Unease as Treasury mulls milk, bread tax to raise revenue

Treasury Cabinet Secretary Njuguna Ndung'u argues for a more equitable sharing of tax responsibilities among citizens.

Residents of Pumwani in Nairobi are worried that the government will impose a value-added tax (VAT) on basic products like milk and bread, which many households cannot do without.

Khadija Akoth, a housewife who lives in the Majengo Slum, is "disheartened" by the prospect and its impact on her family.

More To Read

- Kenya and IMF agree to start formal talks on new lending programme

- Kenya's VAT collections slump 4.3% in first decline since Covid-19 pandemic

- Kenya to defer Sh88.1 billion IMF funding to next year

- CBK's foreign reserves hit four-year high after IMF boost

- IMF concerned over Kenya's budget shortfall despite proposed new taxes

- Treasury spares milk, bread from VAT hike, targets airline industry in new tax review

"With two little ones to care for, the rising cost of milk adds an unbearable strain. Our family budget is stretched thin. This could tip us over the edge," she says.

Khadija Akoth holds her baby during an interview at her home in the Majengo Slum in Pumwani, Nairobi, on March 14, 2024. (Photo: Justine Ondieki)

Khadija Akoth holds her baby during an interview at her home in the Majengo Slum in Pumwani, Nairobi, on March 14, 2024. (Photo: Justine Ondieki)

Miriam Yusuf, a single mother in the same community, also noted that they are already grappling with the high cost of living.

"Life's challenges are already overwhelming," she remarks. "If milk prices increase, it'll be a tightrope walk between providing for my child and keeping a roof over our heads," she said.

"I have a year-old child, and I depend on milk to supplement breast milk. If the prices are to hike, it will be a challenge since I am barely able to put food on the table."

Joseph Ogolla, a tailor by profession and a father of five, also complained about the high cost of living.

"Adding more taxes on essentials like milk and bread will only push struggling families like ours further into hardship," said the Pumwani resident.

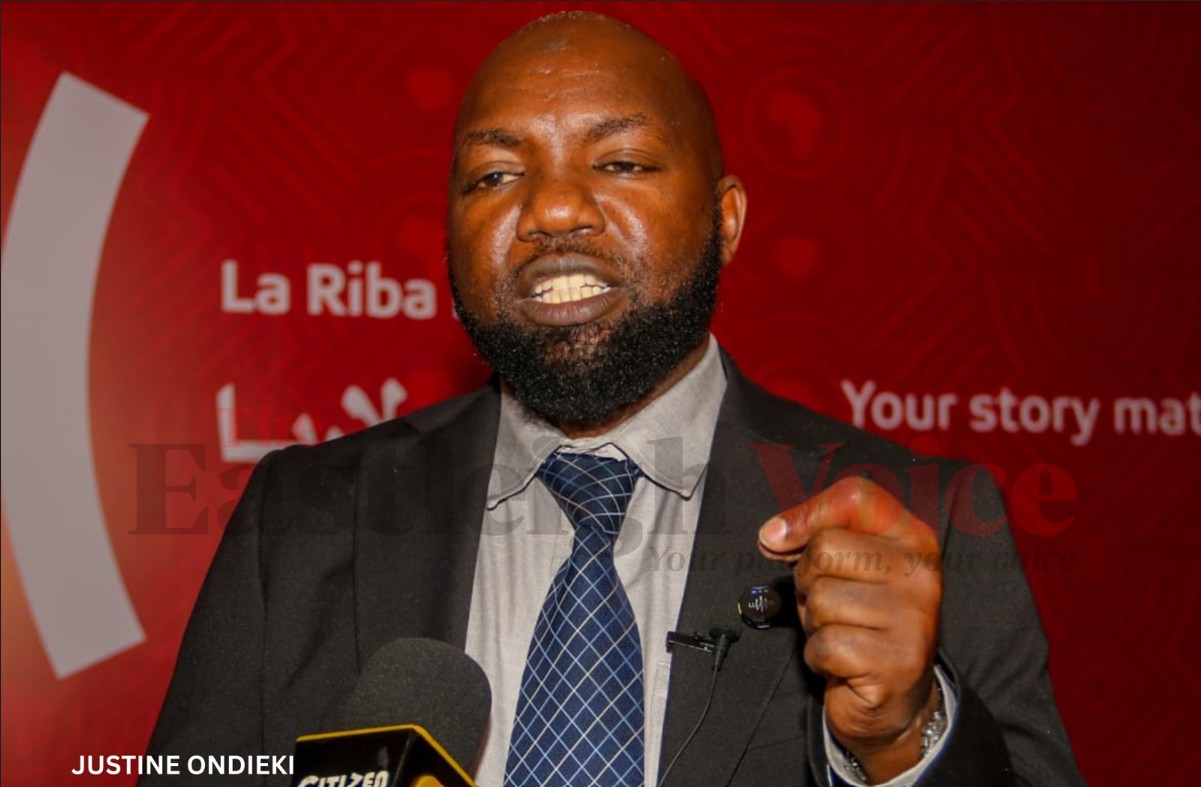

Joseph Ogola during an interview at his business premises at the Majengo Slum in Pumwani Ward, Nairobi, on March 14, 2024. (Photo: Justine Ondieki)

Joseph Ogola during an interview at his business premises at the Majengo Slum in Pumwani Ward, Nairobi, on March 14, 2024. (Photo: Justine Ondieki)

At the centre of these discussions is the Treasury's consideration of a 16 per cent VAT on bread and milk, a move aimed at bolstering revenue collection.

Treasury Cabinet Secretary Njuguna Ndung'u argues for a more equitable sharing of tax responsibilities among citizens.

Nd'ung'u said that studies by government agencies show that the current structure, where bread and milk are zero-rated, has failed to cushion the targeted poor households and instead benefited the middle class, who have a relatively high income.

"When we started simulation work, we realised we could gain a lot. Once you have high tax rates, the political remedy is often to try and create a rebate, or refund, for some of the institutions dealing with products that are related and being considered to be consumed by the poor," Ndung'u said on Tuesday during the Africa Fiscal Monitor forum organised by the International Monetary Fund (IMF).

"The total VAT collected in Kenya comprises about 40 per cent of the total taxes, but 18 per cent goes to tax refunds for products assumed to be consumed by the poor. When you look at those products, you realise 95 per cent of refunds go to bread and milk. Who goes to the supermarket to buy bread and milk? We are not compensating the poor. We are compensating the middle class."

Milk on sale at a store in Eastleigh, Nairobi, on March 14, 2024. (Photo: Justine Ondieki)

Milk on sale at a store in Eastleigh, Nairobi, on March 14, 2024. (Photo: Justine Ondieki)

Should the proposal take effect, the cost of a loaf of bread may rise by up to Sh9, adding strain to families already navigating economic instability.

Presently, the retail prices for essentials such as 500 ml of milk range between Sh60 and Sh70, while a 400g loaf of bread costs between Sh60 and Sh65.

Taxes are among the measures taken by President William Ruto’s government to make Kenya financially secure and reduce dependence on foreign aid.

Ruto said in February that the public must pay the taxes and help rebuild their own country.

“Our country will not be developed by others. Our country will not be developed by aid. Our country will not be developed by debt. Our country will be developed by us (Kenyans) using our own revenues and taxes," the president said.

He added, "The guarantee I give is that no revenues or taxes will be stolen.”

Treasury's tax collection target for the 2024/25 financial year is Sh2.95 trillion, but Ruto says the Kenya Revenue Authority (KRA) of collecting up to Sh4 million.

Top Stories Today