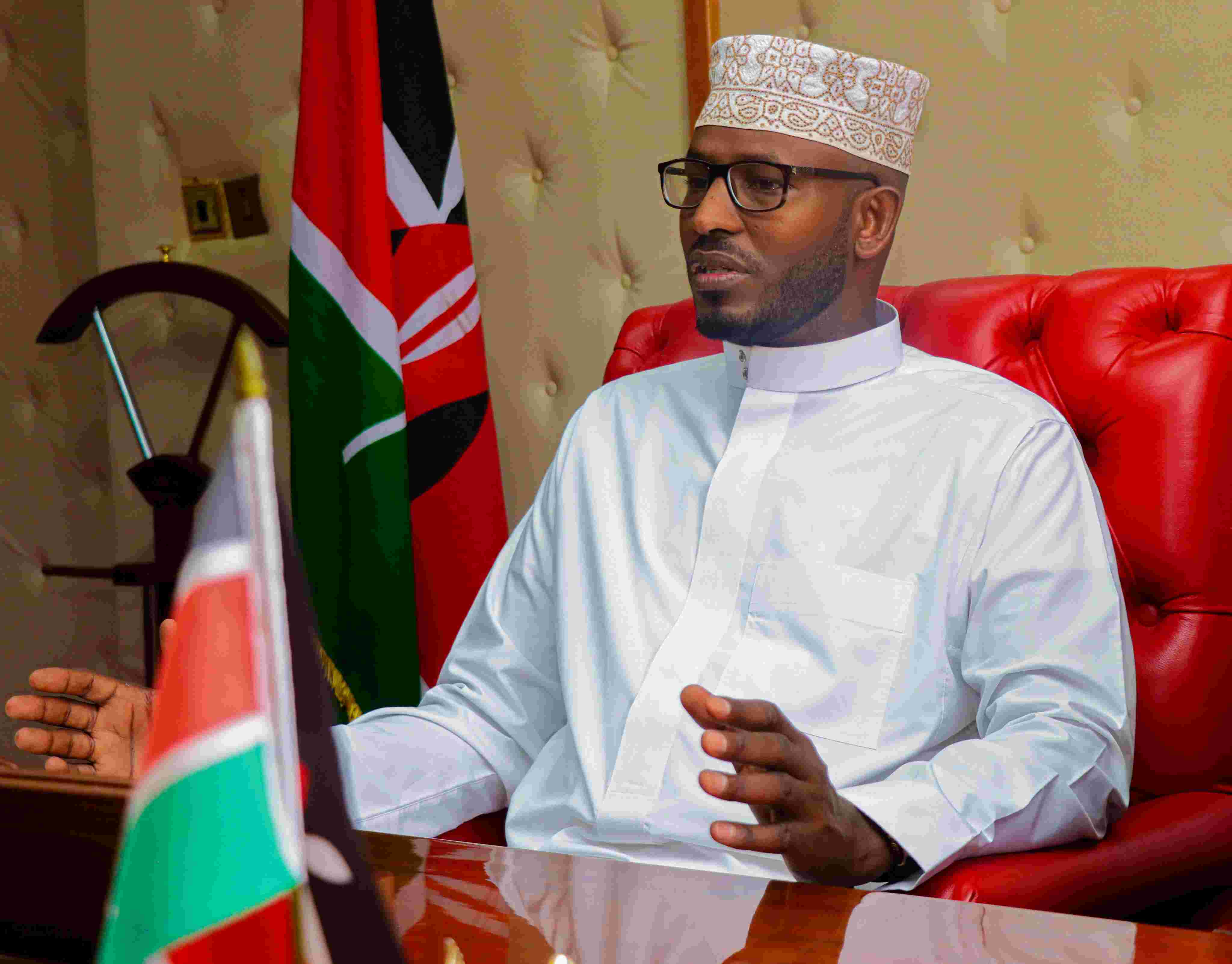

Chairman of the Edible Oil Manufacturers Hayel Saeed pointed out that the prices of fundamental products such as cooking oil, soap, bread, and baked goods would rise sharply.

The price of cooking oil could jump from Sh202 per litre to Sh337, and cooking fat from Sh107 to Sh162, heavily straining low- and middle-income households.

He noted that the price hike would strain family budgets, making it difficult for them to afford enough food to sustain themselves.

According to Saeed, for a typical family of four, the increased cost of basic foods would mean they cannot afford three meals a day.

“With the increase of daily consumables such as bread and chapatis, a family of four people will struggle to have a full meal a day. Some families will be forced to eat one meal every two days,” Saeed said while appearing before the National Assembly Trade, Industry and Cooperatives Committee on Thursday.

Chairman of Bidco Africa Limited Vimal Shah, added that the excise duty aimed at reducing palm oil imports to boost local sunflower oil production would instead harm local manufacturers.

“The bad news about this will apply to our locally grown sunflower oil, so even we will stop focusing on buying locally and focus on exporting the sunflower oil. Why are we destroying our local manufacturing?” he said.

Vimal reiterated that the proposed tax should be abandoned to protect local manufacturing.

“We can’t be talking about improving value addition locally by promoting agriculture and manufacturing yet in this one stroke we are destroying that,” he said.

The manufacturers are also challenging the two per cent levy on the Nut and Oil Crops Directive, arguing that it would provide minimal savings on oil products and disadvantage local processing.

“Remove the two per cent levy on the Nut and Oil Crops Directive on all crude oils to promote local processing. We are now disadvantaged and less efficient on all products that use edible oils as input,” Saeed said.

CEO of Kapa Oil Nitin Shah also criticised the frequent tax increases, highlighting their negative impact on investment.

He pointed out that inconsistent policies deter investors, who prefer more stable environments found in neighbouring countries like Egypt, Uganda, and Tanzania.

“Investors look for profits after investing for four to five years. If you keep changing your policy every year then no investors will come here to invest. If you want investors, the policies must be consistent,” he said.

The introduction of an eco-levy at Sh150 per kilogramme has also been met with opposition. The stakeholders argued that there is no clear mechanism to support environmental conservation through recycling, making the levy counterproductive.

Industry representatives are now lobbying MPs to reverse the proposed excise duty, arguing that other taxes, including the housing levy, already overburden consumers.

They have urged the government to withdraw the proposed excise duty, describing it as a potential humanitarian crisis.

Top Stories Today