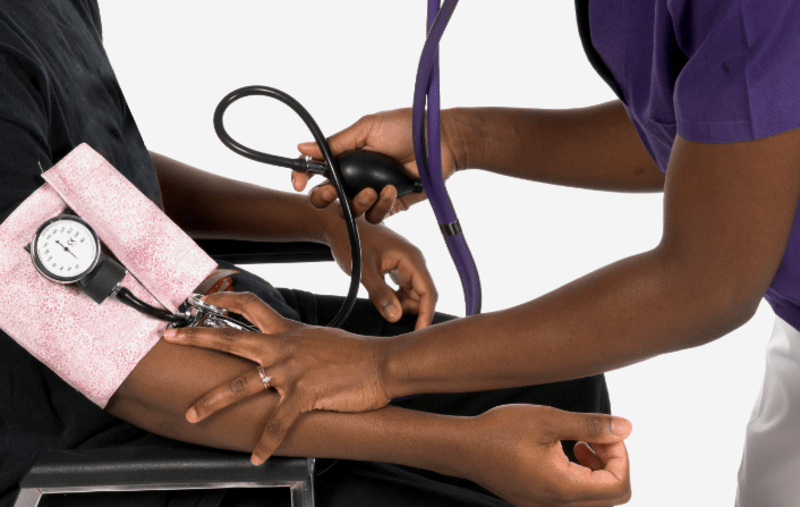

The poor in East Africa burdened by lack of healthcare price controls - report

By Alfred Onyango |

In Kenya, families are still spending billions from their pockets on health services raised through harambees, WhatsApp groups, M-Pesa, loans, the sale of land and other assets.

Lack of government-mandated price controls on healthcare in East Africa is taking a hit on poor households in the region, a new report has said.

Titled 'Primary Healthcare Financing in East Africa', the survey shows that out-of-pocket payments are the primary form of transaction in East Africa.

Keep reading

"The trend, however, poses a significant financial burden for low-income households due to the lack of government-mandated price controls," the report reads.

The survey by Medic East Africa and Medlab East Africa shows that among the East African states, Uganda has the highest out-of-pocket health expenditure in the region at 38 per cent. Tanzania comes in second with 34 per cent, followed by Kenya at 24 per cent. Rwanda has the lowest out-of-pocket expenditure on healthcare, at 11.7 per cent.

Despite the high expenditures out of pocket, the report highlights that health insurance schemes are increasingly gaining traction in countries like Rwanda.

"Informal initiatives sponsored by community-based or faith-based organisations are often more popular than formal insurance programmes. However, most schemes in the region face a shortfall in funds, limiting the translation of insurance coverage into actual benefits for the overall population," the report adds.

However, most schemes in the region face a shortfall in funds, limiting the translation of insurance coverage into actual benefits for the overall population.

"Underfunded healthcare systems and limited access to quality services affect vulnerable demographics such as children, pregnant women, and the elderly. Free or subsidised healthcare services are often not sustainable in the long term," the report reads.

It thus recommends that private financing play a significant role in filling the gaps within the public healthcare system in the region.

Kenyatta National Hospital in Kenya. (Photo: KNH)

Kenyatta National Hospital in Kenya. (Photo: KNH)

It also states that governments can lower out-of-pocket (OOP) expenses by creating a national fund to pay for local healthcare requirements that are financed by taxes and individual contributions.

The pool can serve as a kind of social health insurance, shielding members of the public from unforeseen medical costs.

In Kenya, families are still spending billions from their pockets on health services raised through harambees, WhatsApp groups, M-Pesa, loans, the sale of land, and other assets.

This is despite the availability of medical insurance covers, such as the NHIF.

The report further notes that countries like Kenya, Tanzania, and Uganda have faced challenges in implementing national health insurance schemes.

Kenya's effort to replace the National Health Insurance Fund with the Social Health Insurance Fund (SHIF), for instance, has faced opposition from the Kenya Medical Practitioners, Pharmacists, and Dentists Union.

It is estimated that Kenyans spend Sh150 billion in out-of-pocket expenditures on health services a year, driving nearly a million people into poverty despite the state's efforts to ensure financial protection.

According to the Kenya Demographic Health Survey (KDHS) 2022, the latest report that comprehensively covers Kenya's health sector, only one in four Kenyans has some form of health insurance, with the country's health insurance coverage at 20 per cent.

The government targets hitting 80 per cent of the population enrolled in health insurance coverage by 2030.

With an estimated 15.4 million members in 2023, the data showed that the NHIF had a total of 8.8 million dormant members, which further compels them to cater for medical services directly from their pockets.

This figure is expected to have shot up to date due to socioeconomic factors such as the high cost of treatment and drugs, the income, age, and education level of households, which are worse experienced by those living below 1 dollar (Sh129) a day.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!