Kenya aims for Sh13.4 trillion in taxes as Ruto pushes economic reforms

In the following years, revenues are expected to grow, with Sh3.02 trillion targeted for the Financial Year 2025-2026 period and Sh3.42 trillion for FY 2026-2027.

President William Ruto has set an ambitious goal of collecting Sh13.4 trillion in taxes during his first term, a target that is drawing attention both domestically and internationally.

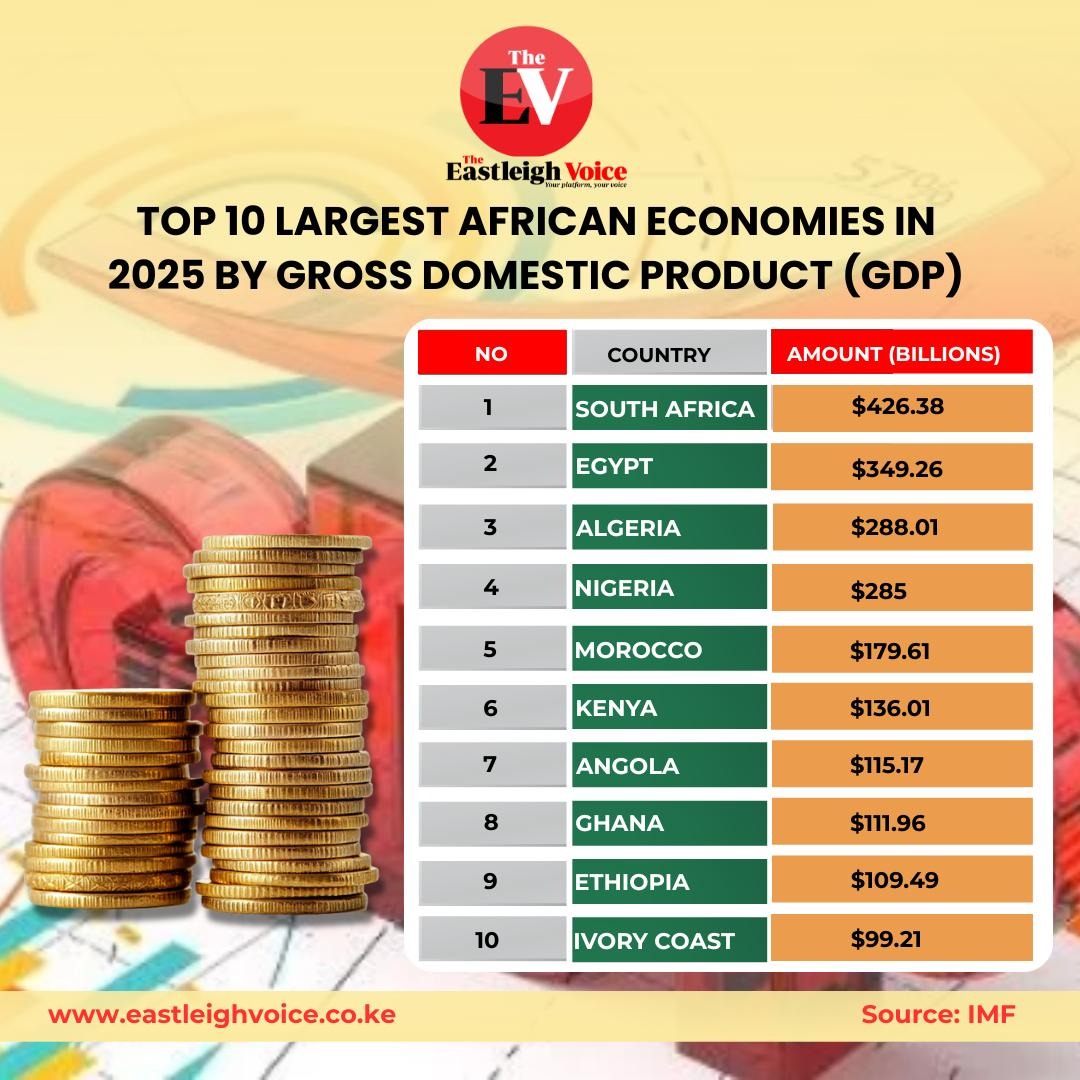

The plan comes as the Kenyan government faces mounting pressure from the International Monetary Fund (IMF) to meet revenue targets, even as his tax policies spark widespread public protests.

More To Read

- KRA waives Sh165 billion in penalties as over three million Kenyans benefit from tax amnesty

- KRA surpasses Sh2 trillion in revenue collection as growth hits 6.1 per cent

- Kenya lost over Sh500 billion to tax waivers and corruption- report

- KRA rolls out new eRITS system to simplify rental income tax compliance for landlords

- Bill proposes new tax regulations for freelancers, gig workers

- Treasury lowers tax collection target by Sh40 billion due to continued underperformance

Official documents from the National Treasury show that the government aims to raise Sh3 trillion in tax revenues in the fiscal year starting in July 2024.

The long-term goal is to surpass Sh4 trillion annually by the fiscal year 2028/29. For the current fiscal year, which ends in June 2025, the Treasury projects that the country will collect Sh2.63 trillion in taxes.

In the following years, revenues are expected to grow, with Sh3.02 trillion targeted for the Financial Year 2025-2026 period and Sh3.42 trillion for FY 2026-2027.

In its 2025 Budget Policy Statement (BPS), the Treasury notes that "in the financial year 2025-2026, total revenue, including appropriation-in-aid (A-i-A), is projected at Sh3,516.6 billion from the projected Sh3,060.0 billion in the financial year 2024-2025.

Of this, ordinary revenue is projected at Sh3,018.8 billion from the projected Sh2,631.4 billion in the financial year 2024-2025."

By the end of June 2025, the Kenya Revenue Authority (KRA) is expected to have collected Sh13.4 trillion in taxes since President Ruto took office in 2022.

During the previous two fiscal years, the KRA netted Sh4.33 trillion, Sh2.04 trillion in 2022-2023 and Sh2.29 trillion in 2023-2024.

This came as a result of several new taxes introduced under the pressure of IMF-backed reforms.

One of the most contentious measures has been the housing levy, which charges employees 1.5 per cent of their salary.

Additionally, the government doubled the VAT on petroleum products to 16 per cent and increased the pay-as-you-earn (PAYE) taxes for high earners.

These measures have caused significant backlash, as many Kenyans report a reduction in their disposable income.

The government's decision to withdraw the controversial Finance Bill 2024 amid nationwide protests last year illustrated the growing resistance to Ruto's tax policies.

In the 2024 Finance Bill, the Treasury initially targeted Sh2.9 trillion in ordinary revenue for the current fiscal year, but this was revised down to Sh2.63 trillion after the Bill was pulled.

Top Stories Today