New tax rules, spending plan take effect after Ruto assents to three key Bills

The new laws aim to raise revenue through expanded tax bases and support critical sectors such as agriculture, health, education, and infrastructure in line with the Bottom-Up Economic Transformation Agenda.

President William Ruto on Thursday signed into law the Finance Bill 2025, the Appropriation Bill 2025 and the Supplementary Appropriation (No. 3) Bill 2025, ushering in sweeping tax changes and unlocking Sh1.88 trillion for government spending in the 2025/2026 financial year.

The new laws aim to raise revenue through expanded tax bases and support critical sectors such as agriculture, health, education, and infrastructure in line with the Bottom-Up Economic Transformation Agenda.

More To Read

- Treasury reports fastest tax growth in two years amid July protests

- High Court petition filed to halt Ruto's Finance Act, citing economic hardship

- Revenue shortfall sparks National Treasury’s Sh18 billion supplementary budget push

- National Assembly passes Finance Bill 2025, targets Sh24 billion in new revenue

- MPs, senators strike deal, agree on Sh415 billion revenue allocation to counties

- MPs reject Treasury's plan to scrap VAT relief on mobile phones, solar, animal feeds

The Finance Act introduces changes to six tax-related laws, including the Income Tax Act, the Value Added Tax Act, and the Excise Duty Act.

It provides automatic reliefs and exemptions for employees, exempts pension-related gratuities from taxation, and lowers the capital gains tax rate from 15 to 5 per cent for large investments approved by the Nairobi International Financial Centre Authority.

The Bill amends the Income Tax Act to mandate employers to apply all applicable reliefs, deductions and exemptions to an employee automatically,” the brief states.

To stimulate the digital economy, the law repeals the Digital Assets Tax and replaces it with a 5 per cent excise duty on transaction fees paid to virtual asset providers.

It also introduces a 10 per cent excise duty on virtual asset service fees, expands taxation on digital services by non-residents, and alters income tax rules on betting to apply to withdrawals by punters.

“The lower excise duty will promote innovation and enhance investments in digital assets,” the statement notes.

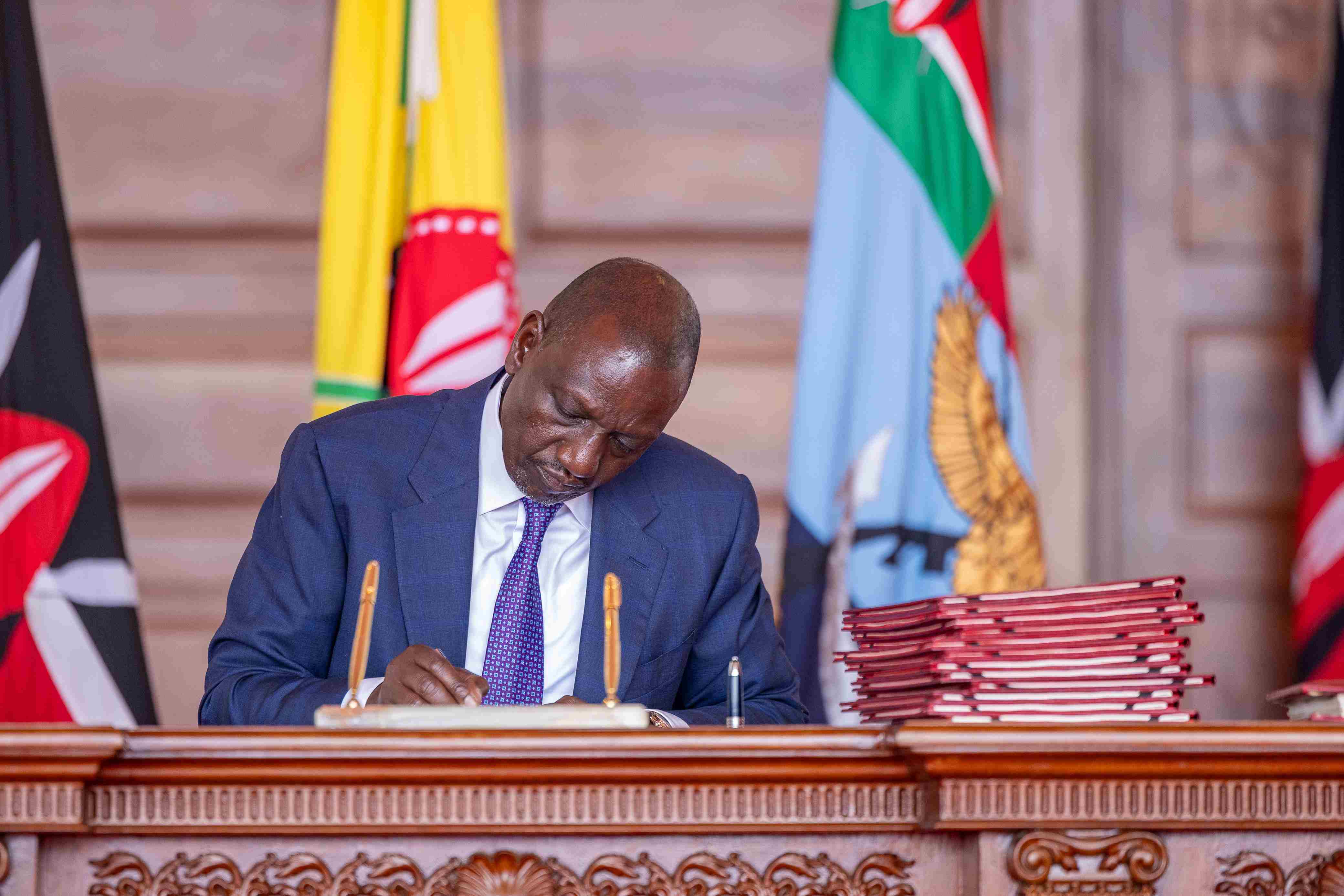

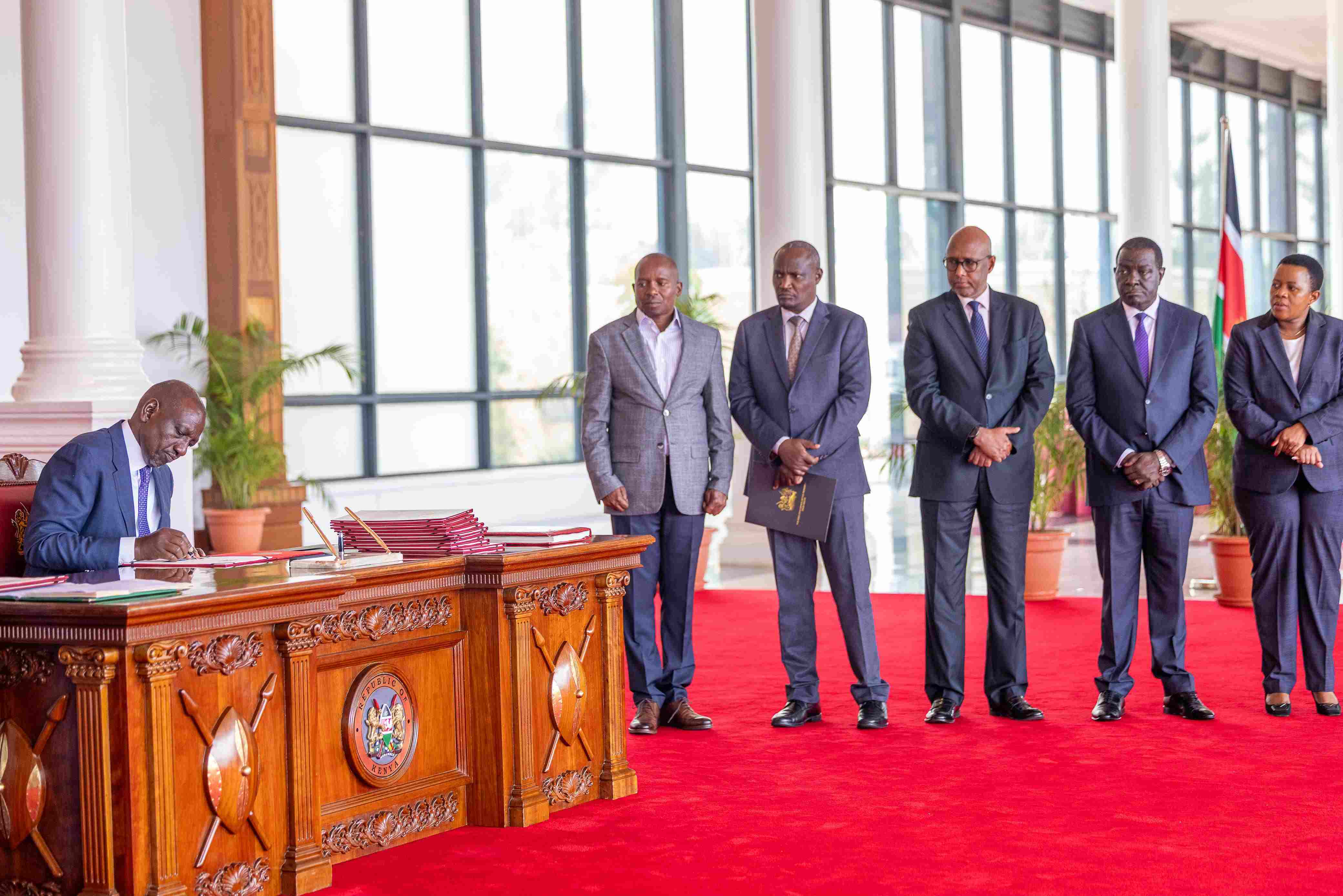

President William Ruto signs into law the Finance Bill 2025, the Appropriation Bill 2025 and the Supplementary Appropriation (No. 3) Bill 2025 as members of the Executive look on at State House on June 25, 2025. (Photo: PCS)

President William Ruto signs into law the Finance Bill 2025, the Appropriation Bill 2025 and the Supplementary Appropriation (No. 3) Bill 2025 as members of the Executive look on at State House on June 25, 2025. (Photo: PCS)

In the Value Added Tax Act, exemptions have been granted on mosquito repellents, machinery for local production, and packaging materials for tea and coffee.

The Excise Duty Act now imposes a 5 per cent tax on deposits into betting, gaming, and lottery wallets, while licensed micro-distillers have been exempted from costly automation requirements to boost local manufacturing.

The Appropriation Act now authorises the National Treasury to withdraw Sh1.88 trillion from the Consolidated Fund and allows ministries, departments, and agencies to utilise an additional Sh672 billion in internally generated revenues.

Of the total, Sh1.81 trillion will go to recurrent spending and Sh744.5 billion to development.

To strengthen food security, the agriculture sector will receive Sh47.6 billion for programmes including a fertiliser subsidy, coffee debt waiver, and the blue economy.

The law allocates Sh18 billion for agro-industrial parks, SEZ textile parks, and MSME support under the Kenya Industrial Estates.

The health sector has been allocated Sh133.4 billion for critical services such as HIV, malaria and TB care, primary health, universal health coverage, and cancer centre development.

The Bill seeks to allocate Sh13.1 billion to the Primary Healthcare Fund, and Sh4 billion for the internship programme for doctors.

Education has received a total of Sh658.4 billion, including funding for teacher recruitment, free primary and secondary education, capitation for junior schools, university scholarships, and the school feeding programme.

To improve infrastructure, the government will spend Sh217.3 billion on roads and bridges, Sh38.6 billion on rail, sea, and air transport, and Sh62.8 billion on electricity and clean energy. Another Sh12.7 billion will go towards digital infrastructure and the creative economy.

The Supplementary Appropriation (No. 3) Bill was tabled in the National Assembly last week.

The estimates revealed that the gross ministerial expenditure for FY 2024-25 has decreased by 0.5 per cent from the original ministerial estimates.

Treasury CS John Mbadi said the new request is driven by urgent demands that have emerged since the last supplementary budget was presented in March.

“Included in the Financial Year Supplementary Estimates No. III is additional expenditure to cater for salaries shortfall, security-related interventions, among other priorities,” he said.

Top Stories Today