Government offloads 15 per cent Safaricom stake to Vodacom in Sh244 billion deal

Kenya’s government plans to sell a 15 per cent Safaricom stake to Vodafone Kenya for Sh244.5 billion, cutting its holding to 20 per cent and funding key infrastructure via new sovereign funds.

The government has announced plans to sell a 15 per cent stake in Safaricom Plc, cutting its shareholding from 35 per cent to 20 per cent once approvals are completed.

According to the National Treasury, the deal is priced at a 23.6 per cent premium, and is expected to raise approximately Sh244.5 billion.

The proceeds will be channelled into critical infrastructure projects under the National Infrastructure Fund and the Sovereign Wealth Fund, spanning energy, roads, and water sectors.

The shares are being sold to Vodafone Kenya Limited at Sh34 each, and once the deal is finalised, Vodafone Kenya’s ownership in Safaricom will increase to 55 per cent.

As part of the arrangement, Vodafone Kenya will make an upfront payment to the government in lieu of future dividends on the state’s residual 20 per cent shareholding.

According to the Treasury, the divestment is being executed within the provisions of the Public Finance Management Act and other laws governing the disposal of shares in government-linked corporations.

Notably, once the agreement is signed, the proposal will proceed to the Cabinet before being forwarded to Parliament for approval.

It will also undergo scrutiny by regulatory bodies, including the Capital Markets Authority, the Central Bank of Kenya, the Communications Authority of Kenya and the Competition Authority of Kenya.

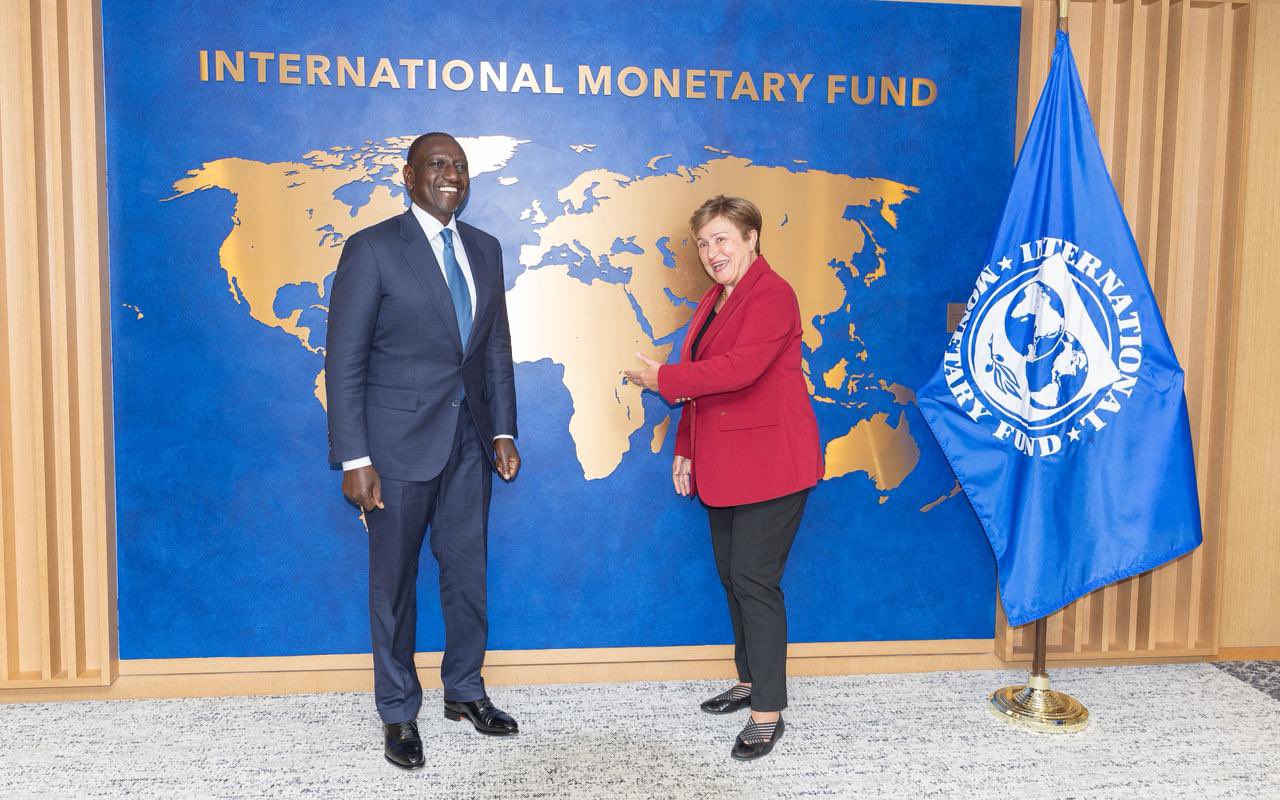

Vodacom Group CEO Shameel Joosub and Treasury CS John Mbadi during the signing of the agreement. (Photo: Handout)

Vodacom Group CEO Shameel Joosub and Treasury CS John Mbadi during the signing of the agreement. (Photo: Handout)

Speaking on Thursday during the signing ceremony in Nairobi, Treasury Cabinet Secretary John Mbadi affirmed the government’s commitment to prudent fiscal management and sustainable economic growth.

“This partial divestment is guided by the need to mobilise non-tax revenue in a responsible and forward-looking manner, reducing pressure on taxpayers and limiting our reliance on debt to finance national priorities,” Mbadi said.

“The proceeds will form part of the seed capital for the National Infrastructure Fund and the Sovereign Wealth Fund, helping us build the long-term financial foundations our country needs.”

Vodacom Group, which has reaffirmed its position as a long-term investor in Safaricom, welcomed the development. CEO, Shameel Joosub, said they are fully committed to Safaricom’s long-term growth and success.

“Our partnership with Kenya spans over two decades, and we continue to view Safaricom as a strategically important business with strong fundamentals and significant potential,” Joosub said.

“We will remain responsible, long-term investors and partners in advancing Kenya’s digital and financial inclusion ambitions.”

On his part, Safaricom CEO Peter Ndegwa assured customers and investors that the telco’s strategy and leadership will remain solid.

“Safaricom’s operations, leadership and strategic direction remain strong, and we continue to focus on delivering innovative products and services that uplift our customers and support Kenya’s digital ambition,” Ndegwa said.

Top Stories Today