Why Raila wants Finance Bill 2024 withdrawn

"As if this is not bad enough, the Finance Bill 2024 proposes even more and higher taxes."

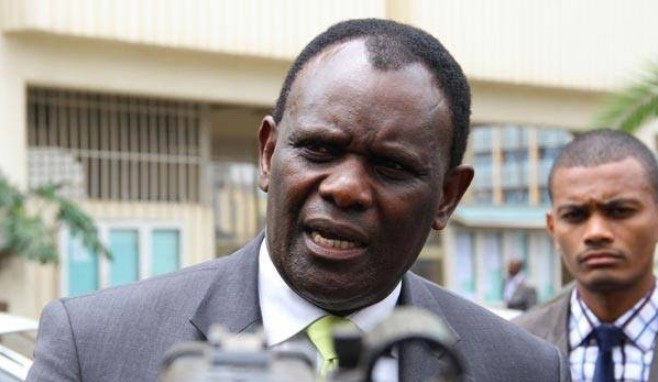

Azimio La Umoja Leader Raila Odinga has joined the ongoing debate about tax proposals contained in the Finance Bill 2024, calling for their withdrawal.

The opposition leader, in a statement released on Thursday, regretted that the tax burden in Kenya is at its highest level since independence, yet public services have largely remained inadequate.

"As if this is not bad enough, the Finance Bill 2024 proposes even more and higher taxes. Consequently, the people and the country will be worse off at this time in 2025 if the Finance Bill 2024 does not undergo radical surgery," protested Raila.

More To Read

- How to bake yummy banana bread for friends and family

- The impact of the recent Finance Bill on different sectors

- How protests over Finance Bill hurt Nairobi’s daily revenue collections

- Police seize 13 trucks, bust massive counterfeit cooking oil ring in Mombasa

- Lamu farmers welcome new edible oil plant in Mpeketoni

- Edible oil scandal: Court allows DPP to withdraw case against ex-KNTC official

According to Raila, who has trained his focus on a spirited bid to be the chairperson of the African Union Commission, the Finance Bill 2024 fails the taxation aspects of predictability, simplicity, transparency, equity, administrative ease, and fairness.

He added that the current Finance Bill is worse than last year's, describing it as an investment killer and a huge millstone around the necks of millions of poor Kenyans who must have hoped that President William Ruto would ease his fiscal policies this year.

"The Bill is a regressive taxation proposal that goes ruthlessly after the poor. Should it be ratified, low-income individuals will be hit with taxes on multiple fronts and will end up paying more than people with higher incomes," said Raila.

He went on to claim that it is obvious that taxes on basic necessities such as food, cooking oil, and money transfers disproportionately hurt the poorest of the poor.

Raila decried the proposal seeking to increase excise duty on mobile money transfers from 15 to 20 per cent should the Bill be passed.

"This happens at a time when the government is further proposing to impose a 16 per cent VAT on foreign exchange transactions. The government is trying to make it costlier for people to send and receive money by phone while at the same time trying to kill remittances from the diaspora," he added.

In his protest, he also called out taxes on edible oil and zero-rated bread, a basic commodity that he described as almost the only item for breakfast for the poor, yet it is set to be subjected to a 16 per cent VAT.

"When the government imposes a 25 per cent excise duty on edible oil as proposed in the Finance Bill 2024, the cost of cooked food, including those served in kibandas and kiosks that are the refuge of millions of casual workers will rise," Raila protested.

He also lamented that the Bill will adversely affect the agriculture, beauty, insurance, and motor sectors of a country that is a significant net importer. Raila further warned that the proposal to raise import declaration fees from 2 per cent to 3 per cent will hurt importers.

"The tax proposals for 2024 will make an already bad situation worse. They could usher in the collapse of an economy that is already severely suffocated, and the poor will be the hardest hit," Raila warned.

Other Topics To Read

Top Stories Today