CS Mbadi targets digital economy in new tax proposal push

According to the CS, the proposal is to expand the tax base by bringing the income of the owners of digital platforms that offer the above services into the tax net.

The Ministry of Treasury and Economic Planning has proposed new tax reforms aimed at increasing government revenue by expanding the scope of the digital marketplace.

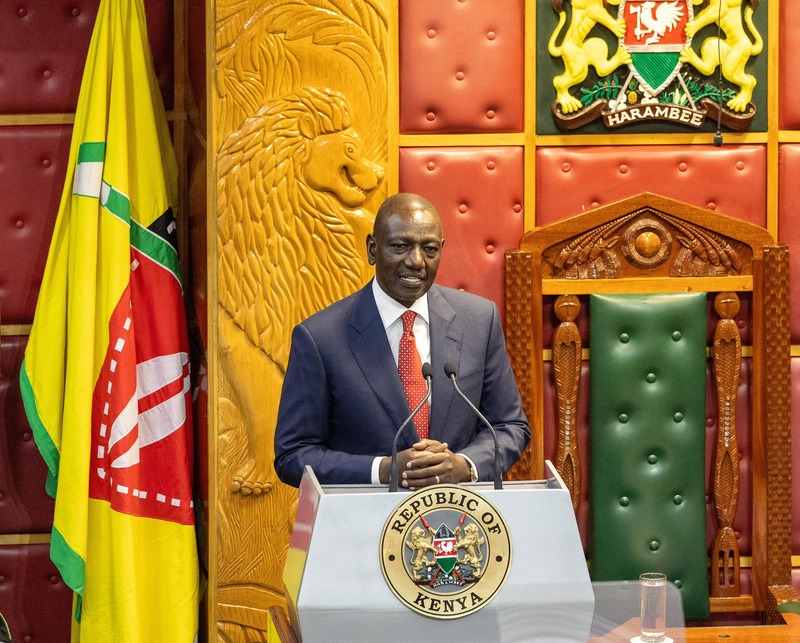

Treasury Cabinet Secretary (CS) John Mbadi, through the Tax Laws (Amendment) Bill, 2024, has proposed measures to broaden the definition of a digital marketplace to encompass ride-hailing, food delivery, freelancers, and various professional services conducted online.

More To Read

- Treasury ordered to draft rules for on-lent loans amid oversight concerns

- Communications Authority of Kenya takes LSK to court over controversial cybercrime law

- Mbadi confirms Treasury deliberately influencing shilling’s value against dollar

- Government clears Sh93 billion in road bills after borrowing Sh104 billion from banks

- Finance Committee slams CS Mbadi for dodging key oversight sessions

- Treasury approves phased settlement of lecturers’ Sh7.76 billion arrears

"The Bill seeks to amend Section 3 of the Income Tax Act in the definition of the digital marketplace by including ride-hailing services, food delivery services, freelance services, and professional services," said Mbadi in a press release.

The proposed reforms are designed to bring revenue from these sectors into the government's tax net, targeting income generated by businesses operating on the Internet or through electronic networks.

According to the CS, the proposal is to expand the tax base by bringing the income of the owners of digital platforms that offer the above services into the tax net.

This push for new taxes follows recent government reviews revealing a revenue shortfall of Sh34.3 billion after the seventh and eighth assessments on disbursement.

The failure to meet financial targets, coupled with the withdrawal of the Finance Bill 2024 which contained revenue-boosting measures prompted the creation of the new Amendment Bill.

The government is seeking to tap into the rapidly growing digital economy, which has become a significant contributor to Kenya's overall economic activity.

Mbadi's tax proposals, which are expected to impact the digital services that many Kenyans use daily, will be presented to Parliament for debate and potential approval.

In addition to the Tax Laws (Amendment) Bill 2024, CS Mbadi has also introduced other legislative amendments, including the Tax Procedures (Amendment) Bill 2024 and the Public Finance (Amendment) Bill, as part of a broader effort to improve financial policy and accountability.

Top Stories Today