Millions at risk as Agricultural Finance Corporation fails to recover loans, manage payroll

At the Eldoret branch, officials overdrawn Sh11.8 million in 2018, yet management has provided no updates on recovering the money despite a court ruling in AFC’s favour in May 2024.

A recent audit of the Agricultural Finance Corporation has exposed widespread financial mismanagement, fraud, and operational lapses that could cost taxpayers and farmers millions.

More To Read

- Audit uncovers State agencies overspending on salaries despite staff shortages

- Auditor General uncovers Sh3.4 billion manual salary payments in counties

- Auditor General flags massive procurement violations across 32 counties

- Auditor General uncovers missing land titles, asset records in 20 counties

- Audit flags seven counties over Sh880 million in unaccounted bursary funds

- Postal Corporation of Kenya on the brink of collapse amid Sh7.3 billion deficit, audit reveals

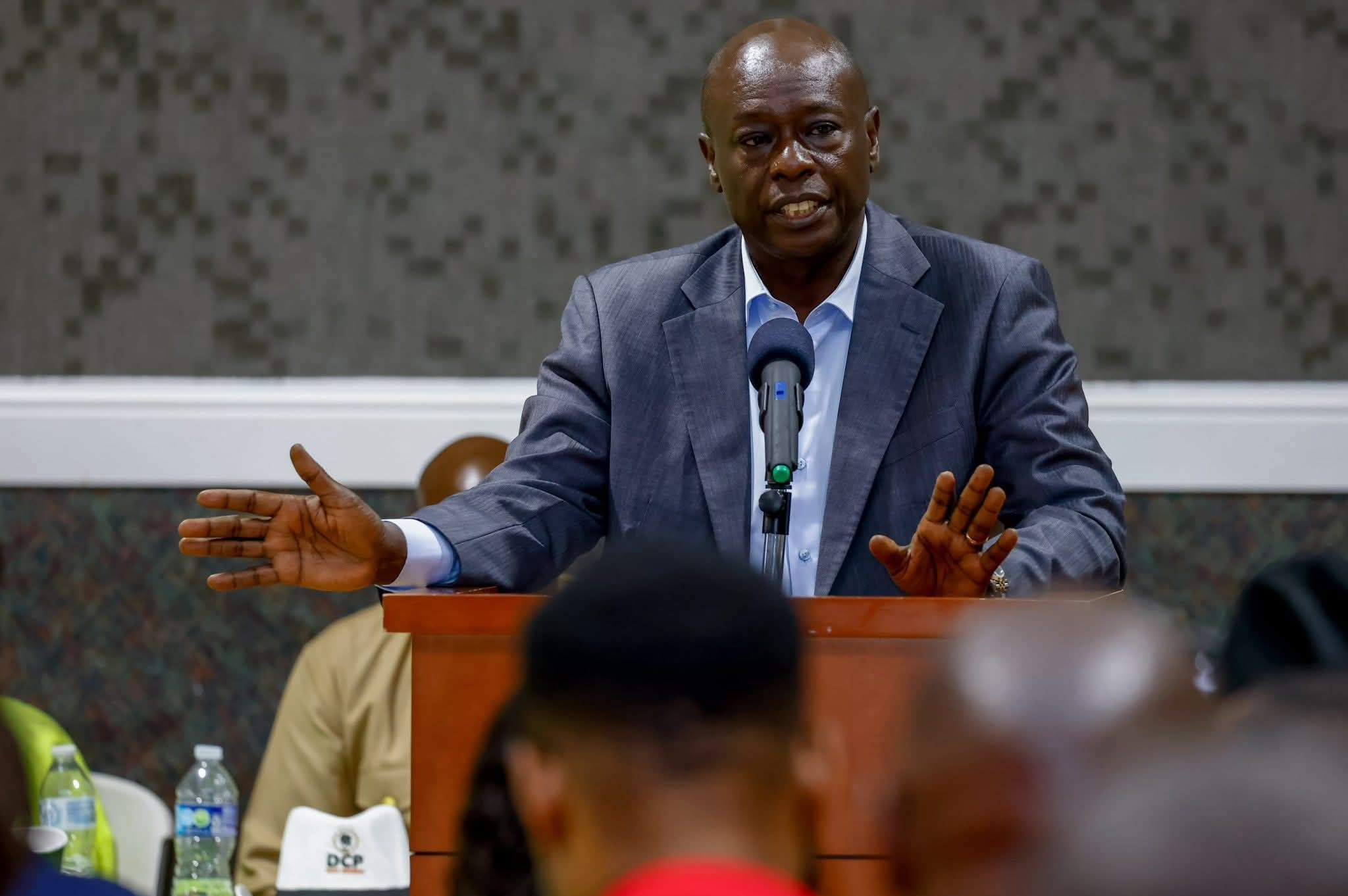

According to Auditor General Nancy Gathungu, the government agency, which is meant to provide affordable loans to farmers, has struggled with weak internal controls, leaving funds unrecovered and assets unaccounted for.

The review, covering the financial year ending June 30, 2024, highlights several unresolved cases of misappropriated funds.

At the Eldoret branch, officials overdrawn Sh11.8 million in 2018, yet management has provided no updates on recovering the money despite a court ruling in AFC’s favour in May 2024.

Gathungu noted that the “recoverability of the amount could not be ascertained,” suggesting the funds may be permanently lost.

Loan irregularities emerged as a major concern. In Kapsabet, 13 farmers received Sh22.6 million in loans using fraudulent title deeds.

AFC filed court cases and won judgments, but no warrants had been executed to recover the money by the time of the audit.

“The recoverability of loans amounting to Sh22.6 million issued on fraudulent titles couldn’t be confirmed,” the report states.

The audit also found that the faulty loan system benefited AFC’s directors. Seven directors had loans worth Sh48.9 million, with five in arrears totalling Sh35.7 million.

Only Sh4.8 million was accounted for as bad debts, leaving a large gap that could overstate AFC’s income.

“In the circumstances, the accuracy and recoverability of the directors’ loan balance of Sh48 million couldn’t be confirmed,” Gathungu said.

Short-term loans were poorly managed, with Sh225 million of Sh889 million owed outstanding for over a decade.

Even after engaging an external agency, AFC recovered little. Payroll mismanagement was evident, with nearly 250 employees facing deductions above the legal two-thirds limit, violating the Employment Act.

Two staff members in acting roles for over six months earned Sh1.9 million in allowances despite policy limits. Collective bargaining agreements were backdated, ignoring guidance from the Salaries and Remuneration Commission, with outdated rates still in use.

The audit also flagged systemic risks in AFC’s loan processing system. A Sh9.9 million loan appeared fully repaid in management records but showed Sh4.8 million outstanding in the system.

Forty loans totalling Sh35.7 million were missing entirely. Some loans were disbursed before approval, while others had principal amounts exceeding the original loan, suggesting potential embezzlement.

27 loans worth Sh18.9 million were incorrectly classified as “normal,” despite being unsecured or in arrears, artificially inflating the corporation’s financial health.

Property and asset management also revealed significant gaps. AFC’s balance sheet included Sh1.1 billion in property, plant, and equipment with major irregularities.

Thirty-one developed plots and two undeveloped parcels valued at Sh191 million lacked proper documentation.

One plot in Kimilili had no ownership papers, and land in Nanyuki and Kerugoya had never been valued.

The audit paints a worrying picture of systemic mismanagement at AFC, highlighting vulnerabilities that threaten both farmers’ access to loans and taxpayers’ money. Without urgent corrective action, the corporation risks further losses and eroding public trust.

Top Stories Today