Kenya pushes Washington to scrap Trump-era tariffs as trade pressures mount

The duties now threaten to erode Kenya's competitiveness in its most lucrative export market.

Kenya is quietly negotiating with the United States to lift a 10 per cent tariff imposed on its exports under President Donald Trump's sweeping protectionist measures.

The duties, introduced in April this year as part of Trump's across-the-board tariff strategy, now threaten to erode Kenya's competitiveness in its most lucrative export market.

More To Read

- US announces withdrawal from UNESCO again, citing "misalignment with national interests"

- Three-month limit: US slaps new visa restrictions on Nigerians, Ghanaians

- Trump’s 30 per cent tariff on South Africa not backed by trade data — Ramaphosa

- US threatens South Africa with 30 per cent tariff on all exports amid BRICS alignment concerns

- US Embassy warns Ugandans against misusing tourist visas for births

- African leaders urge US to ramp up investment, rethink tariffs

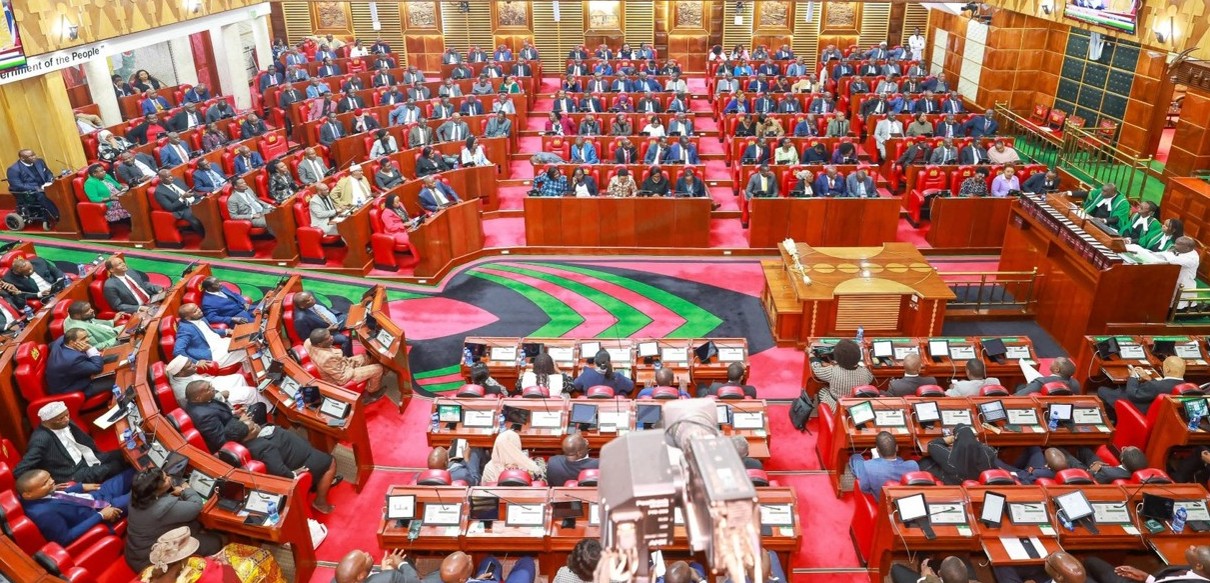

"We have appealed against this 10 per cent and conversations are ongoing," said Kenya's Cabinet Secretary for Trade, Lee Kinyanjui, during an interview with Fixing the Nation.

"It's not just about tariffs—we're also seeking better terms on market access," he added.

The duties, dubbed "reciprocal tariffs" by Washington, are ostensibly in response to Kenya's own 10 per cent levy on US goods, and alleged non-tariff barriers and currency issues.

However, the fallout for Nairobi is considerable: textiles, Kenya's top export to the US, now face higher landing costs, potentially choking an industry that has grown under the African Growth and Opportunity Act (AGOA).

Foreign Minister Musalia Mudavadi is currently in Washington in a bid to salvage the situation and, more broadly, lobby for the renewal of AGOA, which is set to expire in 2025.

Kenya, like other African economies, has long relied on AGOA to maintain duty-free access for its goods.

For a relatively small domestic economy like Kenya's, plugging into global value chains is not optional; it is essential.

But trade alone won't close the growth gap. Kenya's export basket remains worryingly shallow, dominated by primary goods and low-value-added items.

Without industrial upgrading, the country remains vulnerable to global price shocks and fickle demand. Worse, the benefits of trade, without inclusive policies, risk entrenching inequality, enriching urban elites while bypassing rural communities.

The US remains a key trading partner, with bilateral goods trade totalling $1.5 billion in 2024.

Yet Kenya's position is increasingly precarious. Foreign Direct Investment has dipped, companies are pulling out, and global competition is rising.

If the tariffs remain, Kenya's textile industry could contract, jobs could vanish, and the broader export narrative could unravel.

There's also a geopolitical dimension. As global trade becomes more fragmented, Kenya must walk a fine line—wooing traditional Western partners while exploring new frontiers like BRICS and AfCFTA.

Top Stories Today