Domestic capital gains momentum as sub-Saharan Africa accelerates energy transition financing

IRENA maintains that strengthening domestic financial markets is essential to ensuring sufficient funding for energy transition projects.

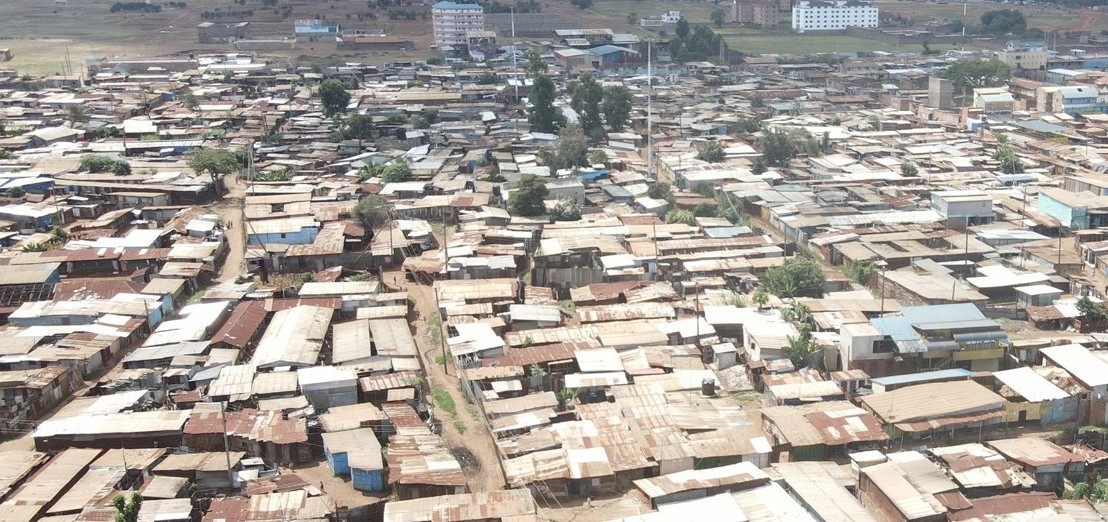

Sub-Saharan Africa is making steady progress in strengthening its energy transition financing architecture, with domestic investment accelerating to narrow the longstanding gap with international capital.

According to the International Renewable Energy Agency (IRENA), SSA is the only region where most investment still comes from international rather than domestic sources.

More To Read

- Kenya beats Tanzania and Uganda in electricity and renewable energy growth

- Africa lags in green jobs boom, holds just 2 per cent of the global sum

- Africa secures Sh12 trillion to fast-track green industrialisation

- Energy transition faces stark reality as oil demand set to rise to 2030

- KenGen unveils battery energy storage system in fresh renewable energy push

- More than 90 per cent of renewable projects now cheaper than fossil fuel alternatives - report

Its latest data shows that 53 per cent of the region’s financing originates from outside the region, compared with 47 per cent from within, as at the close of the 2022/2023 financial year.

The agency notes that the figures indicate domestic investments are catching up, rising from 35 per cent of the total $2.1 billion (Sh272 billion) invested in 2020/2021 to 47 per cent, or $6.6 billion (Sh854.8 billion).

It adds that expanding local financial markets is becoming a decisive factor in reducing the region’s vulnerability to external shocks and currency fluctuations.

South Africa's role

This growth is largely driven by South Africa, which now sources more than two-thirds of its renewable energy investments domestically.

The momentum has been reinforced by regional commitments, including the pledge made in September 2025 by African development finance institutions (DFIs) and major commercial banks to mobilise up to $100 billion (Sh12.9 trillion) for green industrialisation.

The financing is expected to support renewable power generation, battery manufacturing and the development of critical mineral supply chains—sectors considered central to Africa’s net-zero transition.

IRENA maintains that strengthening domestic financial markets is essential to ensuring sufficient funding for energy transition projects.

“Developing domestic financial markets is critical for ensuring that energy transition-related projects have access to diverse funding sources and are not entirely reliant on foreign finance,” the report reads.

“Expanding local equity and bond markets can unlock additional financing, particularly in local currencies, to hedge against exchange rate risks.”

Alternative sources

It further notes that alternative sources, such as crowdfunding, offer significant potential to mobilise both domestic and international funds for renewable energy projects.

“By bypassing traditional intermediaries such as commercial banks, crowdfunding offers easier and faster access to financing, lower transaction costs and marketing benefits.”

Examples such as Kenya’s community-driven solar PV initiatives and Lebanon’s Baaloul microgrid illustrate how citizen-led financing can unlock small-scale but transformative renewable projects.

To support crowdfunding, the agency says policymakers must ensure stable and predictable regulatory frameworks for investors, empower communities and encourage citizen participation through dedicated schemes such as auctions.

Top Stories Today