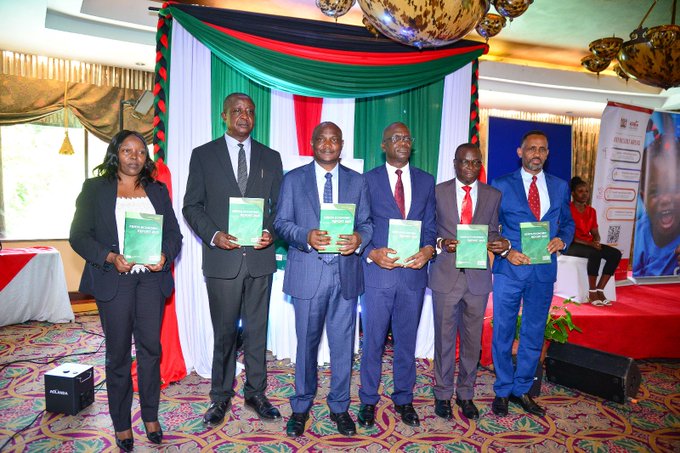

Kenyan banks pay Sh194.8 billion in taxes despite slower growth, high costs - report

The report, which covered 36 banks and microfinance institutions, showed that for every Sh100 profit, the exchequer collected Sh38.50 in taxes.

Despite a slowdown in economic growth and high operating costs, Kenyan banks collectively paid Sh194.8 billion in taxes to the government in 2024.

According to the Total Tax Contribution of the Kenya Banking Sector 2024 Report by the Kenya Bankers Association (KBA) and PwC Kenya, the amount represented 8.09 per cent of all government tax receipts for the year, highlighting the Treasury’s heavy reliance on a small group of highly compliant taxpayers.

More To Read

- Banks remit Sh194.81 billion in taxes as KBA calls for review of PAYE to boost purchasing power

- Banks urge CBK to cut base rate to spur private sector lending

- CBK's Kamau Thugge scores ‘A’ in global finance rankings for steering Kenya’s economy through turbulence

- Kenya improves in economic management but public sector reforms still lag - World Bank

- Kenyan banks’ asset value declines for first time in 23 years

- 11 banks fined for exceeding lending limits, failing capital requirements

The report, which covered 36 banks and microfinance institutions, showed that for every Sh100 profit, the exchequer collected Sh38.50 in taxes. This marks a steady rise in the banking sector’s contribution to the economy since 2021, when Kenya’s economy began recovering from the impact of the Covid-19 pandemic.

The total amount comprised Sh100.12 billion in taxes borne, direct costs to the banks, such as corporate tax and Sh94.69 billion in taxes collected on behalf of the government, including Pay As You Earn (PAYE) and withholding tax.

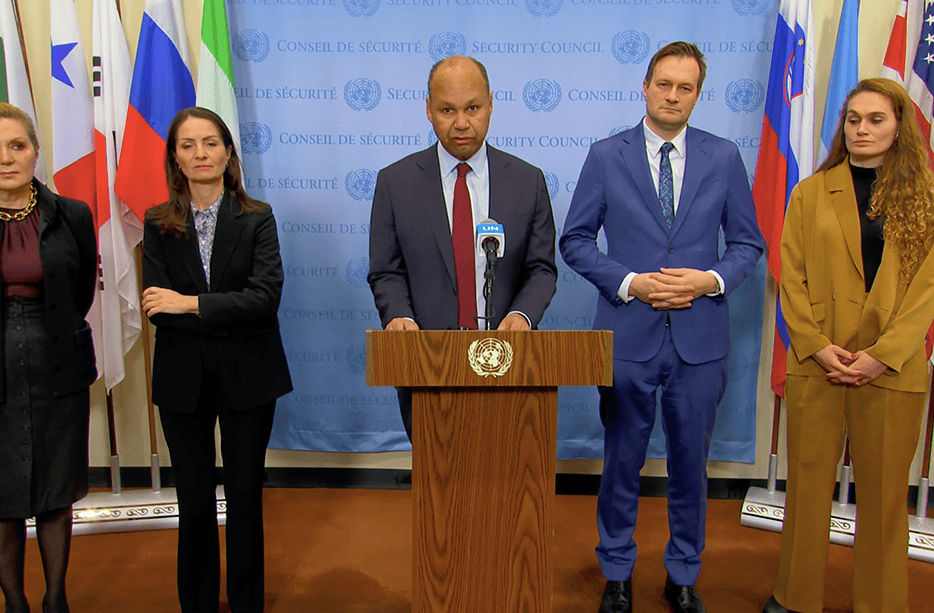

KBA Chief Executive Raymond Molenje said the findings provide crucial insights for policymakers as they consider how to balance fiscal sustainability with sector resilience.

“The Sh194.81 billion tax contribution by 36 participating banks in 2024 highlights the sector’s central role in Kenya’s revenue mobilisation. The banks’ voluntary participation also reflects a strong commitment to transparency and responsible governance,” Molenje said.

The report noted that the sector’s total tax contribution has been growing steadily since 2021, when it surged to Sh129.5 billion, a 23.59 per cent increase from 2020. The rebound was largely attributed to the reopening of the economy after pandemic restrictions were lifted, leading to higher corporate taxes, excise duty, and withholding tax due to improved business activity.

In subsequent years, the growth trend continued, with the banking sector contributing Sh181.27 billion in 2022, Sh190.26 billion in 2023, and Sh194.81 billion in 2024.

During the review period, the report observed a shifting nature of the tax burden. Although corporate tax remained the largest single component at Sh69.41 billion, accounting for 35.63 per cent of total taxes, this represented a 4.98 per cent decline compared to 2023. The dip was attributed to a notable rise in people-related taxes, driven mainly by the full-year implementation of the Affordable Housing Levy, which saw collections from the banking sector more than double, up 113 per cent to Sh3.45 billion.

PwC Country and Regional Senior Partner for Eastern Africa, Peter Ngahu, said the percentage contribution from the 36 banks highlights their vital role in supporting national revenue collection.

“It highlights the continued reliance on a few highly compliant taxpayers. This data informs the essential dialogue around tax policy needed to ensure the sector remains robust,” Ngahu said.

The report further examined how banks distributed value among key stakeholders in 2024. The government received the largest share at 54.95 per cent through taxes, followed by employees at 25.62 per cent in salaries and benefits, while shareholders received 19.44 per cent through dividends.

It also found that banks face significant administrative costs linked to tax compliance. On average, each bank employs three full-time staff for tax-related work, costing about Sh13.5 million annually.

Participants in the study proposed easing the compliance burden by returning to monthly withholding tax filings and expanding automation using systems such as iTax and eTIMS.

“There is a clear call for more automation, such as the pre-filled returns as part of VAT compliance, and clearer tax guidelines on aspects such as digital compliance tools,” reads the report.

The study also assessed the complexity and cost of tax compliance, rating the process of filing tax returns as moderately difficult with a score of 3.27 out of 5. The five-day deadline for Withholding Tax filings was cited as an additional administrative challenge.

According to the Kenya National Bureau of Statistics (KNBS), the country’s macroeconomic environment in 2024 was characterised by moderate growth, with real GDP expanding by 4.7 per cent, down from 5.7 per cent in 2023.

The report linked the slower growth to weak performance in construction and mining, even as sectors such as agriculture, finance, real estate, and transport helped support overall output.

“The prevailing environment of elevated interest rates, inflationary pressures, and moderated credit uptake also shaped both sector performance and tax outcomes,” reads the report.

Top Stories Today