Refugees in Kenya to access SIM cards, mobile money under new regulations

This change gives refugees greater access to more services in line with the government-led Shirika Plan that seeks to foster socioeconomic inclusion of refugees and communities.

Refugees living in Kenya will soon be able to register for SIM cards and mobile money services following the gazetting of new regulations under the Kenya Information and Communications Act that have listed the Refugee ID amongst requirements for registration of telecommunications services.

This change gives refugees greater access to more services in line with the government-led Shirika Plan that seeks to foster socioeconomic inclusion of refugees and communities, thereby transitioning them from humanitarian aid to development-focused approaches.

More To Read

- Kenya’s refugee integration plan criticised over poor public involvement

- Global internal displacement reaches record 83.4 million by end of 2024

- Somalis, South Sudanese lead in refugee population in Kenya as numbers surge to over 800,000

- Inside Sh39 billion new funding to boost refugees’ education in Africa

- Shifting sand dunes displace over 150 families in Southern Somalia

- How state plans to roll out the integration of refugees with host communities under Shirika Plan

Before these regulations, there was no legal framework allowing refugees to own SIM cards and thus access mobile services, but that did not stop them from operating mobile phones.

"The few who had phones registered by proxy, and as regulations state, this is an offense. Others had used their country of origin passport, which is illegal, being a refugee," Commissioner for Refugees John Mburugu said.

Mburugu added that the government will soon also allow refugees to access financial services in local banks by recognising the Refugee ID as a valid Know Your Customer (KYC) document in efforts to promote financial inclusion as they are integrated within their host communities over the years.

In banking, KYC documents are the formal papers used to verify a customer's identity and address. This process is crucial for banks to comply with anti-money laundering (AML) and counter-terrorist financing (CFT) regulations.

"GOK will soon have a framework allowing refugees to open and run bank accounts as per the Banking Act and Regulations through amending the Anti-Money Laundering and Terrorism Financing Regulations of September 2023 to recognise refugee ID as a KYC document," he said.

Shirika Plan is being implemented in three phases with the first phase (2025-2028) catering to the regulatory and policy frameworks needed for its smooth implementation, this will be followed by the stabilization phase (2029-2032) that will focus on strengthening the foundation set in the first phase and the resilient phase (2033-2036) that will ensure that plan is well-positioned to navigate future challenges with agility and adaptability.

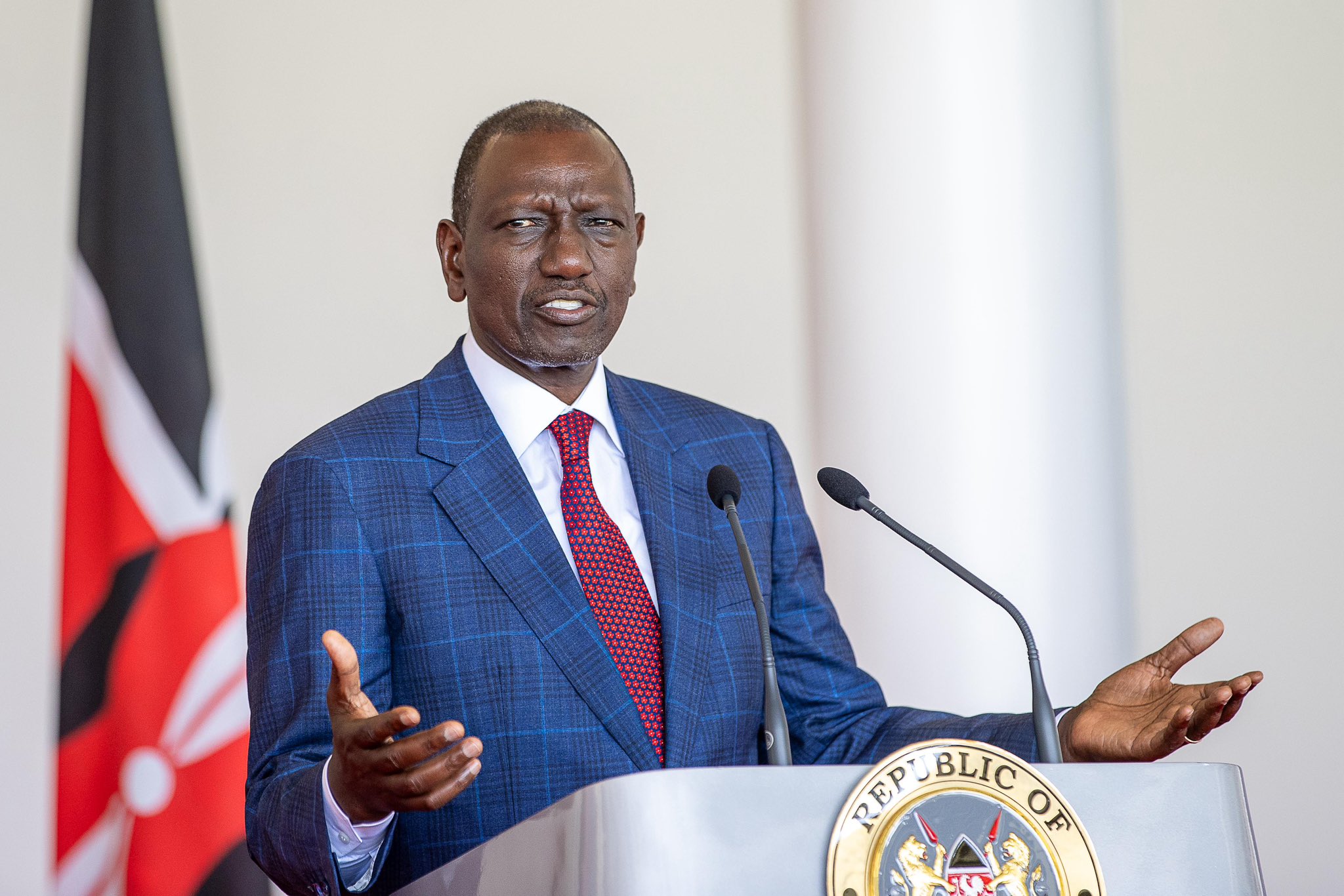

Though the plan allows refugees some citizen privileges like access to labour, health services with 70,000 already enrolled to the Social Health Authority (SHA), banks and mobile phone use through their refugee IDs, Interior Cabinet Secretary Kipchumba Murkomen in March allayed fears of them gaining citizenship status.

"This has nothing to do with whether or not refugees can become citizens of Kenya. Citizens for the Republic of Kenya are defined by law and have nothing to do with how we manage our refugees," he assured.

Top Stories Today