Government plans to reduce PAYE to ease tax burden - CS Mbadi

The CS also emphasised the importance of ensuring that Kenyans have more disposable income after taxes.

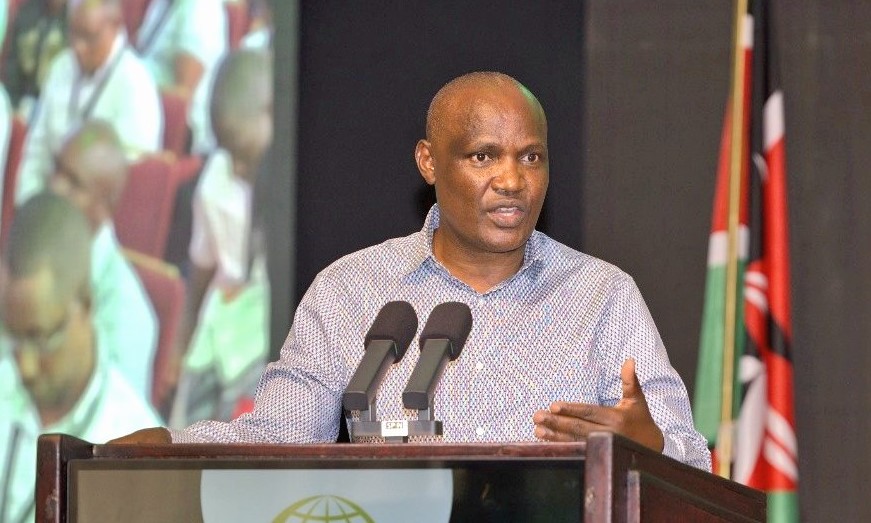

National Treasury and Economic Planning Cabinet Secretary John Mbadi has revealed the government's plans to reduce Pay As You Earn (PAYE) taxes within the next two years, to ease the tax burden on Kenyans.

Speaking at the 41st annual seminar of the Institute of Certified Public Accountants of Kenya (ICPAK) in Mombasa, Mbadi outlined a series of measures that would make the country's tax policies more manageable for citizens, while also addressing key areas of the economy.

More To Read

- Kenyan CEOs warn of tough times as high costs, taxes squeeze businesses

- Treasury rolls out new plan to expand financial inclusion in Northern Kenya

- Kenya borrowing Sh32.4 million every hour as total public debt hits Sh12 trillion

- Kenya confident of new IMF funding deal amid improved economic outlook

- Kenya steps up sovereign credit reforms with plans to create rating committee

- Governors warn of service paralysis as e-procurement dispute deepens

The CS acknowledged that taxation has become a contentious issue for many Kenyans, especially amid the ongoing debate surrounding the government's initiatives like the affordable housing project.

"I think in affordable housing, to a large extent, we may have issues here and there. I know where the problem is, it's the taxation element. That is the elephant in the room," Mbadi said.

The CS admitted that while Kenyans are unhappy about the housing levy, eliminating it would not be a wise move.

"You don't want the housing levy, but it is already there. Let us provide housing to Kenyans who cannot afford decent living. Eliminating it would be unwise," he noted.

Despite the government's initiatives, which include the affordable housing scheme, Mbadi expressed an understanding of the public's frustration over high taxes.

However, he said that steps were being taken to reduce the overall tax burden.

"We must address this issue. Going forward, we must reduce taxes. While the housing levy may remain, we can reduce Pay As You Earn," Mbadi said, hinting that the government is committed to making the tax system more equitable.

To achieve this goal, Mbadi proposed expanding the tax base by improving the collection of Personal Income Tax, Rental Income Tax, and Value Added Tax (VAT), particularly VAT, which he noted is currently evaded on many goods.

"If we improve Personal Income Tax collection, enhance Rental Income Tax, and correctly collect Value Added Tax which is currently evaded on many goods we can lower PAYE within the next one to two years," he explained.

More disposable income

The CS also emphasised the importance of ensuring that Kenyans have more disposable income after taxes, which in turn would contribute to economic growth.

"The question is not whether money goes to the Social Health Insurance Fund or the housing levy. Kenyans need a better package in their hands to promote economic growth. The government must ensure the overall tax burden is manageable," Mbadi said.

Backing the government's approach, National Assembly Majority Leader Kimani Ichung'wah emphasised the role of public-private partnerships (PPPs) in reducing reliance on taxpayers.

"Globally, economies are moving away from raising revenue solely through taxation to financing long-term objectives via public-private partnerships," Ichung'wah said.

The Majority Leader also urged accountants to be champions of transparency, accountability, and value for money in the execution of PPPs.

In his remarks, ICPAK National Chairman Philip Kakai stressed the critical role the accountancy profession plays in supporting government policies.

"In Kenya, ICPAK has gained increasing significance as an enabler of the national development agenda," Kakai said.

The seminar, which focused on leveraging technology to enhance efficiency and accuracy in the accounting profession, also explored the evolving role of accountants.

Top Stories Today