Kenya’s property market outpaces global giants in investment gains - report

In the 12 months leading up to June 2025, property prices in the country rose by 7.8 per cent, the highest annual increase among all the analysed markets.

Kenya’s residential property market is giving better investment returns than any other country in the world, according to a new report by HassConsult.

Comparing nine leading international markets, the study reveals Kenya’s unique growth trajectory.

More To Read

- MPs demand trader-centered designs in ESP market projects

- Expatriate exodus reshapes Nairobi housing market, driving rents down and property prices up

- Kenya residential land market cools as satellite towns and suburbs see slower price growth

- Nairobi housing projects face scrutiny over delays and poor workmanship

- Construction sector rebounds as cement demand hits record high

- MPs push for faster delivery of affordable housing, economic stimulus projects

It highlights that the country has outpaced the traditional market leaders, such as the United States, France and Singapore. The other surveyed countries are: South Africa, the UK, Canada, Switzerland and Australia.

“Kenya’s property prices have experienced an exceptional trajectory for the last 25 years, consistently delivering stronger house price growth and higher rental yields than other international property markets,” the report reads.

“Over that time, house prices globally have risen strongly at key periods, and overall. But the scale and pattern of growth in Kenya has been far greater.”

Since 2000, residential property prices in Kenya have soared by 425 per cent, more than double the growth seen in the U.S (201%), France (151%), and Singapore (122%).

HassConsult underscores that this long-term appreciation positions Kenya as a clear leader in global capital gains for real estate investors.

Notably, in the 12 months leading up to June 2025, property prices in the country rose by 7.8 per cent, the highest annual increase among all the analysed markets.

The report attributes Kenya’s unmatched returns to the sector's unique growth trajectory, supported by a combination of robust domestic demand and alternative financing models.

It adds that the country’s growth in high earners, notably in education, health, trade, and agriculture, as well as mortgage-financed banking staff, has seen housing demand outstrip GDP growth in the country.

“In the last 10 to 15 years, Kenya’s housing market has experienced strong growth, with the demand for detached houses, semi-detached houses, and apartments driven by rising wealth in the country.”

Nevertheless, the report reveals that based on both the appreciation of property value and the current rental yields, properties acquired as investments in Kenya offer close to the highest returns of the eight countries reviewed, topped only by South Africa.

By the end of the second quarter, Kenya recorded a property investment return of 13.28 per cent, placing it just behind South Africa, which leads with 14.01 per cent.

Rounding out the top five are the UK at 9.86 per cent, Australia at 9.66 per cent, and the USA at 8.89 per cent.

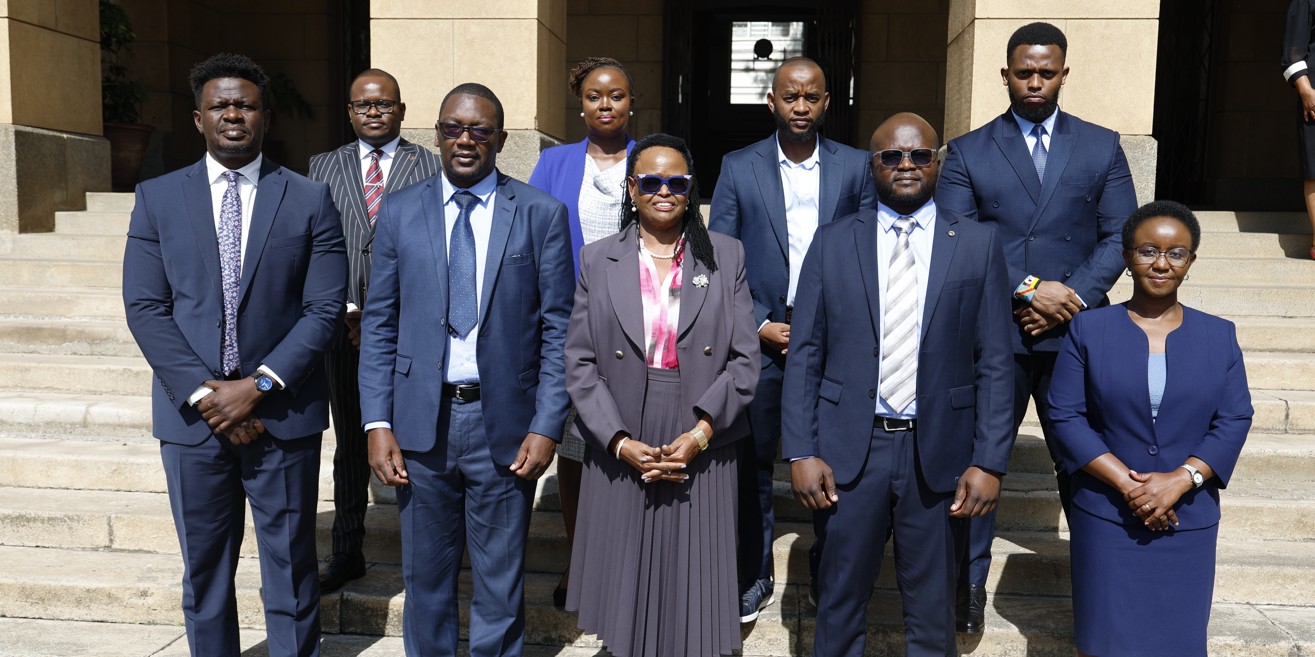

Commenting on the insights, HassConsult Co-CEO Sakina Hassanali reiterated that a critical factor in the strength of Kenya’s housing market has been its source of finance.

“Homes in Kenya are fully paid, which makes the market super-resilient. Owners rarely end up grappling with mortgage repayments they can’t meet, preventing the waves of forced sales suffered in other economies,” Sakina said.

According to the report, less than two per cent of homes in Kenya are mortgage-financed, compared with up to 90 per cent in the international markets analysed.

“Multiple factors are driving down property demand in western and eastern economies, not least of which is declining populations, while the value of property in Kenya’s expanding economy and population only keeps growing,” Sakina added.

Top Stories Today

Reader Comments

Trending