IMF revises Kenya’s 2025 growth forecast upward to 4.8 per cent

Kenya’s upgraded forecast comes amid signs of recovery in key sectors such as agriculture, services, and construction, as well as improving investor sentiment.

The International Monetary Fund (IMF) has revised Kenya’s economic growth outlook upward, projecting a GDP growth rate of 4.8 per cent in 2025, up from 4.7 per cent in 2024.

The improved outlook signals growing confidence in Kenya’s economic resilience despite global uncertainties weighing down economies.

More To Read

- WHO calls for urgent action to achieve universal health coverage by 2030

- African countries take lead in push toward universal health coverage for 1.5 billion people by 2030

- Developing countries’ debt servicing cost hit 50 year high on high interest

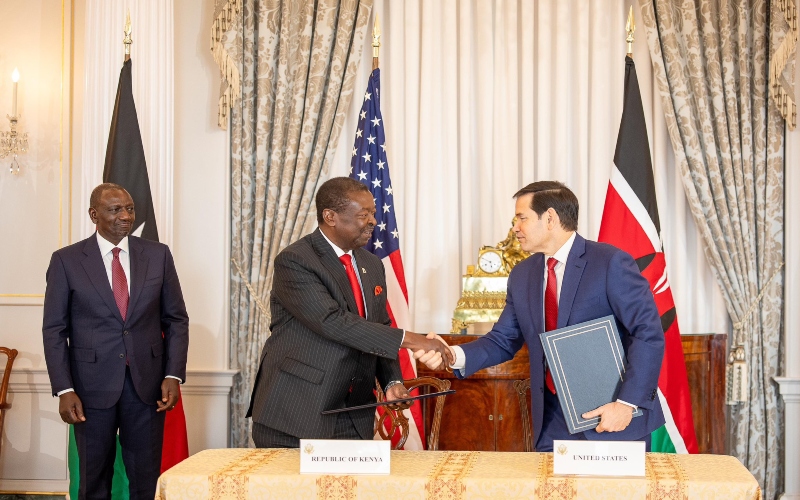

- Ruto backs IMF partnership as key to Kenya’s debt, economic reforms

- African land policy reforms benefit women and communities, but 18-country review reveals key gaps

- Why mastering Generative AI is the fastest way to boost your career and salary

In the update, the lender expects the country’s growth momentum to strengthen further beyond 2025, with GDP expansion projected to consolidate at 4.9 per cent in 2026.

Kenya’s upgraded forecast comes amid signs of recovery in key sectors such as agriculture, services, and construction, as well as improving investor sentiment.

Central Bank of Kenya's September 2025 Market Perceptions Survey reveals sustained optimism by respondents about Kenya’s economic prospects in the next 12 months.

The survey findings show that respondents expect moderate-to-strong and strong activity in the next three months, largely supported by a pick-up in demand in retail trade and tourism services related to the upcoming festive season.

In addition, respondents expect reduced lending rates and ample liquidity to stimulate private sector credit growth and lead to recovery of household and services sector spending and increased imports, hence impacting economic activity.

Similarly, respondents expect a stable macroeconomic environment, including low inflation and a stable exchange rate, to support economic activity in the next three months.

Furthermore, respondents expect activities directly and indirectly related to agriculture to thrive, supported by government-led initiatives and favourable weather.

The survey targeted chief executives and other senior officers of private sector firms comprising commercial banks, microfinance banks (MFBs) and non-bank private firms, including hotels.

Regionally, the IMF says the outlook for Sub-Saharan Africa is showing resilience despite a challenging external environment with uneven prospects in commodity prices, still tight borrowing conditions, and a deterioration of the global trade and aid landscape.

“Economic growth is projected to remain steady at 4.1 per cent in 2025 with a modest pickup in 2026, supported by macroeconomic stabilisation and reform efforts in key economies,” the lender said.

It, however, cautions that this resilience cannot be taken for granted.

“Overlapping monetary, financial, external and fiscal vulnerabilities are present in much of the region. Uncertainty persists and risks remain tilted to the downside.”

It notes that domestic revenue mobilisation and strengthened debt management can help bolster macroeconomic stability while funding essential development needs.

Other Topics To Read

Top Stories Today