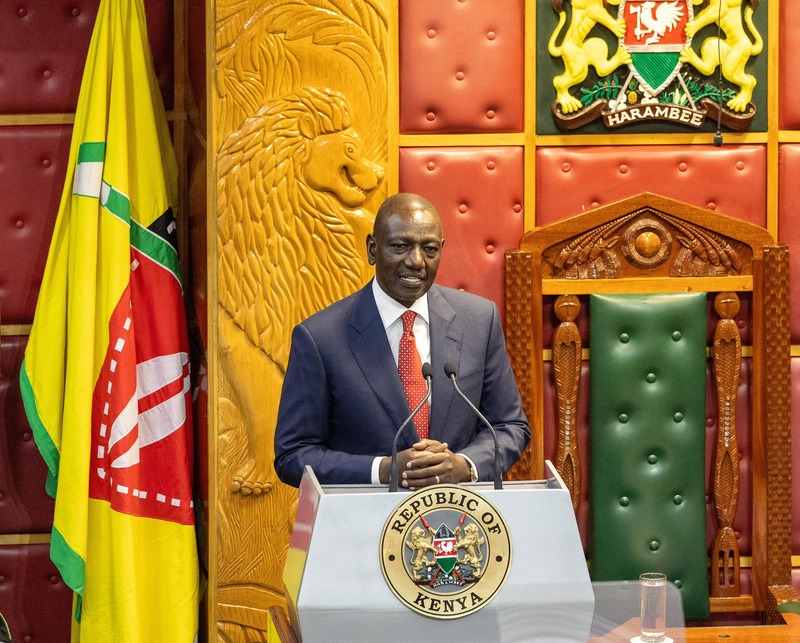

Ruto touts Hustler Fund at world summit, says Sh44bn borrowed so far

By Saleem Abdi |

The President says the fund has saved Kenyans from the predatory lending witnessed on digital platforms, with some denied access to funding in the established formal sector.

Kenyans borrowed more than Sh44 billion from the Hustler Fund in its first year of operation, President William Ruto has told a gathering of world leaders, highlighting its significance for the many informal sector employees in the country.

The President, speaking at the World Government Summit in Dubai, the UAE, said the lending to some 18.2 million customers helped to address challenges of financial inclusion in Kenya’s informal sector, which employs more than 70 per cent of the population.

Keep reading

- Adani Energy Solutions downplays Kenya project cancellation, cites no 'material impact'

- Now we know you, Gachagua tells Ruto as he declares 2025 political comeback

- I won’t stop giving - Ruto says despite rejection of church donations

- How Ruto's rise from ‘David’ to ‘Zacchaeus’ sparked church rebellion

“Affordable credit is now a normal part of everyday business in our MSME (Micro, Small and Medium-sized Enterprises) sector. The Hustler Fund has 18.2 million customers and has disbursed $280 million (Sh44.4 billion by current exchange rate terms) in its first year of operation,” he said.

The President further said that the Hustler Fund, introduced in December 2022, had saved Kenyans from the predatory lending witnessed on digital platforms, with some denied access to funding in the established formal sector.

He also said the fund had enabled Kenyans to save while they borrowed, boosting the country’s saving culture.

“In an economy powered by an informal sector, which provides over 70 per cent of employment and contributes more than 75 per cent of the GDP, our transformation agenda dictates that affordable credit and financial inclusion be made available to the majority as a matter of urgency,” President Ruto said.

Lending through the platform, whose framework is that the government gives funds to banks which then lend to Kenyans through telecommunication firms, grew even as the rate of defaults for the loans grew to about Sh10 billion by the end of last October.

The Treasury last month reported a 73 per cent repayment rate for the Sh36.6 billion in loans disbursed through the fund by last October.

“By the end of October 2023, the fund had disbursed Sh36.6 billion and realised Sh2.3 billion in savings, benefitting 21.3 million customers, with 7.5 million repeat customers whose overall repayment rate is at 73 per cent,” the Treasury stated.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!