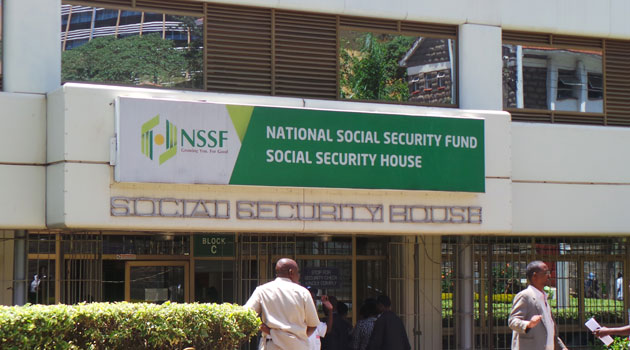

NSSF holds Sh158 million for 18,000 untraced pensioners, Auditor-General's report reveals

NSSF has also been faulted by the Auditor-General for its weak follow-up mechanisms in recovering pension arrears from employers.

Thousands of Kenyans who exited the National Social Security Fund (NSSF) are yet to receive their pension benefits, with the fund still holding Sh158.48 million as of June 2024 meant for 18,671 individuals who have not been traced.

According to the Auditor-General’s latest report, the NSSF has made minimal progress in locating and paying former members, even as the fund continues to face mounting scrutiny over unremitted employer contributions and poor recovery strategies.

More To Read

- "Where did the money go?" Hustler Fund faces scrutiny over Sh8 billion gap

- House team raises alarm over pension delays as arrears pile up to Sh86 billion

- KRA yet to refund Sh904.9 million to NSSF nearly 30 years later, Auditor General reveals

- No evidence to support Sh6 billion Hustler Fund write-off, Auditor General tells MPs

- MPs slam KNBS, KIPPRA for wasting Sh300 million annually on rent while govt buildings lie idle

- Kenya to fully digitise pension payments by July 2025 to combat fraud

The audit revealed that of the 19,623 individuals who exited the scheme, only 952 have been successfully traced over the past two years. These beneficiaries were paid Sh20.3 million, leaving a majority still in the dark over their dues.

“Details of the remaining 18,671 have been mapped and distributed to regions and branches for tracing of members,” NSSF stated in its response to the Auditor-General.

The report comes at a time when the fund is under pressure to not only recover unpaid employer contributions but also ensure that members receive their benefits promptly.

The slow pace in identifying exited members raises further concerns about the fund’s internal systems for record keeping and follow-up.

NSSF has also been faulted by the Auditor-General for its weak follow-up mechanisms in recovering pension arrears from employers.

By June 2023, the fund was owed Sh26.9 billion in unremitted deductions, most of it linked to government entities, counties, and defunct local authorities.

As of December 2024, the fund had managed to collect Sh155.1 million in principal amounts, while Sh7.9 million was under instalment plans.

A further Sh8.8 million was tied to employers undergoing liquidation or receivership.

However, the Auditor-General expressed doubt that a significant portion of the arrears, especially those linked to dissolved bodies, would ever be recovered.

“The recovery rate is quite low and recovery of some will be remote as they relate to defunct local authorities,” warned Auditor-General Nancy Gathungu.

In the same period, the NSSF recovered Sh2.3 billion in penalties from employers who failed to submit deductions on time, under increasing pressure from Parliament to pursue pension debts more aggressively.

A report by the National Assembly’s Public Investments Committee, adopted in June 2024, directed the fund’s Managing Trustee to intensify efforts to recover the outstanding amounts and ensure pensioners receive their rightful benefits without unnecessary delays.

Top Stories Today