Kenya to move away from incremental budgeting model next year

This means the budget statements for every financial year's allocation going forward will start from zero, and all expenses and revenue lines will also be justified afresh.

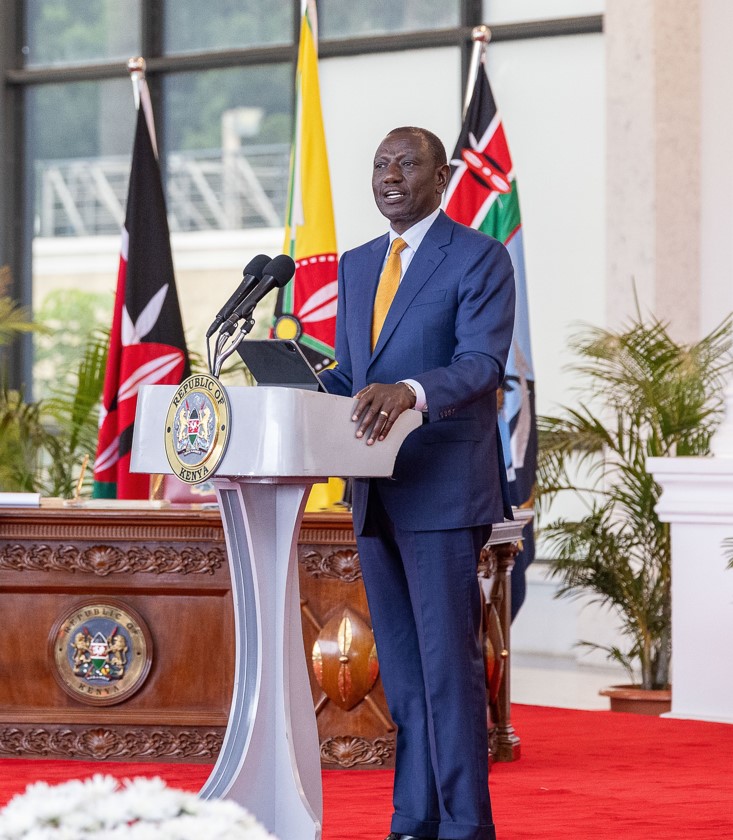

In a bid to reorient the government's budgeting and expenditure framework, President William Ruto has announced that the state will adopt the zero-based budgeting system beginning July 1, 2025.

This means the budget statements for every financial year's allocation going forward will start from zero, and all expenses and revenue lines will also be justified afresh.

More To Read

- Why ODM should convene NDC meeting over broad-based pact with Ruto- Winnie Odinga

- Orengo: Ruto needs ODM and not the other way round

- President Ruto’s ODM invitation sparks speculation of political realignment ahead of 2027

- President Ruto receives key AU reform proposals ahead of Luanda Summit

- President Ruto to deliver State of the Nation address on November 20

- Maasai community sets aside 1 million acres to protect Amboseli ecosystem

The transition will be moving away from the current increment budgeting model, which stipulates that when planning for a subsequent financial year, the budgeting starts by using the current financial year's allocation as a base.

"As pertains to the management of public expenditure, I believe that the time has come for us to break new ground. That is why, beginning in the 2025–26 financial year, we shall adopt a zero-based budgeting system," Ruto said.

However, this will not be the first time the state is going this route. Back in FY2018/19, when the system was last used, the consequent issue of supplementaries characterised the model that by the time the country was getting to Supplementary Budget II 2018/19, all was lost around the zero base.

This, according to policy experts, is a narrative that will be interesting to watch as it unfolds once the model is adopted.

Another key concern that comes with the model is how the government will navigate Article 223 of the Constitution on supplementary appropriation.

The clause states that the national government may spend money that has not been appropriated if the amount appropriated for any purpose under the Appropriation Act is insufficient, a need has arisen for expenditure for a purpose for which no amount has been appropriated by that Act, or money has been withdrawn from the Contingencies Fund.

If the switch is effected, it could then mean that the Public Finance Management (PFM) be amended for the transition from cash to accrual accounting to match the model.

Accrual accounting records revenue and expenses when transactions occur but before money is received or dispensed.

On the other hand, cash basis accounting records revenue and expenses when cash related to those transactions is actually received or dispensed.

Top Stories Today