KRA fires 25 workers over graft, recovers Sh549 million in illicit wealth

To encourage whistleblowing, KRA said it introduced a reward system offering informers five per cent of the recovered tax, capped at Sh5 million per case.

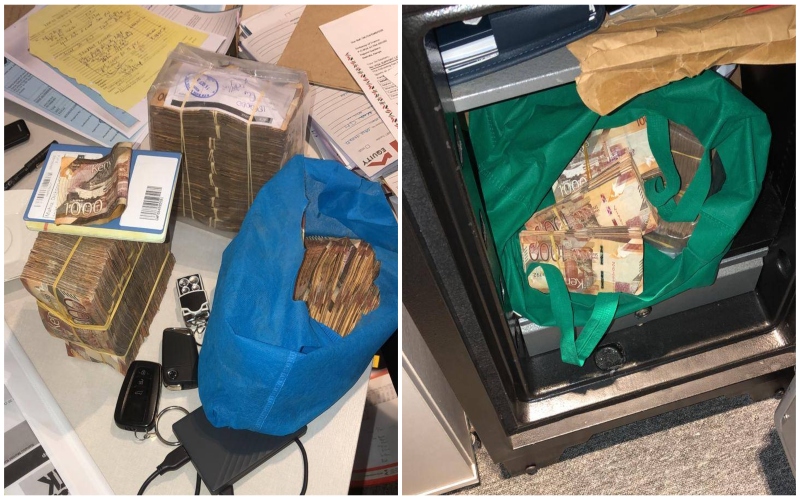

At least 25 Kenya Revenue Authority (KRA) employees were dismissed between July and September 2024 due to corruption, with the agency recovering Sh549 million in illicit wealth during the same period.

This marked a sharp rise compared to the same period in 2023 when only seven staff members were fired over similar allegations.

More To Read

- KRA’s official X account hacked, public warned against fraudulent posts

- Funding shortage puts EACC’s anti-graft war at risk- Auditor General

- High Court rules in favour of KRA in Sh1.1 billion tax dispute, orders fresh tribunal hearing

- Treasury reports Sh16.9 billion in excise duty waivers amid push for local manufacturing

- IMF questions Kenya’s exchange rate policy amid new funding negotiations

- Court dismisses EACC bid to block Sh20.5 million fire engine tender payment

In the three months to September 2024, the authority said it handled 84 disciplinary cases involving its workers, more than double the 37 cases recorded in the previous year.

The dismissed employees were implicated in fraudulent activities such as assisting in the illegal clearance of cargo and tampering with tax returns to help taxpayers evade their obligations.

KRA Commissioner-General Humphrey Wattanga emphasised the authority’s commitment to eradicating graft.

Integrity and accountability

“We are committed to transforming KRA into a world-class institution with the highest standards of integrity and accountability,” he said, terming the dismissals as part of a zero-tolerance approach to corruption.

The agency also conducted lifestyle audits on its employees, recovering Sh549 million in illicit wealth during the 2023-24 financial year.

“In the financial year 2023-24, 41 lifestyle audits were conducted leading to the recovery of Sh549 million. Other key anti-corruption measures include profiling of tax evaders and the adoption of a whole-of-government approach, which promotes collaboration across public institutions to enhance compliance and curb evasion,” reads a KRA report.

To further reinforce its anti-corruption initiatives, KRA established Corruption Prevention Committees (CPCs) tasked with preventing malpractices in operations.

According to Wattanga, these committees meet quarterly to review the implementation of the Public Service Integrity Programme (PSIP) and address emerging risks.

“The CPCs take appropriate administrative actions against any reported malpractices, reporting on emerging risks, and meet quarterly to evaluate the implementation of PSIP activities,” he said.

KRA also revealed it has embraced technology to address revenue leakages.

One of its key innovations is iWhistle, a web-based platform enabling the public to anonymously report corruption and tax evasion.

“To further bolster the fight against corruption, KRA has leveraged technology to seal revenue leakages. iWhistle has been instrumental in recovering Sh4.22 billion in the financial year 2023-24 alone,” KRA said.

Reward for informers

To encourage whistleblowing, KRA said it introduced a reward system offering informers five per cent of the recovered tax, capped at Sh5 million per case.

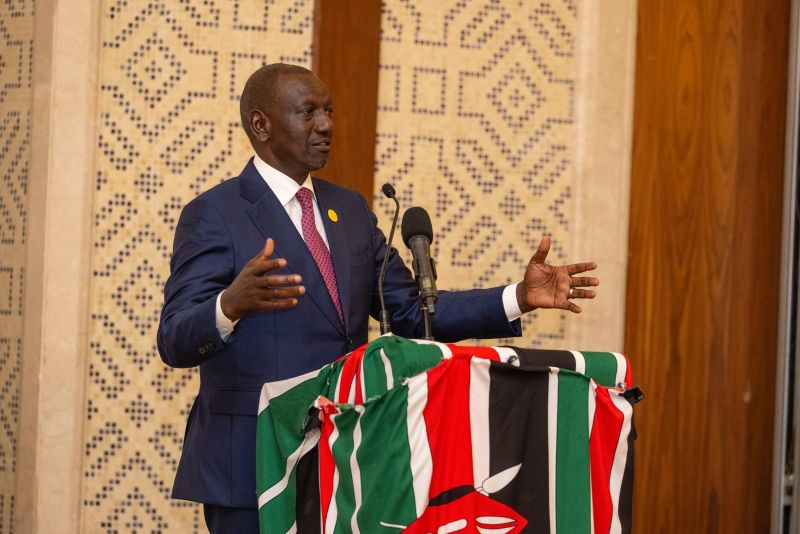

The tax authority has faced mounting pressure from President William Ruto and the National Treasury to eliminate corruption within its ranks.

In 2022, Ruto highlighted widespread collusion between KRA officials and rogue traders, alleging that it resulted in annual revenue leakages of up to Sh400 billion.

Ruto singled out excise duty collection on products like bottled water, spirits, and cigarettes as particularly compromised. He pointed to discrepancies in excise stamps sold, with Kenya reportedly selling 2.9 billion stamps annually compared to seven billion and nine billion in Tanzania and Uganda, respectively.

“There are people who are selling the balance which is approximately seven billion stamps. I have told the Commissioner-General (that) he must tell these people to stop, and we have no choice because I do not want to fight with people, but they must stop,” the President said.

The government has made tax collection a priority as it seeks to boost revenue to fund its budget and reduce reliance on debt, which accounts for over 65 per cent of tax revenue in annual repayments.

Top Stories Today