Helb introduces easier loan repayment for Kenyans in the diaspora

By Lucy Mumbi |

The Loans Board noted that it will offer an 80 per cent penalty waiver for beneficiaries with accrued penalties who pay their loans in one lump sum.

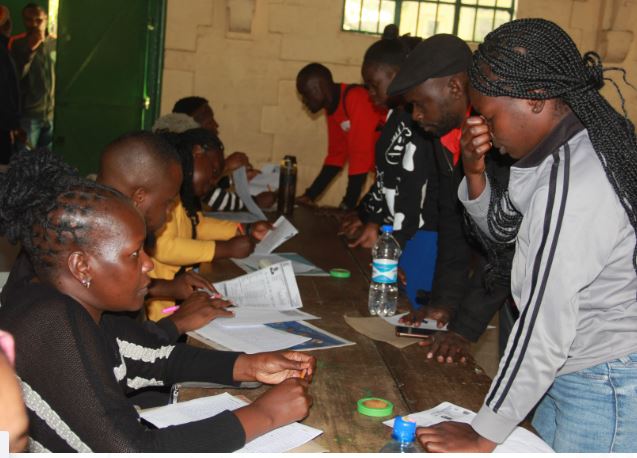

The Higher Education Loans Board (HELB) has introduced a streamlined method for loan repayment, simplifying the process for Kenyans living abroad.

Previously, Helb relied on hiring representatives to locate defaulters internationally. However, in a post on Thursday, Helb said those residing abroad can conveniently repay their loans through the portal, enhancing accessibility and efficiency for diaspora borrowers.

Keep reading

- Attorney General defends new university funding model as fair and effective

- Money from Kenyans in diaspora down by Sh1 billion in September

- Government plans to extend e-Citizen services for 3.5 million Kenyans abroad

- Kenyans in North America top in record diaspora remittances of Sh55.13 billion in August

Kenyans have been urged to log in to the Higher Education Funds (HEF) portal and choose self-serve from the HELB menu to repay a loan, then click on Loan Repayment, select Make Payment, enter the amount, and click Pay.

To complete the transaction, a confirmation message via notification will be sent, select the preferred payment option as you follow the prompts. Lastly, click complete after payment.

HELB has encouraged Kenyans abroad to show their patriotism by settling their loans.

“As per the institution, Kenyans residing abroad should show love for their motherland by paying up and settling their pending loans. Show some love to the motherland and settle those #HELBLoans. Tap, pay, repeat; it has never been easier! Visit http://helb.co.ke,” Helb said.

In 2020, the Loans Board recruited part-time brand ambassadors on a commission basis, primarily stationed in the US and UK, where most of Kenya’s diaspora remittances originate.

“The ambassadors will be responsible for driving brand awareness, recovery, and advocacy. They (brand ambassadors) will implement loan repayment and recovery campaigns and provide feedback on opportunities in the Diaspora,” Helb said.

HELB undergraduate loan repayment begins within one year of finishing studies, or earlier if the board decides to recall the loan. Students can also make voluntary payments anytime to reduce their loan balance.

On June 11, 2024, Helb announced a new deal for loan beneficiaries with a debt penalty waiver for defaulters.

The Loans Board noted that it will offer an 80 per cent penalty waiver for beneficiaries with accrued penalties who pay their loans in one lump sum.

“Pay your loan arrears in a lump sum and enjoy a waiver of up to 80 per cent on accrued penalties,” Helb said.

It noted that the penalties can be paid through USSD code *642#, the HELB app, or the HELB portal, and students can track their loan status anytime, anywhere.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!