Banks face crackdown as CBK pushes for lower lending rates

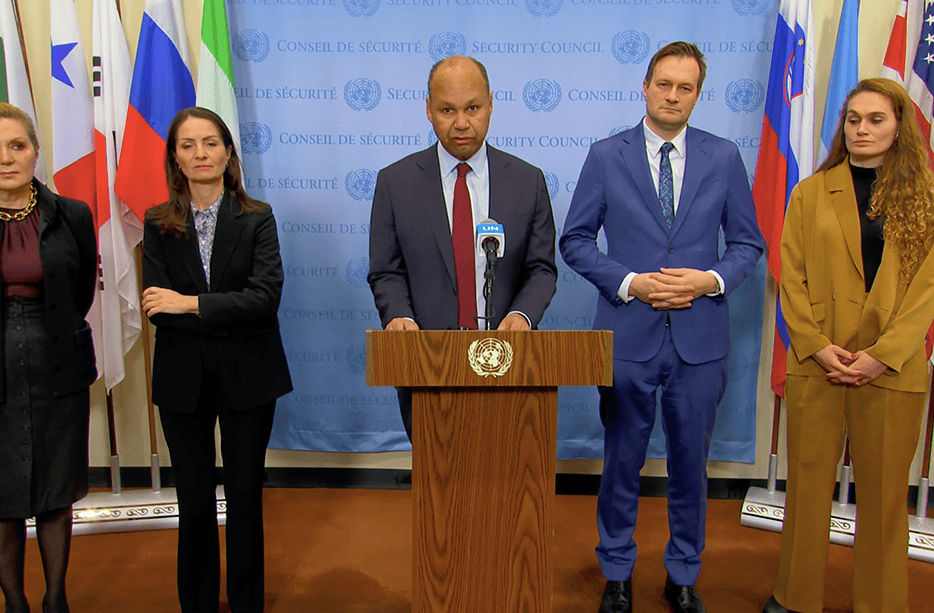

CBK Governor Kamau Thugge revealed that the regulator has initiated onsite inspections to ensure banks reduce their lending rates in line with the lowered Central Bank Rate (CBR), currently at 10.75 percent.

The Central Bank of Kenya (CBK) has issued a stern warning to commercial banks maintaining high lending rates despite recent monetary policy adjustments, cautioning that non-compliant institutions will face severe penalties.

Appearing before the National Assembly Finance Committee, CBK Governor Kamau Thugge revealed that the regulator has initiated onsite inspections to ensure banks reduce their lending rates in line with the lowered Central Bank Rate (CBR), currently at 10.75 percent.

More To Read

- Treasury eyes restructuring as Sh137 billion water sector debt stalls

- County services at risk as 79 public funds lapse or near expiry, CoB warns

- County governments turn to banks as short-term debt hits Sh3.2 billion

- No layoffs for civil servants as Treasury unveils new payroll control system

- Fuel prices hold steady for December–January despite fluctuating global oil costs

- Three-week drop in benchmark crude sets up Kenyans for further fuel price relief

“We are conducting onsite inspections to determine if the cost of funds for banks has decreased. If it has, then we expect lending rates to follow suit,” Thugge stated.

He warned that banks profiting unfairly by failing to adjust rates would be penalised. “Those found to be maintaining excessive lending rates despite lower costs of funds will face severe penalties, including fines amounting to three times their unjust gains,” he asserted.

Thugge also highlighted the government's increased domestic borrowing as a significant factor driving up lending rates, arguing that it limits private sector access to credit.

“When we started this financial year, the projected net domestic borrowing was slightly below Sh400 billion. That figure later increased to Sh430 billion, and with the second supplementary budget, it has now risen to Sh584 billion,” he explained.

He noted that banks prefer lending to the government, considered a risk-free borrower, over businesses facing challenges such as high non-performing loans.

“If banks have a choice between lending to the government, which does not default, and lending to the private sector, which has elevated non-performing loans, it’s an easy decision for them,” Thugge said.

The CBK Governor also pointed out that the introduction of the Central Securities Depository (CSD) has made it easier for Kenyans to invest in Treasury bills and bonds, reducing banks’ access to cheap deposits and affecting lending rates.

MPs Call for Legislative Action

Members of Parliament have called for measures to ensure that reductions in the CBR directly translate to lower commercial lending rates. Finance Committee Chair Kimani Kuria criticised the CBK for not offering stronger protections for private businesses.

“Where do we leave the private sector when the government is competing for loans with businesses? We wish you had said you will protect the private sector despite these issues,” he said.

Homa Bay Town MP Peter Kaluma questioned whether Parliament should introduce legislation to mandate interest rate reductions whenever monetary policy is eased. “What kind of legislative intervention should Parliament put in place to mandate that whenever we have these reductions, they are reflected in commercial rates?” he asked.

Rachuonyo MP Okuome Adipo warned that high interest rates continue to disadvantage small and medium enterprises (SMEs) that struggle to access affordable credit. “Those who are poor will be disadvantaged due to higher lending interest, which will increase borrowing costs,” he said.

Butula MP Joseph Oyula also raised concerns about the government's rising domestic borrowing, warning that it is pushing up interest rates for businesses and individuals.

“The government’s appetite to borrow domestically will affect lending rates. Treasury and CBK should sit down and look for ways to reduce the repayment interest on Treasury bills and lower borrowing appetite. It’s healthier to borrow externally than domestically,” he said.

While MPs pushed for solutions to high lending rates, Thugge cautioned against reintroducing interest rate caps, arguing that past attempts led to credit rationing, particularly for SMEs and high-risk borrowers. “If we don’t control fiscal consolidation, we will not be able to control interest rates. If we try to cap credit, we will end up rationing it, locking out the disadvantaged,” he warned.

The CBK is finalising a new risk-based pricing model for loans within the next two weeks. The framework will align with international best practices while adapting to Kenya's economic conditions, aiming to improve interest rate transmission and ensure fair lending practices.

Top Stories Today