Kenya will be able to repay $2 billion eurobond, CBK says

Central Bank of Kenya Governor Kamau Thugge had acknowledged concerns about the country's ability to repay the 10-year Eurobond when it matures in June.

Kenya can repay a $2 billion Eurobond due later this year, thanks to funding from foreign institutions, its central bank chief said Wednesday.

The nation is sitting on public debts of around $61.5 billion -- equal to around 67 per cent of gross domestic product -- with servicing costs ballooning because of the sharp drop in the value of the local currency.

More To Read

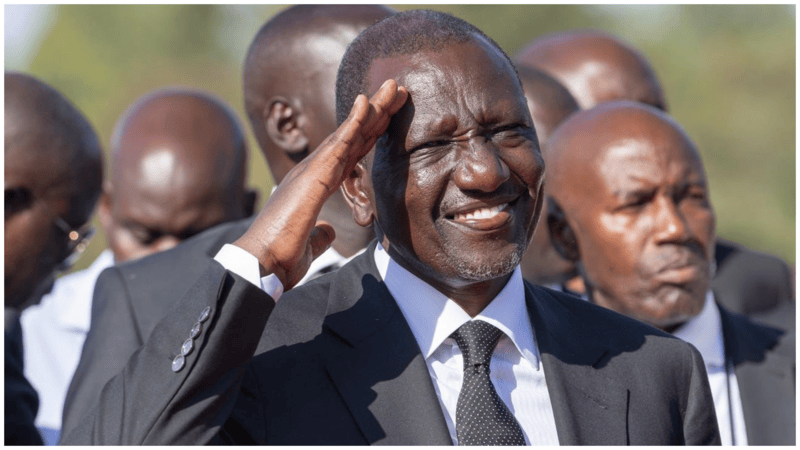

- Raila was a political engineer, and I was his student- Ruto

- Ruto: I reached out to Raila after 2022 elections to right historical injustices

- Ruto recounts painful moment he found out about Raila’s death

- President Ruto hints at UDA-ODM coalition ahead of 2027 elections

- Inside Raila’s last days: Ruto shares final moments with Raila in the weeks before his death

- 'I’m ready to come back home' - Winnie Odinga hints at joining local politics

Central Bank of Kenya Governor Kamau Thugge had acknowledged concerns about the country's ability to repay the 10-year Eurobond when it matures in June.

"We have the resources, the money that is coming in from the World Bank, from regional institutions, from multilateral institutions," he told a press conference in Nairobi.

"This risk of the eurobond will in my view be eliminated."

He said repayment of the bond should also "help contribute to a strengthening of the shilling".

The local currency has slumped by about 29 per cent against the dollar over the past year alone, currently hovering around all-time lows of 160 to the greenback.

The shilling's slide has increased the costs of Kenya's imports, leading to higher prices in a country where already many of its 53 million people live in poverty.

President William Ruto was elected in 2022 on a pledge to help ordinary Kenyans but has raised taxes and cut subsidies as part of a campaign to slash debt and "wasteful" government expenditure.

In a move to curb still-rising inflation, the central bank on Tuesday hiked interest rates by 50 basis points to 12.5 per cent, the highest level in almost 12 years.

Inflation rose to 6.9 per cent in January from 6.6 per cent the previous month, and Thugge said it remained "sticky" at the high end of the government's target range.

But the central bank said the economy was continuing to show a "strong performance" and estimated that GDP grew 5.6 per cent last year after 4.8 per cent in 2022.

Story by AFP

Top Stories Today