State withdraws Land Bill over constitutional, legal concerns

In a letter dated June 13, 2024, to National Assembly Speaker Moses Wetangula, Ichung’wah requested that no further action be taken on the bill.

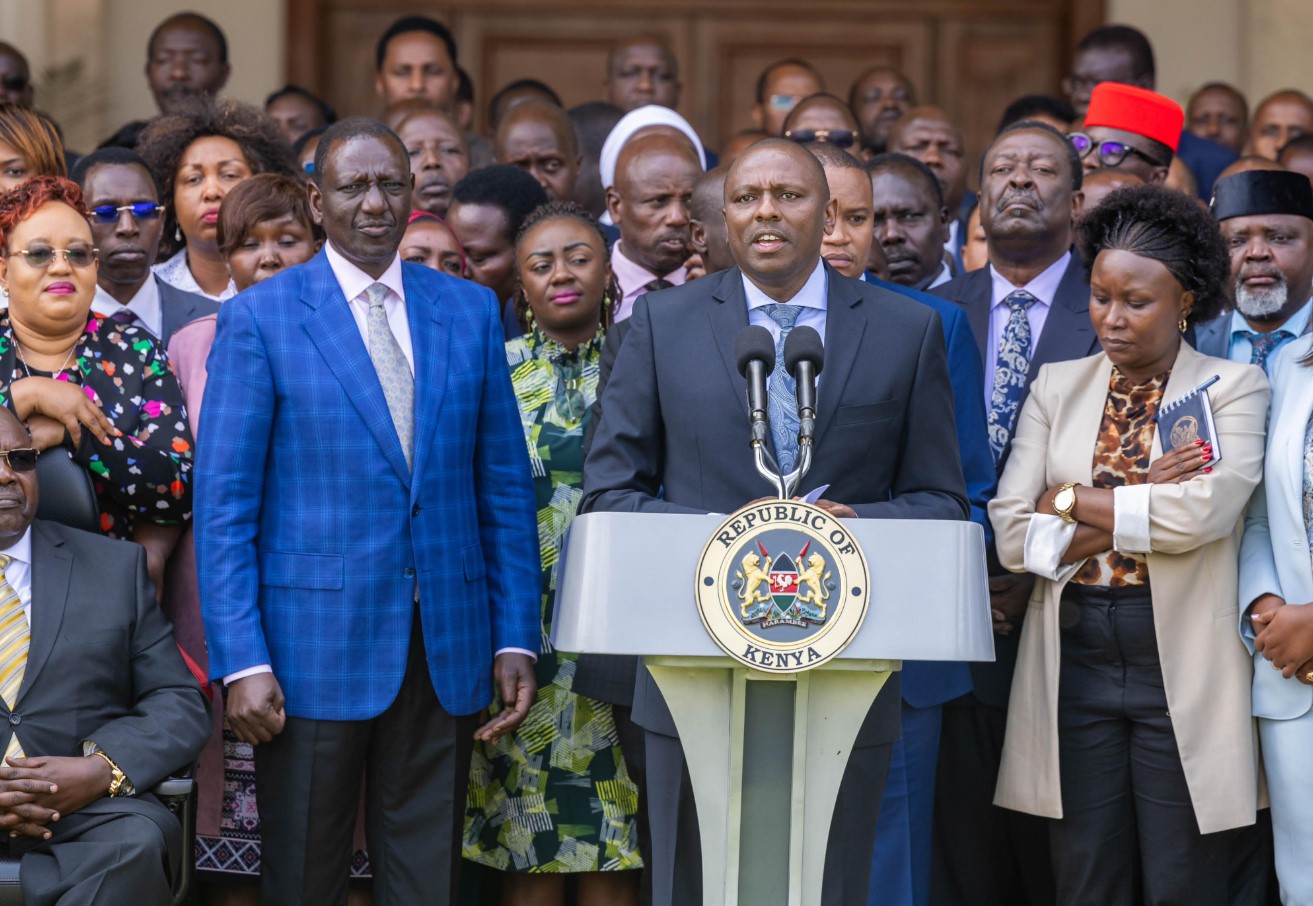

National Assembly Majority Leader Kimani Ichung’wah has formally withdrawn the contentious Land Laws (Amendment) (Number 2) Bill, 2023, citing numerous constitutional and legal issues.

The bill sought to impose land rent on freehold owners.

In a letter dated June 13, 2024, to National Assembly Speaker Moses Wetangula, Ichung’wah requested that no further action be taken on the bill.

More To Read

- Bill targets unsafe pesticide sales on online platforms

- High Court nullifies law limiting NLC’s timeline on historical land cases

- National Land Commission directs State to conclude Ogiek resettlement

- Residents to receive Sh500 million compensation for Isiolo-Garbatulla-Modogashe road project

- Samburu community to regain control of ancestral land after 35-year dispute

- Court quashes vacancies at NLC, upholds commissioners’ six-year terms

"During the meeting of the House Business Committee, I notified the committee not to prioritise the consideration of the Bill to allow for consultations with the Ministry of Lands and Physical Planning and the National Land Commission," reads the letter.

“The Executive had further advised on the need for the ensuing issues to be addressed and resolved before further consideration of the bill."

Following discussions with relevant stakeholders, Ichung’wah confirmed that the majority party would withdraw the bill.

“Having consulted with the relevant stakeholders, this is now to confirm that the majority party has withdrawn the bill. Consequently, I request that the House Business Committee be notified of the withdrawal of the bill and that no further consideration of the bill should be undertaken."

The bill, introduced by Ruiru MP Simon King’ara, aimed to amend the Land Act of 2012 by inserting a new section immediately after Section 54, which sought to impose annual land rent on freehold landowners, equivalent to charges on comparable leasehold properties.

It had proposed increased costs, including increasing physical planning fees of up to Sh5,000 per hour and other professional advice-based services related to physical planning.

It had also proposed granting the Land Cabinet Secretary the authority to compulsorily acquire land as deemed necessary by the government.

Among those who were to feel the pain of additional levies were homeowners on ancestral land on the fringes of the city, like Dagoretti in Nairobi and towns in Kiambu.

While the bill was already being processed by the National Assembly, its withdrawal has coincided with the government's backtracking on the Finance Bill after countrywide protests.

The proposed law sparked protests and was criticised even by the National Land Commission (NLC) as amounting to double taxation.

"There should be no levy charged on freehold land apart from rates. Freehold interests are superior interests, and there is no landlord, so no rent can be owed," NLC Chief Executive Officer Kabale Tache said.

Experts had also warned that the amendments could lead to many Kenyans losing their properties.

Land Development and Governance Institute (LDGI) Executive Director Mwenda Makathimo said Kenyans could also be taxed for owning freehold land, which is not government land.

“That is what this Act will bring. The land you might have inherited from your parents or bought is freehold land," he told Citizen TV.

Eva Makori, Acting Regional Coordinator, International Land Coalition (ILC) Africa, said, “Imposing this annual levy on land that is freehold property essentially has the effect of converting freehold property into leasehold property and by that, running the risk of dispossessing many Kenyans who may not be able to afford to pay the levy and this includes Indigenous people whose lands are ancestral."

Top Stories Today