Bill seeks to waive interest on overdue taxes to offer lifeline to businesses in distress

By Lucy Mumbi |

This measure aims to ease financial strain, enabling businesses to recover and grow. It is also expected to improve tax compliance and boost the economy.

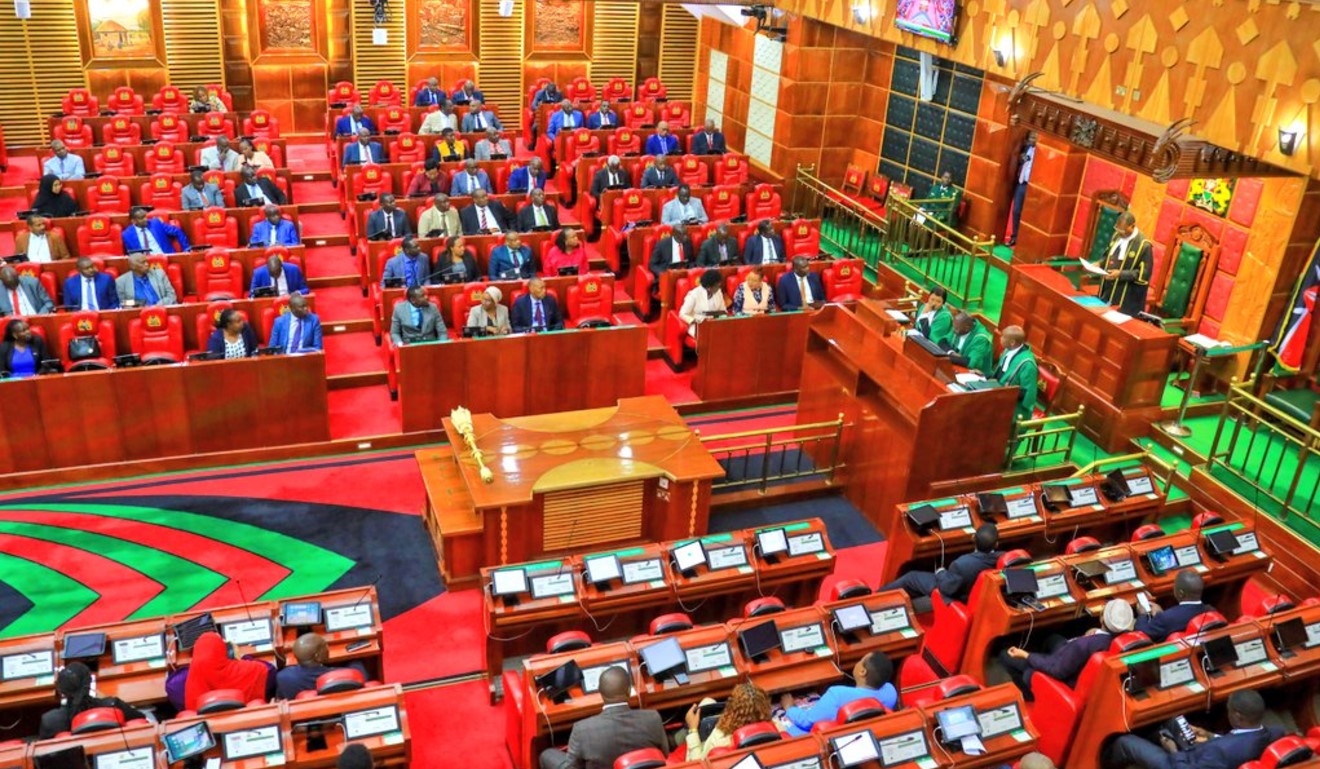

The National Assembly is considering a bill to provide tax relief to businesses burdened by unpaid government dues. The Tax Procedures (Amendment) (No. 2) Bill proposes waiving penalties and interest on overdue taxes until June 2025.

This measure aims to ease financial strain, enabling businesses to recover and grow. It is also expected to improve tax compliance and boost the economy.

Keep reading

- Speaker Wetang'ula directs MPs to vet Ruto's nominees by February 2025

- Crucial Bills delayed as Parliament adjourned 66 times in 2024 over lack of quorum

- Hasty passage of parliamentary Bills raises concerns over public participation

- Silent members: Sudi, Aladwa among 19 MPs who did not speak in Parliament in 2024

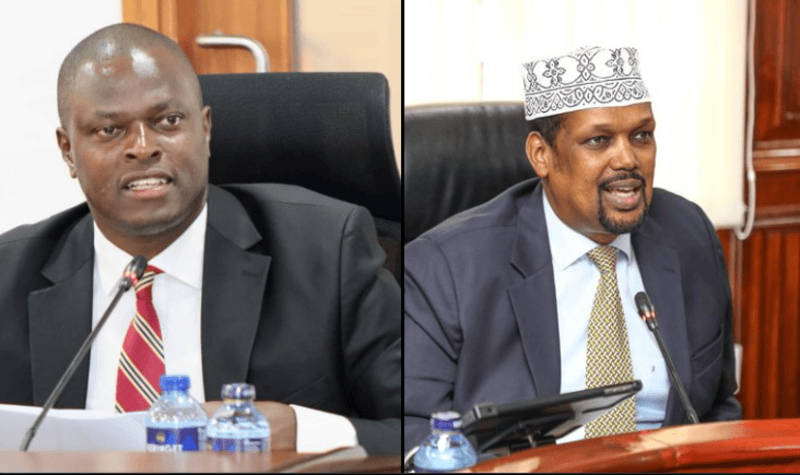

The proposed law, championed by Majority Leader Kimani Ichung’wah, addresses a major challenge businesses face, particularly those struggling due to pending payments from government ministries, departments, and county governments.

He notes that the delays have left businesses in financial distress, from small traders to large contractors. Despite not being paid on time, they are still required to pay taxes such as Value Added Tax (VAT) and income tax, often accumulating penalties and interest for missed deadlines.

"The Committee noted that extending the amnesty period is likely to result in potential revenue losses and thus amended the amnesty period to cover from December 31, 2023 to June 30, 2025," reads the Bill.

Ichung’wah described the bill as a vital support system for businesspeople dealing with delayed payments. He noted that the tax amnesty would allow businesses to settle their tax obligations without additional financial penalties.

“This bill is a lifeline for millions of business people who have invoiced the government and are now in financial distress due to unsettled payments,” he said.

"Waiving penalties and interest creates an environment where businesses can settle their principal tax liabilities without additional financial burdens.”

The amnesty is also expected to free up much-needed liquidity for businesses, enabling them to reinvest in their operations, create jobs, and contribute more to the economy.

“The penalties and interest have placed an insurmountable burden on many entrepreneurs. Contractors and traders owe hundreds of millions in penalties and interest alone. This bill provides them a fair opportunity to get back on track," Ichung’wah added.

The Chairperson of the Departmental Committee on Finance and National Planning @KuriaKimaniMP is set to table the report of the Committee’s Consideration of the Tax Laws (Amendment) Bill, 2024 and the Tax Procedures (Amendment) Bill, 2024, this morning.

— National Assembly KE (@NAssemblyKE) December 3, 2024

The Committee which has… pic.twitter.com/r2RYSdIIPv

Further, the proposed tax relief is seen as a way to boost compliance. By removing penalties and interest, the government hopes businesses will be encouraged to pay their outstanding taxes.

The Kikuyu MP noted that this will benefit the Kenya Revenue Authority (KRA) by ensuring quicker collection of principal taxes and improving revenue streams for the government.

Ichung’wah emphasised that when businesses thrive, they not only pay more taxes but also contribute to economic growth and public services.

“The government stands to collect taxes faster, improving liquidity for public services. When businesses thrive, they generate higher turnover and ultimately pay more taxes, creating a ripple effect of growth and development,” he said.

The bill is also expected to stimulate private sector growth by increasing liquidity, which could lead to new investments and innovation. It offers a win-win solution by providing much-needed relief to businesses while boosting government revenue and economic activity.

As part of efforts to streamline tax administration and address challenges related to tax refunds, the Bill proposes the establishment of a Tax Refund Fund.

According to the Bill, the initiative would be overseen by the Cabinet Secretary for Finance to ensure refunds are processed efficiently and without unnecessary delays.

Under the proposal, one per cent of all taxes collected monthly, including those from the Tax Procedures Act, Income Tax Act, Excise Duty Act, Value Added Tax Act, and Miscellaneous Fees and Levies Act, would be allocated to the fund.

This allocation would cater for refunds arising from overpayments or errors under any of these laws. Payments from the fund are expected to be prompt, covering all amounts owed by the government to taxpayers.

Additionally, the National Treasury would be required to prepare and submit annual financial statements for the fund to the Auditor-General within three months after the end of each financial year.

The Cabinet Secretary would also have the authority to determine the fund's administrative structure through notices published in the Kenya Gazette.

The proposal also includes enacting a dedicated Tax Refund Bill to formalise the refund process and empower the Cabinet Secretary under Section 24 (3) of the Public Finance Management Act. This is intended to address recurring backlogs of tax refunds, particularly those affecting manufacturers.

The proposal stems from the government's recognition of persistent refund challenges, which have hindered businesses over the years.

"By providing a sustainable solution, the fund aims to ensure timely refunds and improve the overall efficiency of tax administration," reads the Bill.

The parliamentary committee reviewing the proposal acknowledged the concerns raised by stakeholders and recommended considering the matter in future legislation to address it comprehensively.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!