Lawmakers probe Sh3.8 billion car loan scheme as billions lie dormant

An Auditor-General's report further revealed that the fund had been largely inactive between 2015 and 2019.

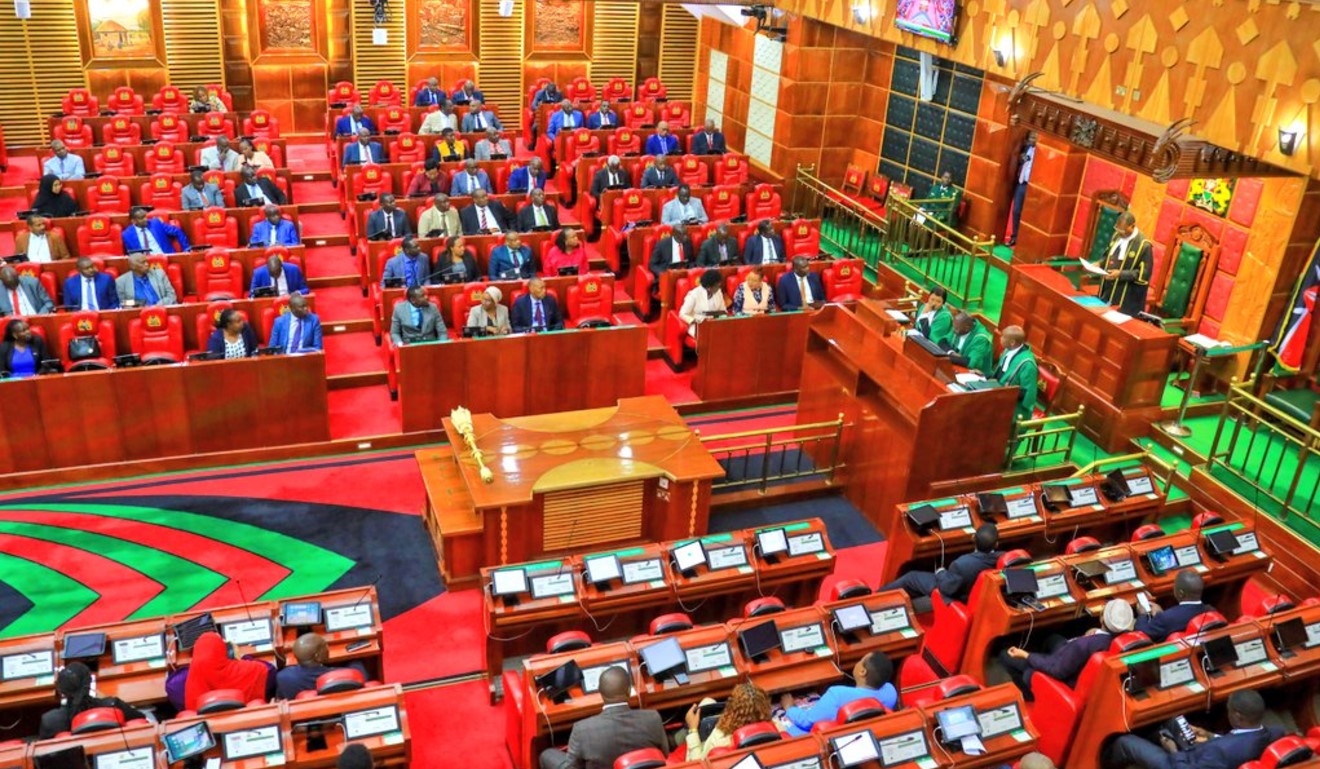

The National Assembly's Special Funds Accounts Committee has raised concerns regarding the effectiveness of the State Officers and Public Officers Motor Car Loan Scheme (SOPOMCLS), questioning its relevance as millions of shillings remain unutilised.

During a meeting held on Thursday to address pending audit queries, legislators were alarmed to learn that despite the fund's value standing at Sh3.8 billion, only Sh641 million had been disbursed in loans since its inception.

More To Read

- Court to hear petition challenging eligibility of Embu North MP Leo Wa Muthende

- Nominated MP Denar Hamisi is dead, National Assembly confirms

- MPs push for urgent funding boost for Auditor General’s office

- Judiciary faces Sh576.6 million pending bills amid budget review

- Hustler Fund faces scrutiny as MPs demand answers on missing Sh14 billion, beneficiary records

- Parliament pushes Public Participation Bill to streamline hearings

An Auditor-General's report further revealed that the fund had been largely inactive between 2015 and 2019, with a staggering Sh3 billion sitting dormant during that period.

In addition to the lack of activity, an audit discrepancy was uncovered, where a Sh9.8 million car grant was recorded in the wrong ledger, leading to further questions about the scheme's financial management.

Edna Atisa, the CEO of the fund, defended the delay in the scheme's rollout, attributing it to difficulties in securing a financial institution to manage the loans.

Atisa explained that the scheme was designed to provide car loans to state officers in the executive arm of government and civil servants under the Public Service Commission.

Administration fee

However, lawmakers were critical of the decision to involve a financial institution that charges a 1 per cent interest fee to administer the scheme.

The committee members questioned whether it was necessary for the fund to engage an external institution for loan processing, suggesting that the fund could handle this function internally.

The CEO also addressed concerns raised about an accounting error during the scheme's early years, stating that due to the fund's limited capacity at its inception, staff from the National Treasury had been responsible for managing the fund.

This prompted lawmakers to question the competence of the officers who had been involved in overseeing the fund's operations at that time.

Currently, Sh3.4 billion of the fund is invested with the Central Bank of Kenya, earning Sh533 million through government securities.

Diverted fund's focus

However, this investment strategy has drawn criticism from the committee, as lawmakers believe it has diverted the fund's focus away from its core mandate of offering car loans to public and state officers.

"Does this car loan scheme exist to provide car loans to state and public officers, or is your mandate to focus on investments while your clients are neglected?" asked Mbooni MP Kivasu Nzioka, the session chair, during the meeting.

In response, Atisa confirmed that the investments were a strategic decision aimed at generating profits to sustain the fund's operations, but the committee was unconvinced that the focus on investment was in line with the fund's primary objective.

The committee has since directed the fund's management to appear again for further investigations into the fund's financial records, particularly focusing on the period leading up to 2024.

Meanwhile, in a separate session, the committee addressed concerns related to the Public Service Superannuation Fund, particularly around unremitted pension contributions from employers.

Dr Jonah Aiyabei, CEO of the Public Service Superannuation Fund, explained that delays in contributions had been due to system inefficiencies during the fund's early operations.

Aiyabei assured lawmakers that an automated system is being developed and will be operational by March 2025.

The committee also directed the National Treasury to pay penalties for the delayed pension remittances as per the fund's regulations.

The Public Service Superannuation Fund was asked to provide additional evidence to support its responses to the audit queries.

Top Stories Today