Kenya steps up sovereign credit reforms with plans to create rating committee

The proposed committee will institutionalise a coordinated national approach to credit ratings, fostering structured, proactive engagement with credit rating agencies (CRAs) and regular monitoring of key rating drivers.

Kenya is ramping up efforts to improve its sovereign credit rating through a high-level, three-day national workshop convened in Mombasa, bringing together a coalition of international and local partners.

The workshop, which kicked off on October 6, is spearheaded by the National Treasury in collaboration with the United Nations Development Programme (UNDP), the Government of Japan, AfriCatalyst, and the African Peer Review Mechanism (APRM).

More To Read

- National Treasury secures Sh437.8 billion loan to plug budget deficit

- MPs raise alarm over alleged misappropriation of College of Insurance land

- MPs question rising debt despite Treasury’s reduced CBK borrowing

- National Treasury says weak revenue, high debt repayments straining Kenya’s budget

- CS Mbadi tables new banking rules targeting non-compliance, unethical practices

- MPs warn Treasury over lapses in fiscal discipline, pension system delays

The forum aims to build a national capacity for engaging credit rating agencies, lower borrowing costs, and align Kenya’s ratings with its robust economic fundamentals. A key highlight is the facilitation of establishing a multistakeholder Kenya Credit Rating Committee.

The proposed committee will institutionalise a coordinated national approach to credit ratings, fostering structured, proactive engagement with credit rating agencies (CRAs) and regular monitoring of key rating drivers.

The government emphasises that this is part of a broader initiative to develop a detailed, actionable plan to enhance the country’s credit rating outlook and reduce the cost of debt servicing.

The forum also seeks to build the country’s capacity to engage effectively with CRAs, including data preparation, negotiation and advocacy skills.

Nevertheless, it is also keen on developing a detailed, actionable plan to improve Kenya's credit rating outlook and lower the cost of debt, supporting the realisation of Vision 2030 and the SDGs.

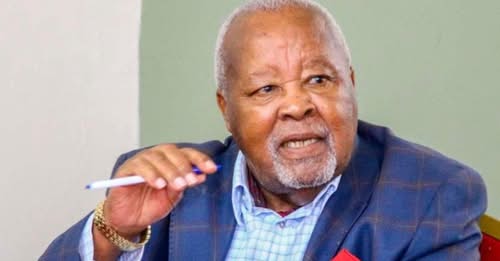

Speaking at the official opening, Cabinet Secretary for the National Treasury, John Mbadi, highlighted Kenya's strong economic base and commitment to prudent fiscal management.

“Kenya is a highly diverse economy and continues to enjoy a stable macro-economic environment that is supportive of growth. In the second quarter of 2025, the economy recorded growth of 5.0% from an average of 4.9% recorded in 2024 and is projected at 5.3 per cent by the end of 2025 and 2026,” Mbadi said.

He added that the current sovereign credit ratings for Kenya, B/B-/Caa1 Negative from S&P, Fitch, and Moody’s, respectively, reflect a constrained profile that has led to elevated borrowing costs due to perceived higher risk premiums.

"Debt service as a share of revenues has grown over time, further squeezing fiscal space and threatening to crowd out critical investments in infrastructure, health, education and climate resilience," he said.

He, however, maintains a brave face, saying the recent developments offer cautious optimism, as the latest ratings were upgrades, signalling growing confidence among rating agencies and investors.

“The recent credit rating upgrade demonstrates the tangible benefits of fairer assessments, which, by extension, translates to lowering borrowing costs. The country can redirect scarce resources from debt servicing into critical priorities such as infrastructure, agriculture, and climate resilience.”

The upgrade is attributed in part to the 2025 Finance Act, which introduced measures to boost tax compliance and improve fiscal transparency.

Complementing these reforms, Mbadi noted Kenya has been executing active liability management operations aimed at smoothing out the country’s debt maturity profile and minimising fiscal shocks.

These strategies are expected to enhance investor confidence and support the country’s broader economic goals.

Notably, the workshop serves as a national platform for stakeholders, from regulators and development partners to private sector actors, to deepen their understanding of credit rating frameworks and expectations.

Top Stories Today