Petition to overturn 6-year-old tax relief for manufacturers faces opposition from AG

Mboya’s petition criticised the government for allegedly unfairly introducing the framework, citing that Blue Nile Rolling Mills (BNRM) and 17 other companies were given a 10-year exemption on import taxes without proper public participation.

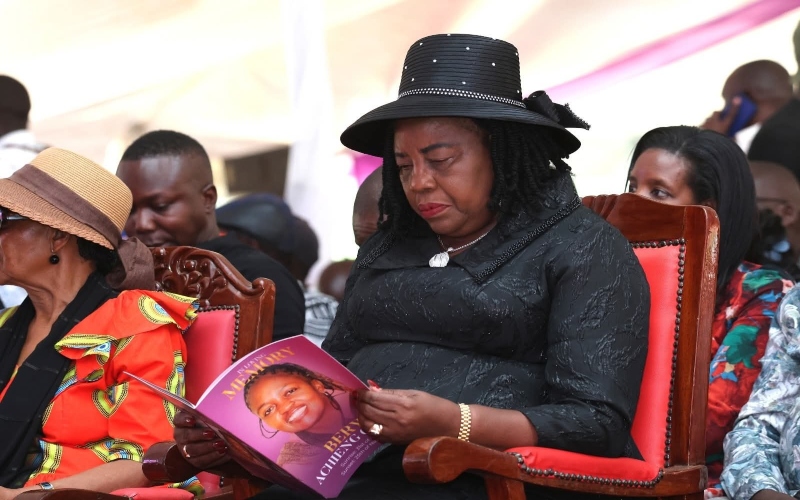

Attorney-General Dorcas Oduor has requested the High Court to dismiss a petition aimed at overturning the Special Operating Framework Agreement (SOFA), a six-year-old policy that grants tax incentives to manufacturers to boost industrial growth.

Oduor argues that there is no basis for halting the agreement, which has been in effect for an extended period.

More To Read

- AG denies knowledge of police officer’s death in Haiti despite Ruto’s statement at UN

- CJ Koome, AG Oduor take opposing views on anticipatory bail amid Ruto criticism

- Justin Muturi reveals how he became AG after initially declining the role

- Whistleblowers to get stronger protection, rewards under new bill

- AG Dorcas Oduor seeks to cut graft trial timelines to six months

- Ruto, Oduor, Wetang’ula, Government Printer face contempt risk over IEBC appointments despite court order

Responding to a petition filed by lawyer Apollo Mboya, Oduor argued that Mboya has failed to provide any compelling justification to suspend laws that have governed the sector for the past six years.

Mboya’s petition criticised the government for allegedly unfairly introducing the framework, citing that Blue Nile Rolling Mills (BNRM) and 17 other companies were given a 10-year exemption on import taxes without proper public participation.

In defense, the Attorney-General stated that Mboya's arguments attempt to make the court interfere with the government’s prerogative in setting national economic policies.

"It is apparent from the pleadings that both the executive and the legislature operated within the constitutional scheme of their respective powers, within the safeguards of the separation of powers," Oduor said through chief State counsel Emmanuel Bitta.

Economic divisions

She emphasised that economic decisions are within the mandate of the political organs of the state, not the judiciary.

Bitta urged the court to reject the petition, noting that it infringes upon the constitutional responsibilities and discretion of state offices. He further questioned why it had taken Mboya more than six years to raise concerns about the tax incentives.

The State counsel also noted that Mboya's affidavit contains information not ordinarily within his knowledge, yet the source of the information has not been disclosed.

In his petition, Mboya claimed that the tax exemptions granted to BNRM had created an uneven playing field within the steel industry and deprived the government of essential revenue.

He further argued that the framework allows certain companies to enjoy blanket tax exemptions and reduced rates, which is both arbitrary and unjustified.

Mboya warned that if the court does not issue conservatory orders, the Trade and Investment Ministry, along with the Treasury, would continue granting exemptions to companies, ultimately harming Kenyans.

On the other hand, BNRM has called for the petition to be dismissed, arguing that the issue of public participation was addressed in a 2020 ruling which found that the Finance Act 2018 had been adequately subjected to public input.

The manufacturer also pointed out that former Attorney-General Justin Muturi, now the Cabinet Secretary for Public Service, had cautioned against revoking the tax incentives under Sofa, noting that it had established a legitimate expectation for the investor.

Muturi had further warned that withdrawing the incentives could lead to disputes that might expose the government to potential liabilities.

Top Stories Today