Kenya raises Sh194bn through Eurobond to ease 2027 debt pressure, boost fiscal stability

Treasury officials highlighted the 64 per cent participation rate in the tender and the upsized bond issue as signs of growing confidence in Kenya’s economic direction.

Kenya has raised Sh194 billion ($1.5 billion) from international capital markets through a new Eurobond aimed at easing pressure on its 2027 debt obligations.

The transaction includes a Sh74.89 billion ($579 million) buyback of the 2027 Eurobond and is part of the government's broader plan to manage public debt more effectively.

More To Read

- Kenya eyes TDB loan to clear Sh51.6 billion debt due September

- Treasury rules out Sh200,000 honorarium for former councillors, proposes Inua Jamii support

- Treasury to deduct county employee dues at source, ends years of non-remittance

- Kenya to only approve donor projects with secured funding, aligned to national priorities - Treasury CS Mbadi

- At least 22 dead in Angola amid protests over fuel price hike

- Senators summon Treasury CS Mbadi over delayed pensions, unremitted benefits

The deal, managed by Citibank and Standard Bank as joint lead managers, was finalised on March 5. The bond carries a 9.50 per cent coupon and was priced at a 9.95 per cent yield. It will mature in 2036, with equal repayments over its last three years, giving it a ten-year weighted average life.

The funds were used to finance the tender offer for the 2027 Eurobond, which settled on March 10.

Treasury officials highlighted the 64 per cent participation rate in the tender and the upsized bond issue as signs of growing confidence in Kenya’s economic direction.

“This transaction underscores Kenya’s commitment to prudent fiscal management and sustainable debt service. It reduces near-term refinancing risk and positions the country to pursue its economic transformation agenda with greater financial stability,” said Citibank Kenya Managing Director and CEO Martin Mugambi.

This marks the second time in a row that Kenya has worked with Citi and Standard Bank under its liability management strategy. The two banks were also involved in Kenya’s return to the global markets after a three-year break.

“This deal reaffirms Citi’s role as a trusted advisor in supporting sovereign access to international capital. It also highlights our ongoing commitment to Kenya’s development and economic growth,” Mugambi added.

Support Kenya’s fiscal position

Stanbic Bank Kenya and South Sudan CEO Joshua Oigara said the Eurobond issuance is expected to support Kenya’s fiscal position and maintain access to external financing.

“Strong investor demand reflects confidence in Kenya’s fundamentals and strategic direction. Standard Bank remains committed to supporting Kenya’s economic transformation by delivering innovative financial solutions,” Oigara said.

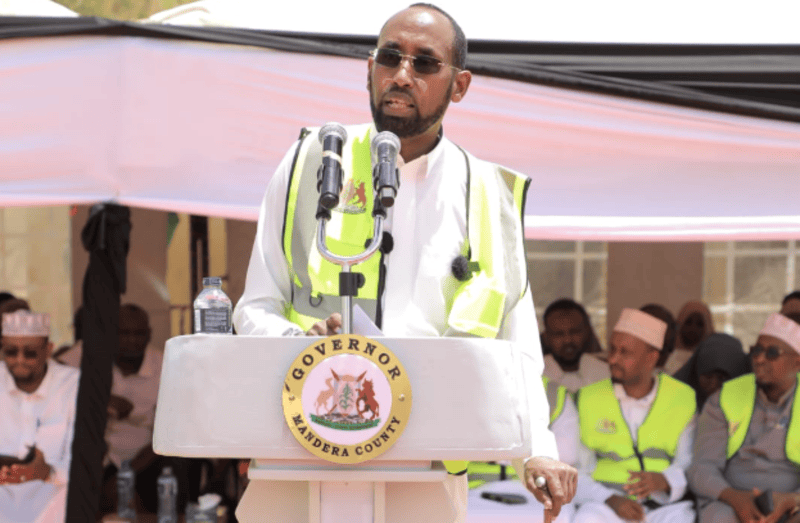

National Treasury Cabinet Secretary John Mbadi noted that as of March 2025, Kenya’s public debt had climbed to Sh11.02 trillion, up from Sh10.5 trillion in June 2024.

He said the rise underlined the need for stronger debt management tools to avoid future financial risks.

Earlier this year, the Treasury launched the 2025 Medium-Term Debt Strategy (MTDS), a roadmap designed to improve the way Kenya handles public debt over the next three years. The move comes amid growing fiscal pressures and uncertainties in global markets.

“The goal of this strategy is to realign our borrowing practices to ensure debt sustainability while supporting economic growth. We must proactively manage our liabilities to reduce refinancing risks and protect the economy from external shocks,” said Mbadi.

The MTDS focuses on lowering reliance on short-term Treasury bills, extending the repayment period of public debt, and growing the local debt market to improve resilience. It also aims to balance concessional and commercial borrowing to keep debt levels manageable while supporting development.

Top Stories Today

Reader Comments

Trending