Isiolo County flagged for operating six commercial bank accounts

A report shows that Sh27.11 million in personnel emoluments was paid manually, which is against the law.

The Office of the Controller of Budget has flagged the Isiolo County Government for using six commercial bank accounts for its operations and processing personnel payments manually, against the law.

The county's budget implementation review report for the first half of the financial year 2023/24 (from July to December last year) showed that Sh27.11 million in personnel emoluments was paid manually.

More To Read

- Isiolo side Odha FC, coach face year-long FKF suspension after playoff chaos

- Rival Isiolo speakers face Senate over audit failures

- Court dismisses petition to remove Governor Guyo over alleged party defection, sets strict rules for party switching

- Parliament seeks Controller of Budget control of Sh63 billion Housing Levy to curb misuse

- Isiolo courts investors as county pushes public–private partnerships in economic transformation drive

- Senate summons Isiolo, Kericho governors for skipping audit hearings

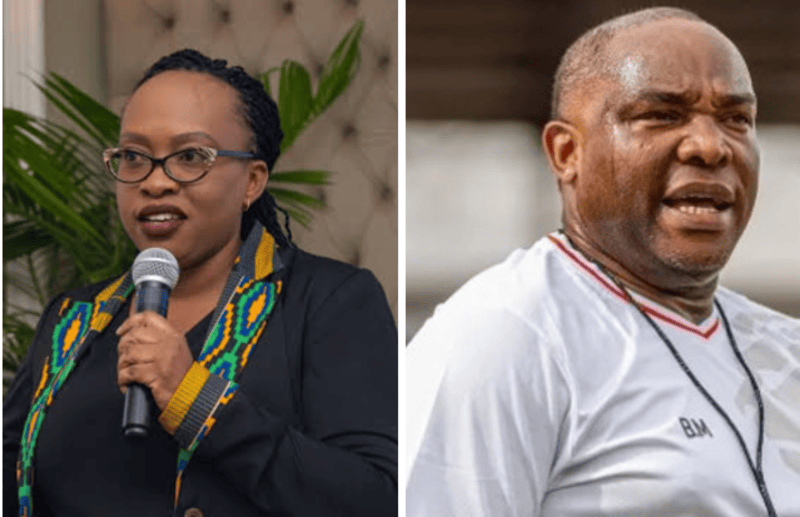

The manual system, Controller of Budget (COB) Margaret Nyakang'o said, was prone to abuse and could lead to the loss of public funds due to a lack of proper controls.

"The government requires that salaries be processed through the Integrated Personnel and Payroll Database (IPPD) system," she said, asking the administration to expedite the acquisition of unified personnel numbers for the staff.

Regulations 82 (1) (b) of the Public Finance Management (County Governments) Regulations 2015 direct that county governments' bank accounts be opened and maintained at the Central Bank of Kenya safe for imprest accounts for petty cash, respective public funds, conditional grants and own source revenue.

The County Public Service Board was also directed to regulate staff engagement with contract and casual workers and ensure strict compliance with approved staff establishments as provided for under Section 74 of the County Governments Act of 2012.

Nyakang'o also flagged the county Treasury's late submission of financial reports on January 24 this year.

Governor Abdi Ibrahim Guyo's administration was also asked to address the high level of pending bills, which stood at Sh432.25 million as of December 31 last year, "to ensure genuine ones are paid promptly."

The administration had, before last December, settled Sh43.85 million in bills, COB indicated.

The county's supplementary budget for the period under review was Sh5.75 billion, out of which Sh4.01 billion was allocated towards recurrent expenditure and Sh1.74 billion for development.

Between July and December last year, the county received Sh2.03 billion as an equitable share and an additional allocation of Sh31.45 million.

Some Sh168.23 million, inclusive of Sh49.92 million from the Facility Improvement Fund (FIF) and Sh10.48 million in revenue arrears and penalties from previous years, was raised as own source revenue, a 107 per cent increase from the previous year's Sh81.29 million.

During the six months, expenditure on domestic travel stood at Sh105. 42 million, with Sh35.7 million spent by the County Assembly and the rest by the executive. The county executive spent Sh28.35 million on foreign travel.

The county assembly spent Sh4.44 million on committee sitting allowances for 18 MCAs and Speaker Mohamed Roba Qoto against the annual budget allocation of Sh1.05 million, with the average monthly allowance for MCAs being Sh41,104.

Under the county's Sh188.06 million allocation towards three funds, which constitute 3.3 per cent of the total budget, Sh110 million was set aside for dealing with emergencies, Sh75 million for bursaries and the rest for the County Assembly Mortgage and Car Loan Scheme.

Financial reports submitted to the COB showed that the county had already spent Sh50 million of the emergency fund, and paid Sh26.2 million and Sh16.16 million for the construction of the Isiolo town modern market and the county headquarters, respectively.

Top Stories Today