CBK targets Sh40 billion in new Treasury bond auction

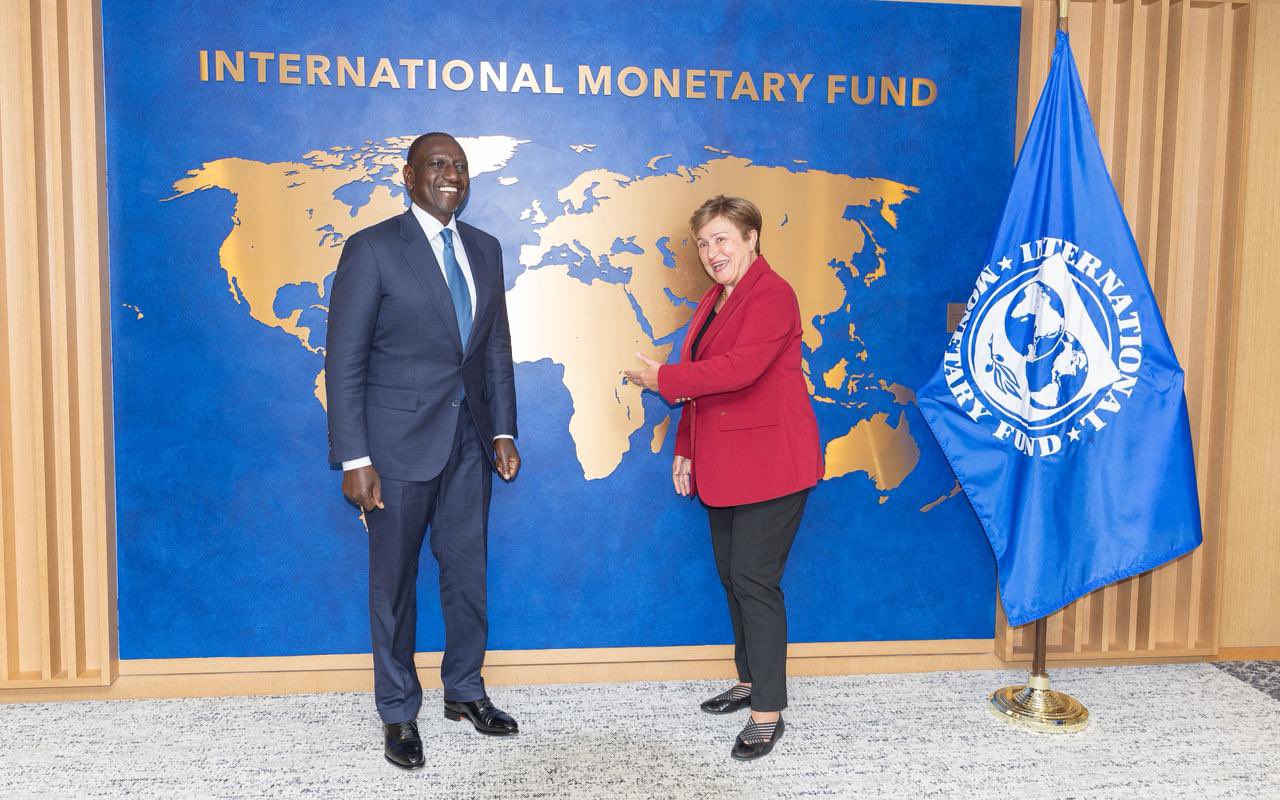

Analysts see this as a deliberate shift toward local funding, consistent with President William Ruto’s goal to reduce reliance on costly foreign loans and limit foreign exchange pressures.

The Central Bank of Kenya (CBK) has launched a new round of Treasury bonds aimed at raising Sh40 billion to support government finances. The bonds include a 15-year and a 25-year paper, both reopened for new investors to participate in previously issued instruments.

In its November prospectus, CBK said, acting in its capacity as fiscal agent for the Republic of Kenya, it invites bids for the above bonds.

More To Read

- KNBS data shows uneven food price shifts as inflation dips slightly

- Kenya Kwanza adds Sh3 trillion to national debt in three years, CBK reveals

- CBK warns of rising debt distress, urges fiscal coordination

- World Bank upgrades Kenya’s growth outlook to 4.9 per cent, warns of elevated risks

- MPs question rising debt despite Treasury’s reduced CBK borrowing

- CBK data shows Sh344 billion decline in mobile money transactions, steepest drop in 18 years

The subscription period runs from November 11 to November 19, 2025, with payments due by November 24, 2025.

The 15-year bond will yield 12.34 per cent per year, while the 25-year bond will offer 14.19 per cent, with interest earnings taxed at 10 per cent.

Funds raised will go toward general budgetary support, reflecting the government’s continued dependence on domestic borrowing to meet its financial obligations.

National Treasury data shows that Kenya’s total debt rose by at least Sh250 billion between June and September, driven by a Sh340 billion increase in local borrowing. External debt, by contrast, fell by about Sh58 billion.

Analysts see this as a deliberate shift toward local funding, consistent with President William Ruto’s goal to reduce reliance on costly foreign loans and limit foreign exchange pressures.

Secondary trading for both bonds will start on November 24, allowing investors to trade in multiples of Sh50,000 through CBK’s DhowCSD platform or licensed financial institutions.

The central bank also continues to offer a rediscounting facility, which lets bondholders access cash against their holdings at a rate three per cent above the higher of the coupon rate or market yield.

Reopening these long-term bonds is part of CBK’s strategy to extend the maturity of domestic debt while providing investors with predictable returns amid stabilising interest rates and easing inflation.

The 15-year bond matures on July 10, 2034, and the 25-year bond matures on September 23, 2047.

Pension funds and insurance companies remain the primary buyers due to the stable income, while retail participation remains limited because of the high minimum investment requirement.

The auction comes as the government balances fiscal consolidation with the need to continue funding infrastructure and social programmes.

Treasury bonds remain a vital tool in mobilising domestic resources to cover budgetary needs and sustain public spending.

Top Stories Today