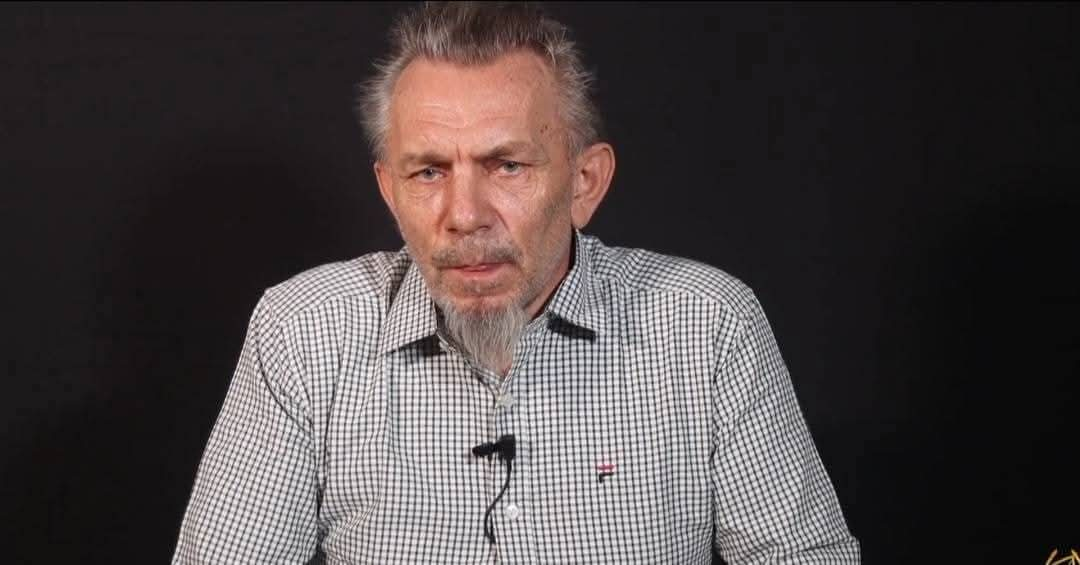

CBK's Kamau Thugge scores ‘A’ in global finance rankings for steering Kenya’s economy through turbulence

Over the past year, Kenya has maintained inflation within the target range, while the shilling has remained stable against major currencies. Interest rates on government securities, including the Central Bank Rate, have eased.

Kenya’s Central Bank Governor Kamau Thugge has earned an “A” grade from Global Finance magazine for his performance in managing inflation, stabilising the shilling, and guiding interest rates. His performance placed him among the world’s top central bankers, including US Federal Reserve Chair Jerome Powell.

Global Finance evaluates central bank leaders on an A+ to F scale, assessing success in areas such as inflation control, economic growth, currency stability, and interest rate management.

More To Read

- FAO index shows decline in global food prices, except cereals

- World Bank warns political interference weakening Kenya’s state-owned enterprises

- Kenya’s private sector posts fastest growth in five years on soaring demand

- KNBS data shows uneven food price shifts as inflation dips slightly

- Kenya Kwanza adds Sh3 trillion to national debt in three years, CBK reveals

- CBK warns of rising debt distress, urges fiscal coordination

An “A” grade reflects excellent performance, highlighting leaders who deliver results with independence, discipline, and strategic foresight. Thugge, who was named Central Bank Governor of the Year by African Banker magazine in May 2024, said the award reflects the efforts of the CBK team over the past two years.

“We have had to make tough decisions to rein in inflation and manage the exchange rate. We are proud that these efforts have borne fruit,” he said.

Over the past year, Kenya has maintained inflation within the target range, while the shilling has remained stable against major currencies. Interest rates on government securities, including the Central Bank Rate, have eased.

The CBK has also implemented a revised Risk-Based Credit Pricing Model for the banking sector, aimed at improving transparency in lending and strengthening monetary policy transmission.

The award places Thugge alongside other leading central bankers, including those from Denmark, Vietnam, Indonesia, Chile, and Morocco. The ceremony will be held in October in Washington, DC, on the sidelines of the IMF–World Bank Annual Meetings.

Joseph Giarraputo, founder and editorial director of Global Finance, noted that central bankers have spent recent years battling inflation with higher interest rates.

As inflation recedes, their tough policy decisions are yielding results, he said, adding that the magazine’s report cards honour leaders who deliver outcomes with strategic foresight.

"Most central bankers have spent the past few years battling inflation with their most effective tool — higher interest rates, though their mandates may differ from country to country. As inflation recedes, we are beginning to see the results of those tough policy decisions. Our annual Central Banker Report Cards recognise those leaders who have not only delivered results but done so with independence, discipline, and strategic foresight," he said.

Top Stories Today