Explainer: Applicable procedure and implications of rejection of Finance Bill 2024

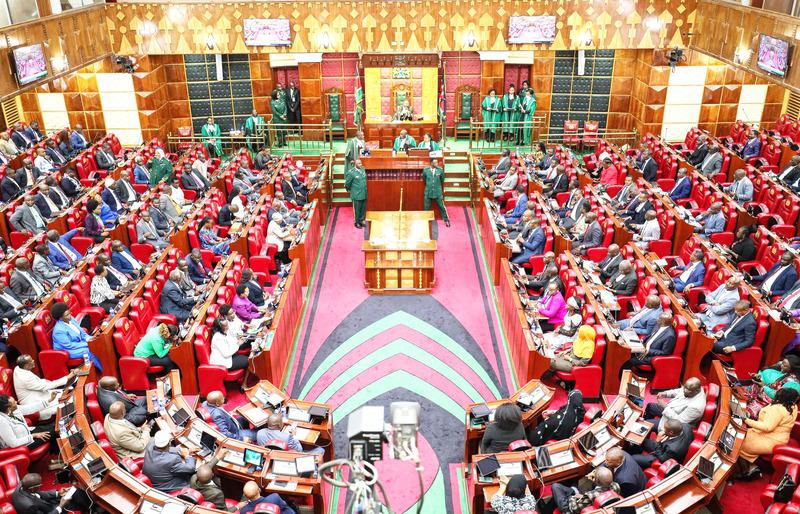

This Explainer serves as additional guidance to Members of Parliament on the basic applicable procedure and implications of the rejection of the Finance Bill, 2024.

The National Assembly has released detailed procedures and implications of President William Ruto's withdrawal of the Finance Bill, 2024. It is as follows:

Pursuant to the provisions of Article 115 (1)(b) of the Constitution, the President, vide a Memorandum dated June 26, 2024, referred the Finance Bill, 2024 back to the National Assembly for reconsideration with reservations recommending the deletion of all sixty- nine (69) Clauses of the Bill.

More To Read

- Wetang’ula decries 'disruptive' conservatory orders, urges judicial restraint

- KEPSA calls on Parliament to enact reforms to stabilise public universities after 49-day lecturers’ strike

- Civic groups urge Parliament to reform state-owned enterprise laws

- Parliament to fast-track electoral laws ahead of 2027 polls, says Wetang’ula

- Committee uncovers neglect, poor management in MPs’ constituency offices

- Teen who breached Parliament, claiming to be President Ruto’s son, freed

Following receipt of the Memorandum, my office has received queries from Members of the National Assembly on the effect of the Memorandum and the expected next course of action. To this end, for information purposes, I wish to guide as follows-

A. What is the procedure for consideration of the President's Memorandum to a Bill?

1. Article 115 of the Constitution empowers the President to refer back a Bill to Parliament for reconsideration, noting any reservations that the President may have concerning the Bill. Thereafter, Parliament is required to consider the reservations in the manner provided for under Article 115 of the Constitution.

B. What has the President's Memorandum recommended to the National Assembly in respect of the Finance Bill, 2024?

2. The President's Memorandum has referred the Finance Bill, 2024 back to the National Assembly for reconsideration with reservations recommending the deletion of all 69 clauses of the Bill.

C. What is the effect of the President's Memorandum on the Bill and Can the Bill be revived?

3. The President's Memorandum constitutes a rejection of the bill in its entirety. The effect is that the entire Bill will be lost upon approval of the President's reservations and recommendations by the National Assembly. Any Member intending to negate the President's reservations/veto or revive any of the sixty-nine (69) Clauses of the Bill is required to marshal the votes of at least two-thirds of the Members of the National Assembly, being 233 Members. This is in keeping with the provisions of Article 115(4)(a) of the Constitution.

D. What is the next course of action?

4. Upon receipt of the President's Memorandum, the Speaker of the National Assembly is required to refer the Memorandum to the Departmental Committee on Finance and National Planning. I have referred the Memorandum to the Committee for consideration and reporting to the National Assembly when it next sits.

5. In the event the Committee fails to report to the House at its next sitting, the House shall proceed and consider the Memorandum at Committee of the Whole House upon resumption from recess.

E. What should guide the Committee and the House in considering the President's Memorandum?

6. The President's Memorandum recommending the deletion of all clauses of the Bill notes that it is informed by the need to reject the voice of the people of Kenya who have rejected the Bill in its entirety. The Committee and the House shall take this justification into account in their deliberations.

F. Will the National Assembly be recalled to consider the President's Memorandum?

7. Standing Order 42(3) of the National Assembly Standing Orders requires the Speaker to transmit to every Member any Message received from the President at a time when the House is not in session and to report the Message to the House on the day it next sits.

8. The National Assembly altered its Calendar and proceeded for a short recess on Wednesday, June 26, 2024. The House is scheduled to resume its regular sittings on Tuesday, July 23, 2024. The Departmental Committee on Finance and National Planning shall be required to report to the House on the President's Memorandum on this day.

G. Is there a precedent of the President rejecting an entire Bill?

9. Yes. It is not unusual for the President to refer a Bill back with reservations recommending its rejection through deletion of all of its Clauses. The National Assembly has previously received and considered the President's reservations recommending the deletion of all clauses in a Bill during the 11th and 12th Parliaments.

10. In particular, the House received and considered reservations relating to the Central Bank (Amendment) Bill (National Assembly Bill No. 28 of 2014) and the Law of Contract (Amendment) Bill (National Assembly Bill No. I of 2019). In both instances, the House failed to marshal the votes of two-thirds of the Members of the National Assembly required to veto the President's recommendations.

H. Can the Finance Bill, 2024 become law by effluxion of time?

11. Emphatically, No! Having been referred back to the National Assembly for reconsideration on account of the President's reservations, the Finance Bill, 2024 cannot become law through mere lapse of time.

1. What is the link between the Budget, the Finance Bill and the Appropriation Bill?

12. The Budget for any financial year comprises Estimates of Expenditure for the national government. The approved Estimates of Expenditure are translated into an Appropriation Bill for consideration and passage by the National Assembly.

13. Documents supporting the Budget contain also projections of revenue, loans, and grants required to finance the Budget for a Financial Year. The projections of revenue are derived from existing tax measures and proposed revenue-raising measures through new or additional taxation. Any new or additional taxation measures and any variation to existing tax measures are introduced through a Finance Bill.

14. The Finance Bill is a piece of legislation that largely consolidates the various proposed taxation measures intended to raise additional revenue to support the budget. It may lead to an increase or reduction of taxes. The various revenue-raising measures in a Finance Bill are costed and therefore constitute part of the Estimates of Revenue.

J. What are the implications of the Rejection and Loss of the entire Finance Bill, 2024?

15. We are guided that the rejection and loss of the entire Finance Bill, 2024 shall occasion a financing gap of approximately Sh300 billion between the expenditure approved by the National Assembly through the Appropriation Bill, 2024 and the projected revenues that may be raised from the existing tax measures.

16. The next Financial Year shall commence in the next four days, being July 1, 2024. The instrument which authorises the withdrawal of monies from the Consolidated Fund for utilisation by the national government is the Appropriation Bill, which is distinct from the Finance Bill.

17. Notably, the House has already passed the Appropriation Bill, 2024. We are guided that the financing gap may be bridged by the reduction of approved expenditure. This may be achieved by enacting a Supplementary Appropriation Bill in accordance with the applicable procedure.

This Explainer serves as additional guidance to Members of Parliament on the basic applicable procedure and implications of the rejection of the Finance Bill, 2024 in addition to Notification No. 006 of 2024 that I issued on June 27, 2024.

Top Stories Today