Betting crisis: Why Kenya cannot ban popular Aviator game

The legislators are investigating the operations of betting and gaming companies in Kenya, citing a growing crisis of addiction.

The Betting Control and Licensing Board has told Parliament it cannot take action against the popular betting game Aviator, even as MPs raised concerns over its rising impact on Kenyan households and youth.

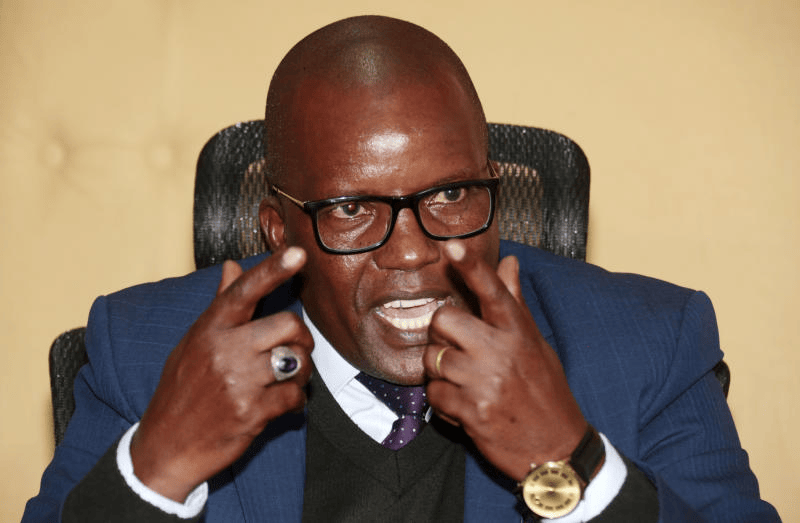

Appearing before the National Assembly’s Finance and National Planning Committee, BCLB Chief Executive Peter Mbugi said Aviator is owned and operated by a foreign firm based outside Kenya’s legal jurisdiction.

More To Read

- Executive undermining Parliament’s independence, says Kivutha Kibwana

- Petition to move Jomo Kenyatta’s remains from Parliament put on hold

- CJ Martha Koome pushes back against criticism over parliamentary interference

- Frequent court injunctions threaten to stall Parliament’s work, Wetang’ula warns

- Deputy Speaker Gladys Shollei lauds committees as Parliament’s ‘engine room’

- Senate invites public views on Bill proposing sweeping changes to its powers

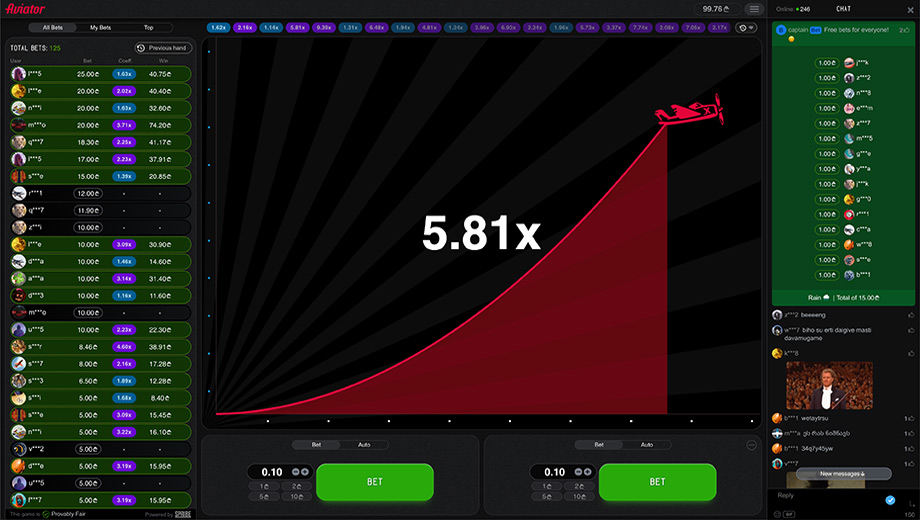

“The Aviator has swiftly risen to prominence as one of the most sought-after gambling games globally,” he told MPs.

Mbugi explained that the game’s intellectual property rights are held by SPRIBE, a company based in Warsaw, Poland, and that several variants of the game have since emerged, contributing to its widespread appeal across different countries.

“There are many other variants of the game touted to the public in different jurisdictions. This is why the game is so popular and seemingly attractive and enticing to the punter or gambler,” he added.

The legislators are investigating the operations of betting and gaming companies in Kenya, citing a growing crisis of addiction.

Gilgil MP Martha Wangari questioned the legal status of Aviator and criticised its aggressive promotion on local media. She said the game has become so widespread that it is affecting the stability of families in both urban and rural areas.

Wangari noted that Aviator has especially taken root among young people, but many older Kenyans have also fallen into the gambling trap.

BCLB Chief Executive Peter Mbugi said Aviator is owned and operated by a foreign firm based outside Kenya’s legal jurisdiction. (SPRIBE)

BCLB Chief Executive Peter Mbugi said Aviator is owned and operated by a foreign firm based outside Kenya’s legal jurisdiction. (SPRIBE)

Her remarks triggered concerns from other MPs, who said students were using school fees to gamble while some parents were betting with their life savings.

Although the board said it cannot ban Aviator, Mbugi told the committee that it is pushing for sweeping reforms aimed at tightening control of the local betting industry, which currently has 236 registered firms.

Among the proposals is the introduction of high capital thresholds to filter out small or speculative entrants.

“For a small-scale betting shop (Muaka), the BCLB is proposing a minimum capital investment of Sh50 million. For public gaming operators like casinos, the draft proposed Bill aims to raise the requirement to Sh5 billion," Mbugi said.

In addition, the board wants gamblers to provide photographic ID verification during registration, which would require a picture of the individual holding their national ID within the frame.

The BCLB also told the committee that it has flagged more than 106 illegal gambling websites in collaboration with the Communications Authority, and that Kenya must now treat gambling with the same urgency it applied to tobacco and alcohol regulation.

“We have controlled gambling advertisement in the media, which is one of the factors contributing to the increase in gambling activity,” Mbugi said.

“Going forward, gambling adverts must go through the Kenya Film Classification Board for classification, and we believe gambling is adult content that can only be aired outside watershed periods.”

He said betting advertisements will also be required to carry warning messages such as “Gambling is Addictive!” or “Gamble/Play responsibly,” and must not glamorise gambling in any way.

The board has already stopped authorising outdoor advertising and discouraged daily jackpots, free bets, bonuses, and discounts.

Mbugi said that despite limited legal tools, the government has collected Sh96.7 billion in taxes from betting companies over the last seven years.

In the 2023/2024 financial year, tax revenues reached Sh22.3 billion, while by January 2025, Sh14.5 billion had already been collected.

He noted that the betting industry continues to operate under outdated laws enacted in 1966 and urged MPs to support the proposed reforms.

Betting firms in Kenya are currently taxed through multiple channels, including 15 per cent excise duty on stakes, 20 per cent withholding tax on net winnings, and a 50 per cent gaming tax on gross revenue. They also pay corporate tax on profits.

Top Stories Today