Kenya eyes TDB loan to clear Sh51.6 billion debt due September

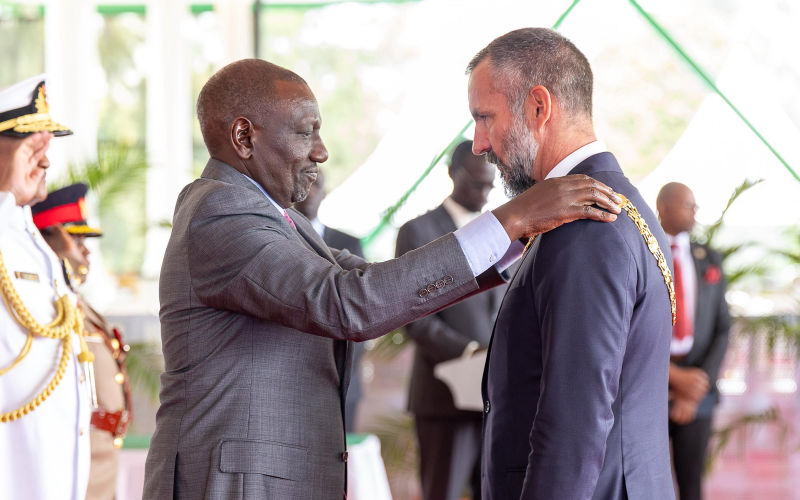

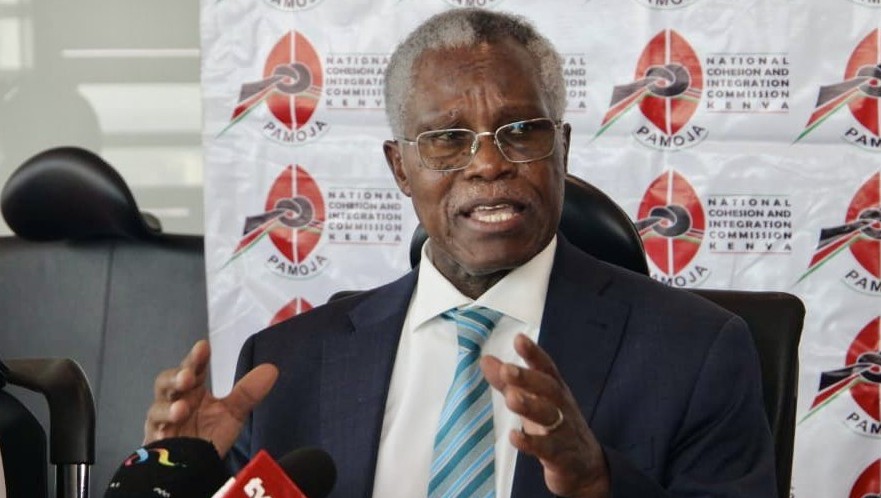

Treasury Cabinet Secretary John Mbadi said the government is seeking a cheaper facility to replace the existing loan and extend repayment terms.

Kenya is exploring new borrowing options from the Trade and Development Bank (TDB) to settle a Sh51.6 billion ($400 million) syndicated loan that matures next month, aiming to reduce the immediate strain on public finances.

Treasury officials say the move will allow the government to avoid diverting tax revenues while managing rising expenditures amid slower revenue growth.

More To Read

- Mbadi urges State agencies to prioritise PPPs in project planning

- Parastatals’ unchecked borrowing fuelliing Sh2.9 billion debt, Auditor General warns

- Mbadi gives counties 30 days to integrate payrolls with IPPD

- Court declines to hear nomination of Harold Kipchumba as Mbadi's replacement

- Government targets land sale to settle Kenya Railways pension arrears

- Treasury rules out Sh200,000 honorarium for former councillors, proposes Inua Jamii support

Treasury Cabinet Secretary John Mbadi said the government is seeking a cheaper facility to replace the existing loan and extend repayment terms.

He added that the refinancing is central to Kenya’s strategy of restructuring its external debts to reduce costs and improve sustainability.

“We are looking to refinance TDB, but if they are not going to offer us a competitive rate, then we would rather get some money and pay it off,” Mbadi said.

“We will either refinance the TDB facility or pay it off from our revenue collection. This is the biggest external debt we are confronted with. This will help us deal with commercial debt, which has been a big problem for us.”

Refinancing the TDB loan would allow Kenya to replace the current debt with a new facility on better terms and a longer repayment schedule.

The Treasury is also negotiating with China to convert dollar-denominated SGR loans into yuan, a move expected to cut interest payments by half.

The current SGR debt requires about Sh130 billion in annual servicing, but a currency swap could reduce the effective interest rate from 6.37 per cent to around three per cent.

Mbadi noted that these negotiations are part of a broader government plan to diversify foreign debt and manage costs.

Kenya has also been active in the Eurobond market, issuing new bonds to retire maturing 2024 and 2027 Eurobonds worth Sh258.4 billion ($2 billion) and Sh116.3 billion ($900 million), respectively.

Treasury data shows that commercial debts, including Eurobonds and syndicated loans, account for Sh1.16 trillion or 23 per cent of external debt.

Mbadi confirmed that further Eurobond buybacks are being considered for bonds maturing in 2028 and 2031 to spread repayment obligations over a longer period. “We realised we had a problem with commercial and bilateral debt. Commercial debts are mostly Eurobonds and syndicated loans, mostly to TDB,” he said.

“We will deal with the closest Eurobond maturity in 2028 and spread it out. We will then deal with maturities in 2031 and 2032 and spread the payments between 2034 and 2048 when we will have no other Eurobonds maturing.”

In addition, Kenya recently secured Sh21.8 billion ($169.42 million) in Samurai financing from Japan for local motor vehicle assembly and energy projects. The facility, issued under Japanese regulations, reflects the government’s effort to diversify its borrowing sources away from heavy reliance on dollar-denominated loans.

Top Stories Today