City Hall to register roadside vendors in drive to widen tax base

County officials said that many small enterprises, including food kiosks, salons, garages, and open-air markets, have operated for years outside the tax system.

Nairobi County has embarked on an ambitious drive to register informal traders and streamline its revenue systems as part of efforts to meet a Sh21 billion own-source revenue target for the 2025-26 financial year.

The county says the plan will focus on expanding the tax base by formalising small businesses and fully integrating digital payment platforms.

More To Read

- Governor Sakaja unveils six-borough structure to enhance service delivery

- City Hall moves to recognise urban farmers in policy review

- How Riruta’s upgrade to Level IV hospital is transforming healthcare across Dagoreti

- Why City Hall moved hospital accounts to Sidian Bank- Sakaja

- City residents say Nairobi's illegal billboard cleanup favours some areas over others

- Sakaja’s loan request for salaries draws ire from Nairobi MCAs for lack of details

The strategy was discussed during a high-level meeting convened by the Finance and Economic Affairs department to review revenue collection plans and align sectoral efforts.

The forum brought together heads of departments, subcounty administrators, and revenue officers tasked with developing new ways to increase county income.

County officials said that many small enterprises, including food kiosks, salons, garages, and open-air markets, have operated for years outside the tax system. The administration now wants every business identified, registered, and brought under the county’s tax database.

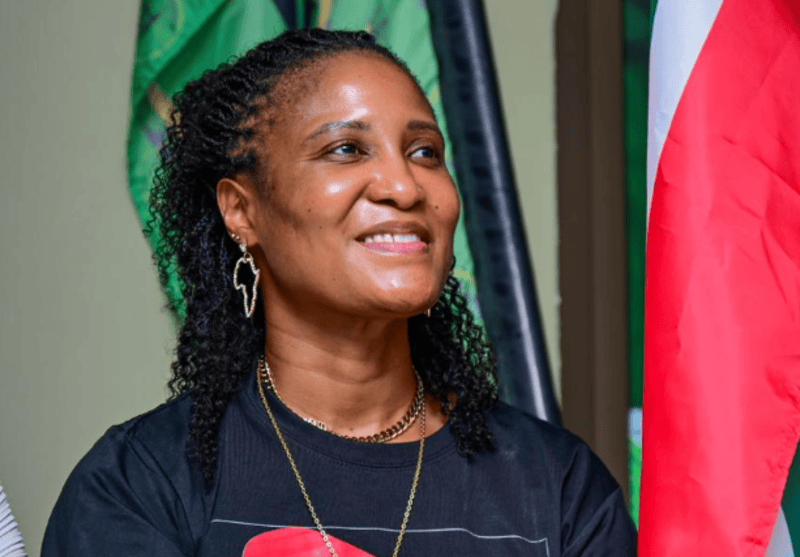

“We must grow our customer database,” said Tiras Njoroge, chief officer for Revenue Administration. “That is the only way we can move away from relying on the same few compliant businesses.”

Each ward and subcounty has been directed to map businesses operating within their boundaries and forward verified records to the central revenue unit.

According to Njoroge, the county intends to rely on data-driven strategies that identify “high-yield” revenue streams, guided by the 80-20 principle where a small fraction of sources generates the bulk of revenue.

To improve convenience and transparency, the county plans to strengthen the NairobiPay platform and expand the number of payment points across subcounties. Officials said digital payments would help close loopholes and ensure collections are traceable.

“We are not introducing new levies,” Njoroge added. “We are improving compliance through better systems and processes.”

The county has already opened service centres in Umoja 1, Ruai, and Dandora to make it easier for residents to pay for services, register businesses, and resolve tax-related issues.

The centres are equipped with digital tools and staffed with officers trained to assist the public.

Finance executive Asha Abdi called for more realistic budgeting and tighter coordination between revenue targets and expenditure plans. She said the county must stop setting inflated goals without matching its collection ability.

“In previous years, we have achieved only 50 to 60 per cent of our revenue targets,” Abdi said. “This year, we must be realistic and base our plans on verifiable data and effective collection systems.”

The county collected Sh13.8 billion in the 2024-25 financial year, up from Sh12.8 billion the previous year, but still below the Sh20 billion target. Officials believe improved compliance, stronger enforcement, and the formalisation of informal traders will help the county close the gap.

To ensure accountability, sector departments will be required to conduct quarterly performance reviews and share reports with the finance team. The departments will also receive new revenue targets based on data gathered during registration to track progress throughout the financial year.

The county also plans a public awareness campaign to educate traders on the benefits of registration and digital payments. Officers have been instructed to enforce tax compliance consistently, issue penalties to defaulters, and ensure uniform implementation across all subcounties.

Top Stories Today