Manufacturers warn of 25% tax that may cause bread to rise to Sh80

By Hanifa Adan |

The association fears that the tax could decimate these livelihoods and destabilise the manufacturing industry at large.

The Edible Oil Sub-Sector of the Kenya Association of Manufacturers has warned about the severe economic and social impacts of the proposed 25 per cent excise duty on vegetable oils included in the Finance Bill 2024.

The association cautioned that this tax, which would apply to raw materials and refined cooking oils, threatens to cause widespread harm nationwide.

Keep reading

"If implemented, this excise duty will trigger an unprecedented surge in the price of cooking oil, a staple in Kenyan households," the association stated.

"The cost of this essential commodity is projected to skyrocket by 80 per cent, rendering it unaffordable for millions of Kenyans, particularly low-income earners and small-scale traders, commonly known as 'hustlers' and 'mama mbogas," it added.

Cooking oil is a fundamental ingredient in many everyday foods, such as bread, mandazis, chapatis, and chips. According to the association, the excise duty will cause a cascading effect, inflating the price of a standard loaf of bread (400g) from Sh70 to Sh80.

Other essential products derived from vegetable oils will also see significant price increases; for instance, the price of long-bar soap could rise from Sh180 to Sh270 and margarine (250g) from Sh160 to Sh300.

"Such price hikes will disproportionately affect the most vulnerable members of society, worsening the already high cost of living and plunging millions into deeper financial distress," the association warned.

The proposed tax is also seen as a threat to the government's agenda of promoting local value addition in agribusiness. The edible oils sector is a significant contributor to Kenya's economy, directly employing approximately 10,000 individuals and indirectly supporting over 30,000 jobs.

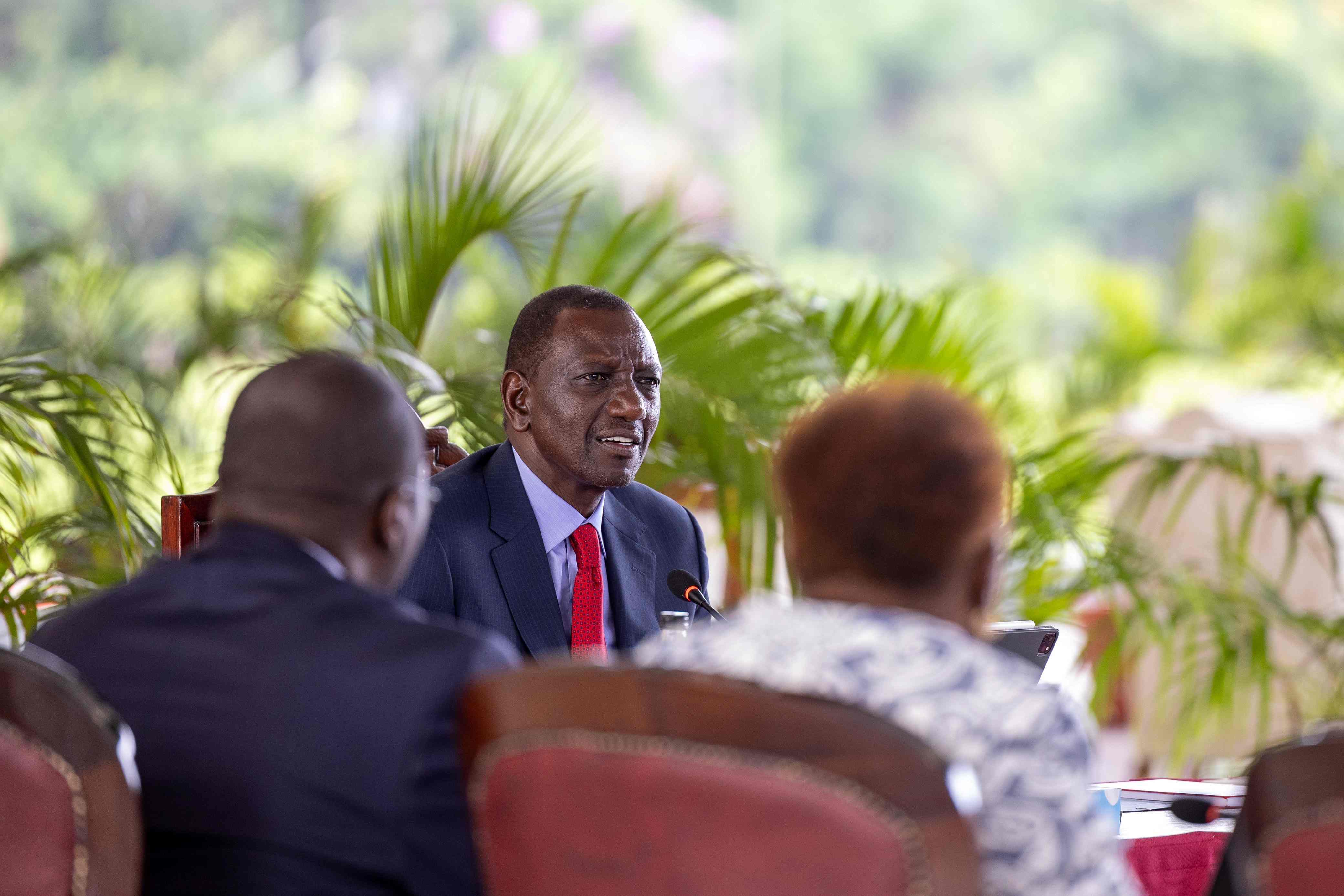

President William Ruto chairs cabinet meeting at State House , Nairobi, on May 2, 2024

President William Ruto chairs cabinet meeting at State House , Nairobi, on May 2, 2024

The association fears that the tax could decimate these livelihoods and destabilise the manufacturing industry at large.

In light of these grave implications, the association is urging the government to scrap the proposed 25% excise duty on vegetable oils from the Finance Bill 2024.

"This tax is not just an economic miscalculation; it is a potential humanitarian crisis that Kenya cannot afford," its statement read.

16 per cent VAT on bread

Another key question that arises on bread is the proposed introduction of 16 per cent VAT on the VAT-zero-rated product.

With a 25 per cent excise duty on vegetable oils already proposed, will a VAT on bread amount to double taxation?

Earlier, stakeholders had warned that the inclusion of 16 per cent on bread may see the product rise from Sh60 to Sh70.

Molo MP, Kuria Kimani, and Chair of the National Assembly Committee on Finance and Planning attributed the proposal to the National Treasury, which he claimed linked the bread to diabetes. Kenyans, he added, had submitted their proposals to the Treasury, saying that bread is not a luxury good.

His statement sparked an uproar nationwide, with unconfirmed reports stating that President William Ruto ordered the 16 per cent VAT proposal on bread to be scrapped. Ruto was said to have expressed concerns over the potential impact on consumers and instructed the relevant authorities to reconsider the proposal. However, he has yet to publicly speak on the controversial tax proposals.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!