Treasury targets Sh2.5 trillion in pension, insurance savings for infrastructure projects

This initiative follows the collapse of high-profile PPP deals involving Indian billionaire Gautam Adani in Kenya's road and energy sectors, amid allegations of corruption.

The National Treasury is exploring ways to harness the Sh2.5 trillion savings from the pension and insurance sectors to finance infrastructure projects under the Public-Private Partnership (PPP) model.

This initiative follows the collapse of high-profile PPP deals involving Indian billionaire Gautam Adani in Kenya's road and energy sectors, amid allegations of corruption.

More To Read

- Government eyes handing NTSA’s smart driving licence programme to private investor

- Government sets 14-day deadline to end student bursary delays nationwide

- Treasury: Kenya can no longer rely on taxes or borrowing for big infrastructure projects

- World Bank warns political interference weakening Kenya’s state-owned enterprises

- Treasury CS John Mbadi defends ballooning State House budget

- Ndindi Nyoro questions government’s decision to sell 15 per cent Safaricom stake

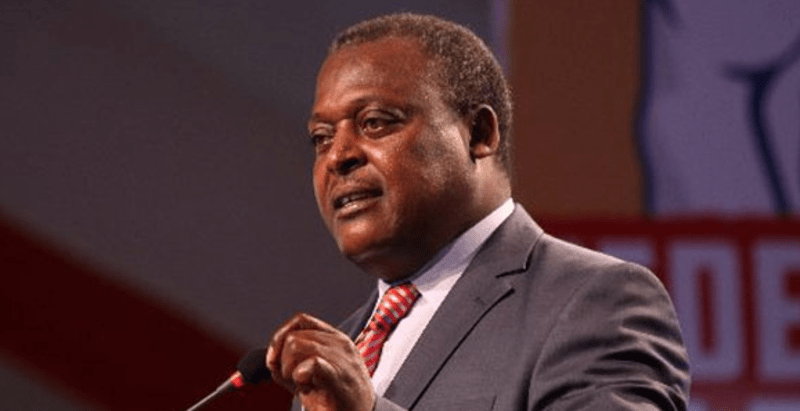

Speaking at the Public Service Superannuation Fund's (PSSF) Annual General Meeting in Nairobi on Wednesday, Treasury Cabinet Secretary John Mbadi instructed Principal Secretary Chris Kiptoo to establish a committee of experts.

The team, excluding politicians, will develop strategies to channel pension and insurance funds into sustainable, commercially viable infrastructure projects.

"I'm hereby directing the Principal Secretary to convene a team of experts and not politicians to look at how we can leverage savings from pension and insurance sectors to finance PPP projects. That team will report back on March 31, 2025," Mbadi said.

He stressed the need to reduce Kenya's reliance on external borrowing. "We must look for ways of running away from going outside the country to look for money. The CS National Treasury should not be going to Washington to look for money," Mbadi stated.

Currently, the Retirement Benefits Authority (RBA) restricts investments in government infrastructure projects to a 10 per cent allocation in debt instruments.

These include infrastructure or affordable housing projects approved under the PPP Act, 2013.

The RBA regulations outline specific asset classes for retirement funds, such as fixed deposits, corporate bonds, mortgage bonds, collective investment schemes, and East African Community (EAC) government securities.

Mbadi's directive comes amid growing public concern about the lack of transparency and due diligence in PPP contracts.

These issues have led to fears of taxpayers potentially losing billions through questionable deals.

The newly formed committee has until March 2025 to present its findings to the Treasury, a move expected to guide the government's strategy for leveraging domestic resources to support critical infrastructure development.

Top Stories Today