Senators want 42 levies imposed on tea sector scrapped, say they are hurting farmers

Kirinyaga Senator James Murango revealed that the tea industry is subjected to numerous taxes, including eight collected by the KRA.

Kenya’s tea sector is struggling under the weight of at least 42 taxes and levies applied across the entire supply chain, senators have said, warning that these costs are causing severe hardship for millions of tea farmers.

According to senators, the excessive charges disproportionately affect farmers, from the cultivation stage through to processing, marketing, and distribution.

More To Read

- Kenya pushes for strict pesticide ban across COMESA bloc

- Turkana engages farmers, stakeholders on draft agricultural policy which seeks to boost farming

- Senators propose Bill to expand powers in fresh bid to counterbalance National Assembly

- Senators clash over expanded list of counties benefiting from equalisation fund

- Audit exposes fake firms, unsafe inputs and lost billions in Ruto's fertiliser subsidy plan

- Senators demand answers over billions paid to ghost schools

Kirinyaga Senator James Murango revealed that the tea industry is subjected to numerous taxes, including eight collected by the Kenya Revenue Authority (KRA).

These include a 30 per cent corporation tax on profits and a 16 per cent Value Added Tax (VAT). In addition, the Agriculture and Food Authority (AFA) imposes five annual fees ranging from Sh2,000 to Sh25,000.

Other levies are charged by county governments, such as Mombasa, as well as national agencies like the Kenya Bureau of Standards (KEBS), Kenya Ports Authority (KPA), Kenya Plant Health Inspectorate Service (KEPHIS), and the National Environment Management Authority (NEMA).

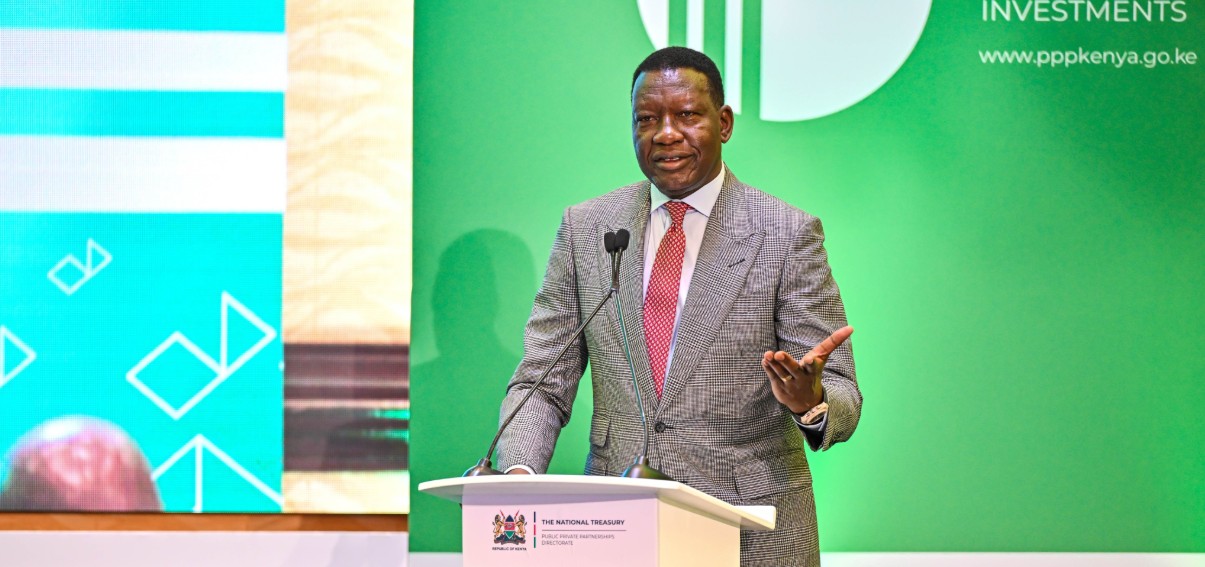

Senator Murango has urged the Cabinet Secretary for the National Treasury, John Mbadi, to present a detailed breakdown of all taxes and levies imposed on the tea sector.

He also requested a clear plan in the 2025/2026 financial year to address double taxation and eliminate unnecessary charges that continue to overburden farmers and other stakeholders in the industry.

“For how long will primary agriculture be taxed? We had agreed that the government would reduce these taxes during my tenure as Chair of the Agriculture Committee, but nothing has been done,” Murango said.

The tea sub-sector is a vital part of Kenya’s economy, supporting millions of smallholder farmers in counties such as Kirinyaga, Kericho, Murang’a, Nyeri, Kiambu, Tharaka-Nithi, Embu, Bomet, Kisii, Nyamira, Kakamega, Vihiga, and Trans Nzoia. It also remains a significant source of foreign exchange.

In 2024, total earnings from tea amounted to Sh215.2 billion, Sh181.7 billion from exports, Sh18 billion from local sales, and Sh15.5 billion from committed stocks. Despite these impressive figures, the sector’s profitability is being squeezed by the heavy tax burden.

Top Stories Today