Public hearing on Finance Bill, 2024 scheduled for June 10 at KICC

Among the key proposals generating interest and concern are the introduction of a 2.5 per cent motor vehicle tax, the reclassification of VAT from zero-rated to vatable at 16 per cent, and the amendment of section 51(2) of the Data Protection Act.

The National Assembly, through the Departmental Committee on Finance and National Planning, has invited the public to submit oral views on the Finance Bill, 2024 at a public hearing on the Finance Bill, 2024 (National Assembly Bills No. 30 of 2024), on Monday, June 10, 2024, at the Kenyatta International Conference Centre (KICC) from 9.30 am to 5.00 pm.

The Finance Bill, 2024, was first read on May 13, 2024, and subsequently referred to the Departmental Committee on Finance and National Planning for detailed review.

More To Read

- From detention to global recognition: Rose Njeri named in 2025 Time100 Next list

- The impact of the recent Finance Bill on different sectors

- How protests over Finance Bill hurt Nairobi’s daily revenue collections

- 16 killed in June 25 memorial protests, most by police – Amnesty International

- We are forgotten: Erickson Mutysia’s mother makes heartbreaking plea for justice

- Fury as plainclothes police camp outside Rongai artist Matiri's home without warrant ahead of protests

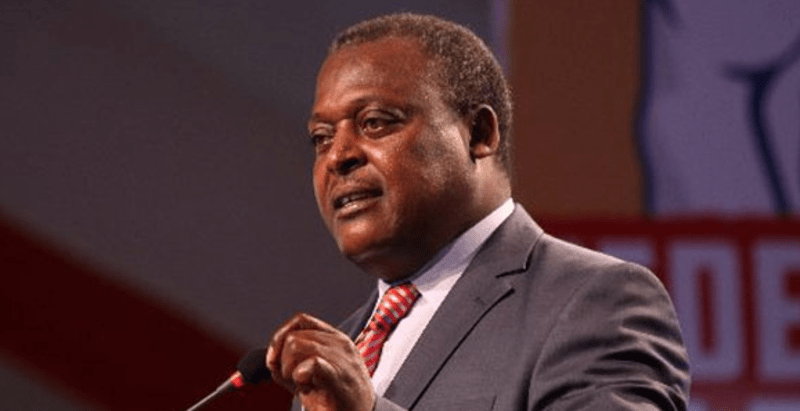

Sponsored by the Chairperson of the Departmental Committee on Finance and National Planning Kuria Kimani, the bill includes significant revenue-raising proposals, such as amendments to the Income Tax Act (Cap. 470), the Value Added Tax Act (Cap. 476), the Excise Duty Act (Cap. 472), and several other statutes.

It also seeks to amend various pieces of legislation relating to fees, levies, and the management of public funds.

Article 118(1)(b) of the Constitution mandates Parliament to facilitate public participation and involvement in its legislative processes.

Standing Order 127(3) of the National Assembly further requires House Committees to engage the public when considering bills.

Among the key proposals generating interest and concern are the introduction of a 2.5 per cent motor vehicle tax, the reclassification of VAT from zero-rated to vatable at 16 per cent, and the amendment of section 51(2) of the Data Protection Act.

The bill proposes changes in the computation of time under tax laws for lodging tax returns, paying taxes, and submitting documents, excluding weekends and public holidays from these calculations.

The also bill proposes that the minimum tax payable to the Commissioner on each vehicle at the time of insurance issuance will be Sh5,000, with a maximum amount set at Sh100,000.

These tax proposals are part of the Kenya Kwanza government's strategy to raise revenue for its ambitious projects.

Top Stories Today